Trade journaling software offers detailed tracking and analysis of actual trading activities to enhance performance and strategy management. Trading simulators provide risk-free environments for practicing strategies with virtual funds, enabling skill development without real financial exposure. Explore the advantages of both tools to optimize your trading journey effectively.

Why it is important

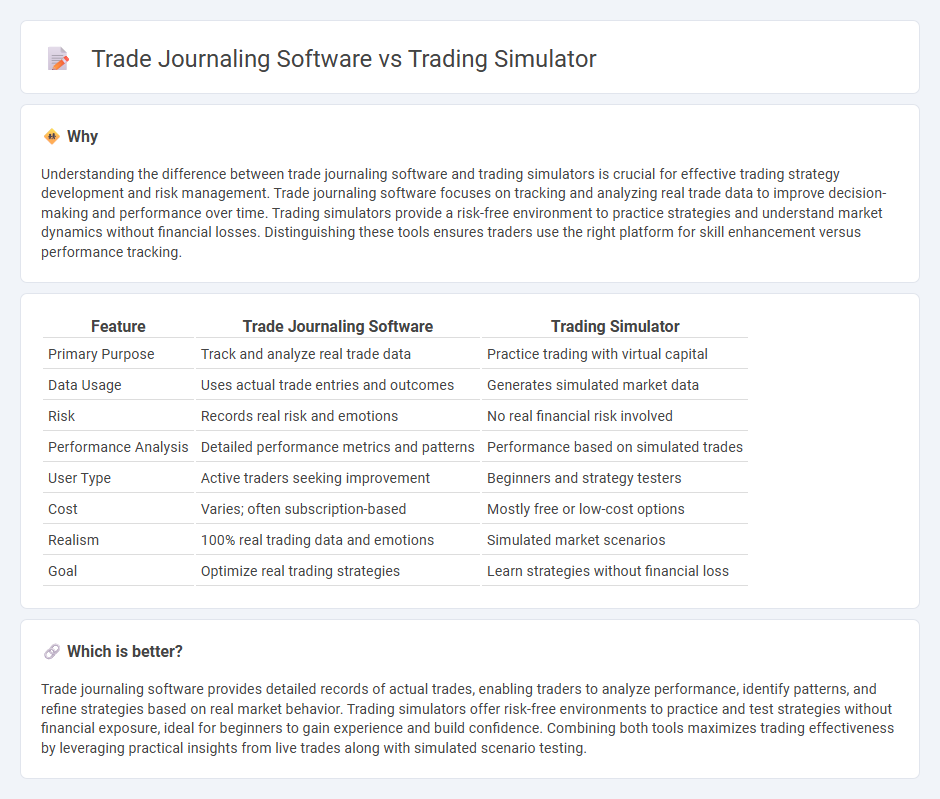

Understanding the difference between trade journaling software and trading simulators is crucial for effective trading strategy development and risk management. Trade journaling software focuses on tracking and analyzing real trade data to improve decision-making and performance over time. Trading simulators provide a risk-free environment to practice strategies and understand market dynamics without financial losses. Distinguishing these tools ensures traders use the right platform for skill enhancement versus performance tracking.

Comparison Table

| Feature | Trade Journaling Software | Trading Simulator |

|---|---|---|

| Primary Purpose | Track and analyze real trade data | Practice trading with virtual capital |

| Data Usage | Uses actual trade entries and outcomes | Generates simulated market data |

| Risk | Records real risk and emotions | No real financial risk involved |

| Performance Analysis | Detailed performance metrics and patterns | Performance based on simulated trades |

| User Type | Active traders seeking improvement | Beginners and strategy testers |

| Cost | Varies; often subscription-based | Mostly free or low-cost options |

| Realism | 100% real trading data and emotions | Simulated market scenarios |

| Goal | Optimize real trading strategies | Learn strategies without financial loss |

Which is better?

Trade journaling software provides detailed records of actual trades, enabling traders to analyze performance, identify patterns, and refine strategies based on real market behavior. Trading simulators offer risk-free environments to practice and test strategies without financial exposure, ideal for beginners to gain experience and build confidence. Combining both tools maximizes trading effectiveness by leveraging practical insights from live trades along with simulated scenario testing.

Connection

Trade journaling software and trading simulators are interconnected tools that enhance trading strategies by allowing users to record and analyze simulated trades, thereby improving decision-making skills without financial risk. Trading simulators generate realistic market scenarios where traders can practice executing trades, while journaling software captures detailed data such as entry and exit points, trade duration, and emotional states. Integrating these tools enables traders to identify patterns, refine tactics, and develop discipline, leading to better performance in live market conditions.

Key Terms

**Backtesting**

Backtesting in trading simulators allows traders to evaluate strategies using historical market data, providing a risk-free environment to refine decision-making before live trading. Trade journaling software complements this by enabling detailed recording and analysis of each simulated or live trade, helping identify patterns and improve strategy performance. Explore how integrating both tools can enhance your backtesting effectiveness and overall trading success.

**Performance Tracking**

Trading simulators offer real-time performance tracking by replicating market conditions, allowing users to test strategies without financial risk. Trade journaling software focuses on detailed post-trade analysis, helping traders identify patterns and improve decision-making through historical data review. Explore our comprehensive guides to understand which tool enhances your trading performance best.

**Real-time Execution**

Trading simulators offer real-time execution by replicating live market conditions, allowing traders to practice orders and strategies with immediate feedback. Trade journaling software focuses on recording and analyzing past trades without influencing current market activity. Explore more about how real-time execution impacts trading performance and strategy refinement.

Source and External Links

Test Your Strategies With Our Trading Simulator - TradeStation - Offers real-time, simulated trading for stocks, options, and futures with advanced backtesting, forward testing, and algorithmic trading tools, available to funded brokerage account holders.

Day Trading Simulator - Trade Stocks, Futures & Crypto - Provides a session-based replay simulator synchronized across symbols, charts, and tools, featuring multi-symbol, multi-timeframe views and replay controls for equities, futures, and crypto markets.

Free Futures Trading Simulator | NinjaTrader - Delivers risk-free futures paper trading with live streaming market data, unlimited simulated trading for funded accounts, and a free trial with a high-performance backtesting engine.

dowidth.com

dowidth.com