Front running involves executing trades based on advance knowledge of pending orders to capitalize on price movements, often raising ethical and legal concerns. High-frequency trading uses sophisticated algorithms and high-speed data networks to execute large volumes of trades within milliseconds, aiming to profit from small price discrepancies across markets. Explore the key differences and impacts of front running versus high-frequency trading to deepen your understanding of modern trading strategies.

Why it is important

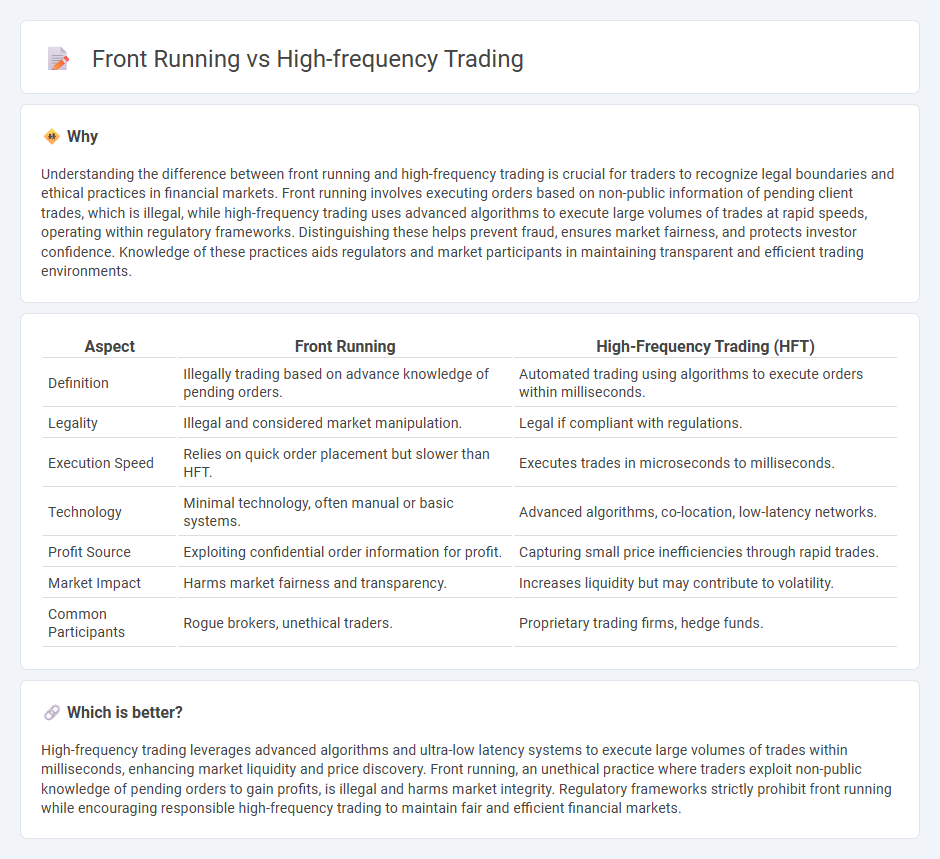

Understanding the difference between front running and high-frequency trading is crucial for traders to recognize legal boundaries and ethical practices in financial markets. Front running involves executing orders based on non-public information of pending client trades, which is illegal, while high-frequency trading uses advanced algorithms to execute large volumes of trades at rapid speeds, operating within regulatory frameworks. Distinguishing these helps prevent fraud, ensures market fairness, and protects investor confidence. Knowledge of these practices aids regulators and market participants in maintaining transparent and efficient trading environments.

Comparison Table

| Aspect | Front Running | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Illegally trading based on advance knowledge of pending orders. | Automated trading using algorithms to execute orders within milliseconds. |

| Legality | Illegal and considered market manipulation. | Legal if compliant with regulations. |

| Execution Speed | Relies on quick order placement but slower than HFT. | Executes trades in microseconds to milliseconds. |

| Technology | Minimal technology, often manual or basic systems. | Advanced algorithms, co-location, low-latency networks. |

| Profit Source | Exploiting confidential order information for profit. | Capturing small price inefficiencies through rapid trades. |

| Market Impact | Harms market fairness and transparency. | Increases liquidity but may contribute to volatility. |

| Common Participants | Rogue brokers, unethical traders. | Proprietary trading firms, hedge funds. |

Which is better?

High-frequency trading leverages advanced algorithms and ultra-low latency systems to execute large volumes of trades within milliseconds, enhancing market liquidity and price discovery. Front running, an unethical practice where traders exploit non-public knowledge of pending orders to gain profits, is illegal and harms market integrity. Regulatory frameworks strictly prohibit front running while encouraging responsible high-frequency trading to maintain fair and efficient financial markets.

Connection

Front running involves executing orders ahead of known large trades to capitalize on expected price movements, a tactic often enabled by high-frequency trading (HFT) algorithms. HFT leverages advanced technology and low-latency networks to rapidly process market data and place orders in milliseconds, facilitating front running strategies at scale. This connection raises regulatory concerns as both practices can undermine market fairness and transparency.

Key Terms

Latency

High-frequency trading (HFT) leverages ultra-low latency systems to execute thousands of trades within microseconds, capitalizing on minute price discrepancies. Front running exploits latency advantages by anticipating large orders, allowing traders to act ahead and profit from the resulting price movements. Explore the intricacies of latency's impact on market fairness and trading technology advancements.

Order Execution

High-frequency trading (HFT) utilizes sophisticated algorithms and ultra-low latency connections to execute large volumes of orders within microseconds, optimizing order execution by capturing minimal price discrepancies across markets. In contrast, front running involves the unethical or illegal practice of executing orders based on advance knowledge of pending large orders, compromising market fairness and order execution integrity. Explore the nuances of these trading strategies and their impact on order execution efficiency and market ethics in detail.

Market Manipulation

High-frequency trading (HFT) leverages advanced algorithms and ultra-fast data transmission to execute large volumes of trades within milliseconds, aiming to capitalize on small price discrepancies, while front running involves illegally executing orders based on advance knowledge of pending large transactions to gain unfair profit. Both practices impact market integrity, but front running is explicitly classified as market manipulation due to its deceptive nature, whereas HFT operates within legal boundaries under strict regulatory scrutiny. Explore further insights into how regulatory frameworks distinguish these practices and protect market fairness.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do You Get ... - High-frequency trading (HFT) is an automated trading method using powerful computers and advanced algorithms to execute large volumes of trades at extremely high speeds--often in microseconds--to capitalize on small price differences across markets.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT involves algorithmic trading with high-speed execution, massive transaction volumes, and short-term investment horizons, primarily used by institutional investors to profit from tiny price fluctuations through rapid buy and sell orders across multiple exchanges.

High-frequency trading - Wikipedia - HFT is a quantitative trading style featuring extremely short portfolio holding periods and reliance on computer algorithms that process large data volumes to execute strategies like market-making, arbitrage, and latency arbitrage with a focus on speed to exploit minute market inefficiencies.

dowidth.com

dowidth.com