High-frequency trading leverages advanced algorithms and ultra-fast data processing to execute thousands of trades per second, capitalizing on minute price discrepancies across markets. News-based trading relies on real-time analysis of breaking news and economic reports to predict market movements and make strategic trades. Explore the key differences and strategies behind these trading approaches to enhance your investment decisions.

Why it is important

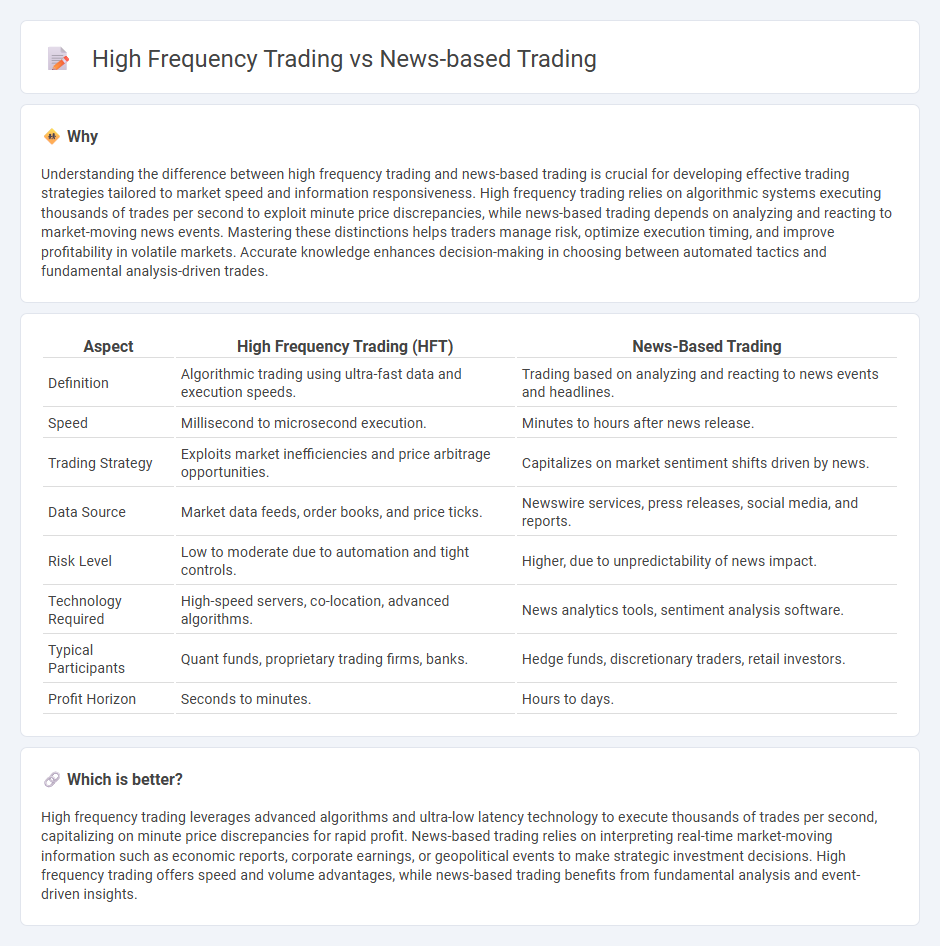

Understanding the difference between high frequency trading and news-based trading is crucial for developing effective trading strategies tailored to market speed and information responsiveness. High frequency trading relies on algorithmic systems executing thousands of trades per second to exploit minute price discrepancies, while news-based trading depends on analyzing and reacting to market-moving news events. Mastering these distinctions helps traders manage risk, optimize execution timing, and improve profitability in volatile markets. Accurate knowledge enhances decision-making in choosing between automated tactics and fundamental analysis-driven trades.

Comparison Table

| Aspect | High Frequency Trading (HFT) | News-Based Trading |

|---|---|---|

| Definition | Algorithmic trading using ultra-fast data and execution speeds. | Trading based on analyzing and reacting to news events and headlines. |

| Speed | Millisecond to microsecond execution. | Minutes to hours after news release. |

| Trading Strategy | Exploits market inefficiencies and price arbitrage opportunities. | Capitalizes on market sentiment shifts driven by news. |

| Data Source | Market data feeds, order books, and price ticks. | Newswire services, press releases, social media, and reports. |

| Risk Level | Low to moderate due to automation and tight controls. | Higher, due to unpredictability of news impact. |

| Technology Required | High-speed servers, co-location, advanced algorithms. | News analytics tools, sentiment analysis software. |

| Typical Participants | Quant funds, proprietary trading firms, banks. | Hedge funds, discretionary traders, retail investors. |

| Profit Horizon | Seconds to minutes. | Hours to days. |

Which is better?

High frequency trading leverages advanced algorithms and ultra-low latency technology to execute thousands of trades per second, capitalizing on minute price discrepancies for rapid profit. News-based trading relies on interpreting real-time market-moving information such as economic reports, corporate earnings, or geopolitical events to make strategic investment decisions. High frequency trading offers speed and volume advantages, while news-based trading benefits from fundamental analysis and event-driven insights.

Connection

High frequency trading (HFT) leverages algorithms to execute trades within milliseconds, capitalizing on market inefficiencies triggered by news releases. News-based trading algorithms parse real-time news feeds using natural language processing to quickly interpret market sentiment and generate trade signals. The synergy between HFT's speed and news-based trading's informational edge enables traders to exploit stale market reactions before competitors adjust prices.

Key Terms

**News-based trading:**

News-based trading leverages real-time information from financial news, economic reports, and market events to make strategic investment decisions, aiming to capitalize on volatility triggered by breaking news. Advanced algorithms analyze sentiment, keywords, and the timing of news releases to quickly execute trades before market prices fully adjust. Discover how integrating AI-driven news analytics can enhance your trading strategy and stay ahead of market shifts.

Sentiment Analysis

Sentiment analysis in news-based trading identifies market-moving emotions expressed in financial news to inform buy or sell decisions, relying heavily on natural language processing algorithms to assess tone and potential impact. High-frequency trading uses sentiment data integrated into ultra-fast algorithms to execute large volumes of trades within milliseconds, capitalizing on short-term market inefficiencies identified through real-time sentiment shifts. Explore deeper insights into how sentiment analysis shapes trading strategies and market dynamics.

Market Impact

News-based trading leverages real-time information releases to capitalize on market sentiment shifts, often causing noticeable price fluctuations due to sudden volume spikes. High frequency trading (HFT) exploits milliseconds-level latency advantages to execute large volumes of orders, sometimes increasing order book volatility but generally resulting in minimal lasting market impact. Explore in-depth analyses comparing their respective effects on liquidity and price stability for a comprehensive understanding.

Source and External Links

News Based Trading - News-based trading involves exploiting temporary mispricing of securities caused by news events, using algorithms to analyze sentiment and make informed trades, with a focus on events like quarterly results or mergers, and requiring strong risk management due to potential noise and inefficiency in the market.

News Trading Strategies | How To Trade The News - News trading is a short-term, event-driven strategy that capitalizes on market volatility triggered by economic data or significant headlines, differing from technical and fundamental analysis by focusing on immediate market reactions to specific news events.

Trading the news - Trading the news is a technique to trade financial instruments by responding in real-time to events such as economic reports or corporate announcements, either manually or via automated algorithmic systems that scan live news feeds to capture market moves caused by news releases.

dowidth.com

dowidth.com