Volatility harvesting capitalizes on market fluctuations by systematically buying low and selling high during periods of price swings, aiming to generate returns regardless of market direction. Momentum trading focuses on buying securities exhibiting upward price trends and selling those with downward trends, leveraging the persistence of price movement to maximize gains. Explore the nuances and strategies behind volatility harvesting and momentum trading to enhance your trading approach.

Why it is important

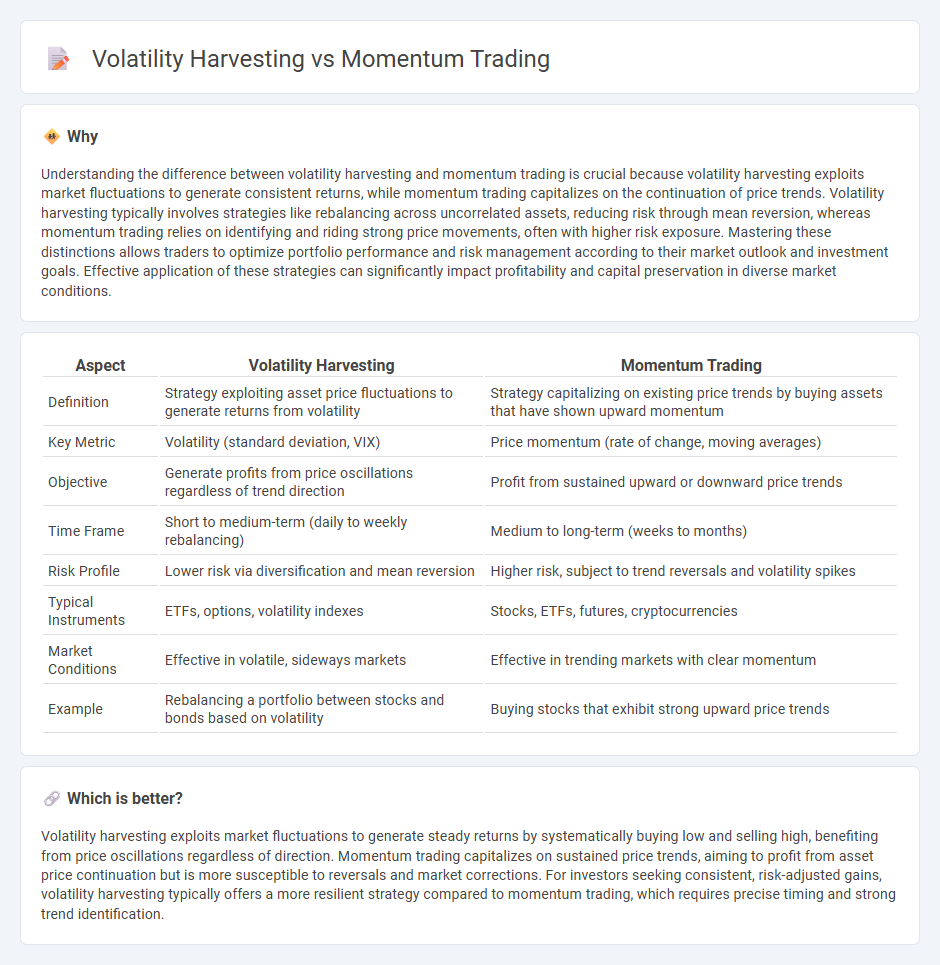

Understanding the difference between volatility harvesting and momentum trading is crucial because volatility harvesting exploits market fluctuations to generate consistent returns, while momentum trading capitalizes on the continuation of price trends. Volatility harvesting typically involves strategies like rebalancing across uncorrelated assets, reducing risk through mean reversion, whereas momentum trading relies on identifying and riding strong price movements, often with higher risk exposure. Mastering these distinctions allows traders to optimize portfolio performance and risk management according to their market outlook and investment goals. Effective application of these strategies can significantly impact profitability and capital preservation in diverse market conditions.

