Stop hunting involves identifying and triggering stop-loss orders to induce price movements for profit, while front running is the unethical practice of executing trades based on advance knowledge of pending orders. Both strategies exploit market mechanics but differ in methodology and legality. Discover more about how these tactics impact trading dynamics and investor decisions.

Why it is important

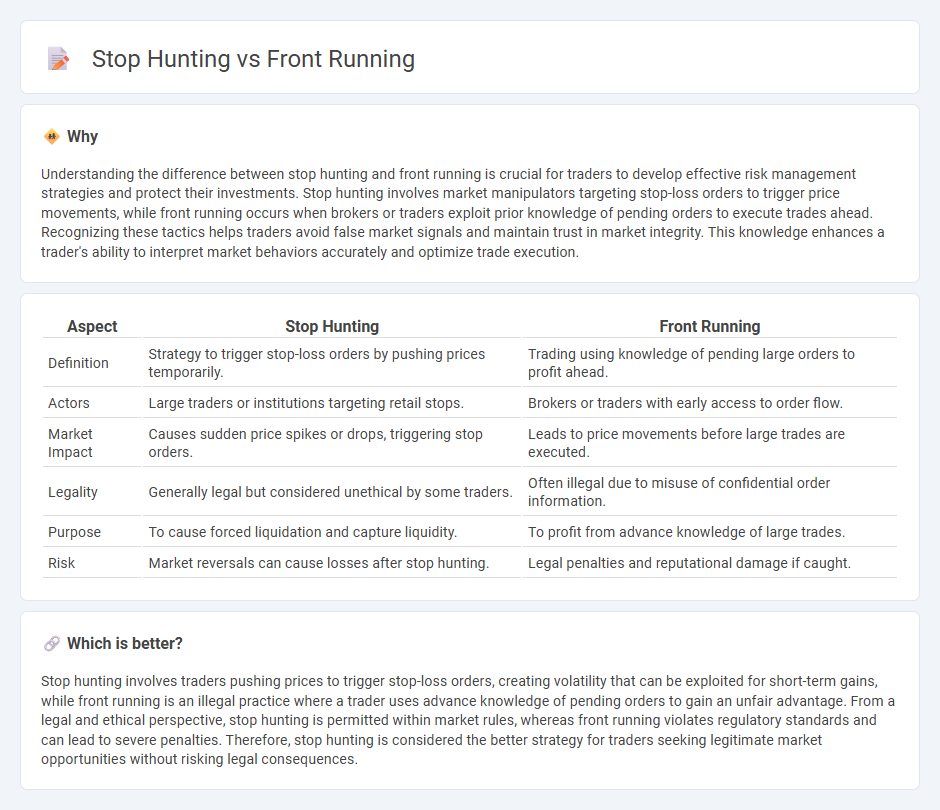

Understanding the difference between stop hunting and front running is crucial for traders to develop effective risk management strategies and protect their investments. Stop hunting involves market manipulators targeting stop-loss orders to trigger price movements, while front running occurs when brokers or traders exploit prior knowledge of pending orders to execute trades ahead. Recognizing these tactics helps traders avoid false market signals and maintain trust in market integrity. This knowledge enhances a trader's ability to interpret market behaviors accurately and optimize trade execution.

Comparison Table

| Aspect | Stop Hunting | Front Running |

|---|---|---|

| Definition | Strategy to trigger stop-loss orders by pushing prices temporarily. | Trading using knowledge of pending large orders to profit ahead. |

| Actors | Large traders or institutions targeting retail stops. | Brokers or traders with early access to order flow. |

| Market Impact | Causes sudden price spikes or drops, triggering stop orders. | Leads to price movements before large trades are executed. |

| Legality | Generally legal but considered unethical by some traders. | Often illegal due to misuse of confidential order information. |

| Purpose | To cause forced liquidation and capture liquidity. | To profit from advance knowledge of large trades. |

| Risk | Market reversals can cause losses after stop hunting. | Legal penalties and reputational damage if caught. |

Which is better?

Stop hunting involves traders pushing prices to trigger stop-loss orders, creating volatility that can be exploited for short-term gains, while front running is an illegal practice where a trader uses advance knowledge of pending orders to gain an unfair advantage. From a legal and ethical perspective, stop hunting is permitted within market rules, whereas front running violates regulatory standards and can lead to severe penalties. Therefore, stop hunting is considered the better strategy for traders seeking legitimate market opportunities without risking legal consequences.

Connection

Stop hunting and front running are connected through their manipulation of market orders to exploit other traders' stop-loss levels. Stop hunting involves triggering stop-loss orders to create price movements, while front running occurs when a trader or broker executes orders ahead of large pending trades to capitalize on expected price changes. Both practices undermine market fairness and liquidity by exploiting order flow information.

Key Terms

Order Book

Front running exploits advance knowledge of pending large orders to execute trades ahead, leveraging the order book's visibility for profit. Stop hunting targets clustered stop-loss orders within the order book, triggering price movements to activate these stops and capitalize on the resulting volatility. Explore more to understand how these tactics impact market dynamics and trading strategies.

Liquidity

Front running exploits advance knowledge of large pending orders to capitalize on imminent price moves, enhancing liquidity extraction from market participants. Stop hunting targets clustered stop-loss orders, triggering rapid price shifts that allow traders to capture liquidity at key levels. Explore deeper insights into how these strategies impact market liquidity and trading dynamics.

Market Manipulation

Front running is a market manipulation tactic where a trader exploits advanced knowledge of pending orders to trade ahead, profiting from the anticipated price movement. Stop hunting involves driving prices to trigger stop-loss orders deliberately, causing forced liquidation and amplifying volatility for the manipulator's benefit. Learn more about these strategies to understand their impact on market integrity and investor protection.

Source and External Links

Front Running Explained: What Is It, Examples, Is It Legal? - Front running is when a broker or trader uses non-public information about a large upcoming trade to execute their own trades first and profit from the price movement caused by the trade, which is illegal and unethical.

Front running - Wikipedia - Front running, also known as tailgating, is the illegal practice of trading securities based on advance knowledge of a large pending transaction that will influence the price, often involving brokers or institutional insiders.

Blockchain Front-Running: Risks and Protective Measures - Front-running in blockchain occurs when a trader sees a pending transaction and puts their own transaction first by paying higher fees to profit from the expected price movement, with variations like back-running and displacement front-running.

dowidth.com

dowidth.com