Comparison Table

| Aspect | Volatility Harvesting | Momentum Trading |

|---|---|---|

| Definition | Strategy exploiting asset price fluctuations to generate returns from volatility | Strategy capitalizing on existing price trends by buying assets that have shown upward momentum |

| Key Metric | Volatility (standard deviation, VIX) | Price momentum (rate of change, moving averages) |

| Objective | Generate profits from price oscillations regardless of trend direction | Profit from sustained upward or downward price trends |

| Time Frame | Short to medium-term (daily to weekly rebalancing) | Medium to long-term (weeks to months) |

| Risk Profile | Lower risk via diversification and mean reversion | Higher risk, subject to trend reversals and volatility spikes |

| Typical Instruments | ETFs, options, volatility indexes | Stocks, ETFs, futures, cryptocurrencies |

| Market Conditions | Effective in volatile, sideways markets | Effective in trending markets with clear momentum |

| Example | Rebalancing a portfolio between stocks and bonds based on volatility | Buying stocks that exhibit strong upward price trends |

Which is better?

Volatility harvesting exploits market fluctuations to generate steady returns by systematically buying low and selling high, benefiting from price oscillations regardless of direction. Momentum trading capitalizes on sustained price trends, aiming to profit from asset price continuation but is more susceptible to reversals and market corrections. For investors seeking consistent, risk-adjusted gains, volatility harvesting typically offers a more resilient strategy compared to momentum trading, which requires precise timing and strong trend identification.

Connection

Volatility harvesting capitalizes on frequent price fluctuations by systematically buying low and selling high, generating consistent profits from market oscillations. Momentum trading focuses on identifying and following trending assets to maximize gains as price movements persist. Both strategies intertwine, as volatility provides the price variability necessary for momentum traders to detect and ride strong directional trends, enhancing overall portfolio returns.

Key Terms

**Momentum Trading:**

Momentum trading capitalizes on the continuation of existing price trends by identifying and investing in assets showing strong upward or downward momentum, often measured by indicators such as Moving Average Convergence Divergence (MACD) or Relative Strength Index (RSI). This strategy relies heavily on technical analysis and market sentiment, aiming to ride the trend until signs of reversal appear. Discover how momentum trading strategies can enhance your portfolio performance by exploring specific techniques and risk management approaches.

Trend

Momentum trading capitalizes on persistent market trends by buying assets exhibiting upward price movement and selling those with downward momentum, aiming to maximize returns during sustained directional shifts. Volatility harvesting exploits price fluctuations within a trend, systematically buying low and selling high to capture profits from short-term price oscillations without necessarily predicting overall market direction. Discover how integrating these strategies can enhance trend-focused portfolio performance.

Relative Strength

Momentum trading capitalizes on assets demonstrating strong relative strength by buying winners and selling losers, aiming to profit from sustained price trends. Volatility harvesting exploits fluctuations in asset prices by systematically rebalancing a portfolio to capture gains from price swings, often regardless of directional movement. Explore our detailed analysis to understand how combining relative strength metrics enhances these strategies.

Source and External Links

Momentum Trading: Types, Strategies and More - Part I - Momentum trading involves buying or selling assets based on recent price trends with two main types: time-series momentum, which focuses on an asset's own past performance, and cross-sectional momentum, which compares assets within a portfolio to identify top performers for trading.

Momentum Trading: Types, Strategies, and More - QuantInsti Blog - Momentum trading strategies rely on recent price movements to select assets, using time-series momentum that triggers trades based on an asset's historical gains, or cross-sectional momentum that ranks assets against peers to choose winners and avoid losers.

Momentum Trading for Beginners (What They Don't Teach You) - This video explains momentum trading as a strategy to ride strong price moves across stocks, crypto, and forex by following trends, using indicators like RSI and MACD, and emphasizes risk management and practical tactics for high-probability trades.

dowidth.com

dowidth.com