Grid trading involves placing buy and sell orders at predetermined price intervals to capitalize on market fluctuations, creating a structured profit strategy with controlled risk. News-based trading relies on reacting to economic events and market-moving news to make quick, high-impact trades based on real-time information. Explore the advantages and challenges of both methods to enhance your trading strategy effectively.

Why it is important

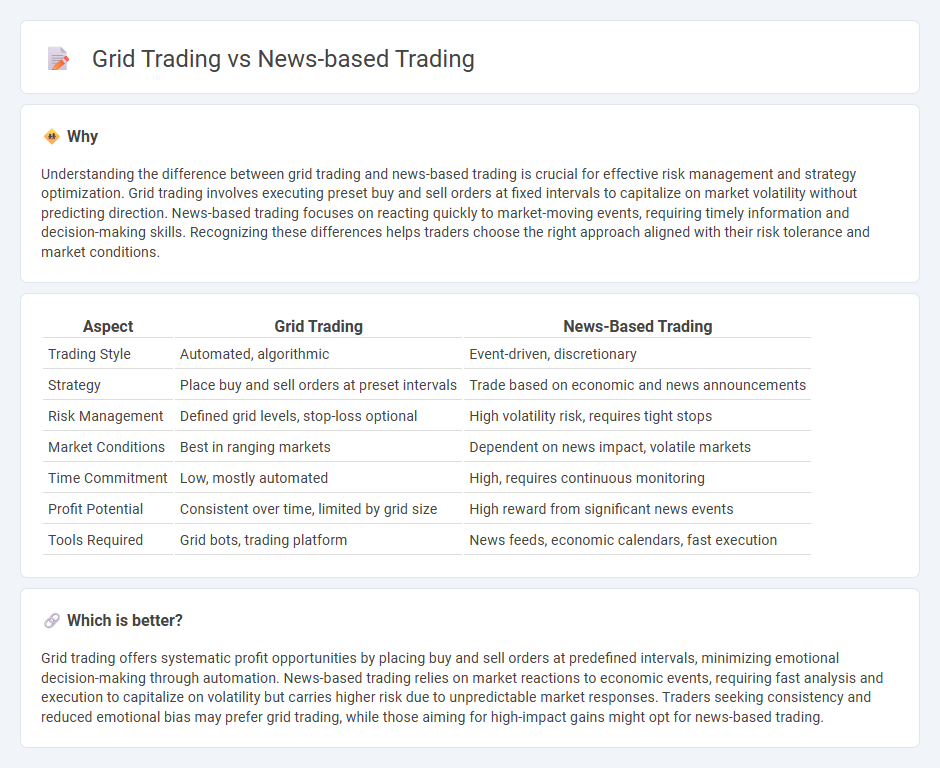

Understanding the difference between grid trading and news-based trading is crucial for effective risk management and strategy optimization. Grid trading involves executing preset buy and sell orders at fixed intervals to capitalize on market volatility without predicting direction. News-based trading focuses on reacting quickly to market-moving events, requiring timely information and decision-making skills. Recognizing these differences helps traders choose the right approach aligned with their risk tolerance and market conditions.

Comparison Table

| Aspect | Grid Trading | News-Based Trading |

|---|---|---|

| Trading Style | Automated, algorithmic | Event-driven, discretionary |

| Strategy | Place buy and sell orders at preset intervals | Trade based on economic and news announcements |

| Risk Management | Defined grid levels, stop-loss optional | High volatility risk, requires tight stops |

| Market Conditions | Best in ranging markets | Dependent on news impact, volatile markets |

| Time Commitment | Low, mostly automated | High, requires continuous monitoring |

| Profit Potential | Consistent over time, limited by grid size | High reward from significant news events |

| Tools Required | Grid bots, trading platform | News feeds, economic calendars, fast execution |

Which is better?

Grid trading offers systematic profit opportunities by placing buy and sell orders at predefined intervals, minimizing emotional decision-making through automation. News-based trading relies on market reactions to economic events, requiring fast analysis and execution to capitalize on volatility but carries higher risk due to unpredictable market responses. Traders seeking consistency and reduced emotional bias may prefer grid trading, while those aiming for high-impact gains might opt for news-based trading.

Connection

Grid trading and news-based trading intersect through their reliance on market volatility and price fluctuations. Grid trading capitalizes on predetermined price intervals to execute buy and sell orders, while news-based trading exploits sudden market movements triggered by economic announcements and geopolitical events. Combining both strategies allows traders to optimize entry and exit points by leveraging structured trade patterns alongside real-time market reactions.

Key Terms

**News-Based Trading:**

News-based trading leverages real-time economic data releases, geopolitical events, and market sentiment shifts to capitalize on swift price movements in financial markets. Traders analyze news impact on assets like stocks, forex, or commodities, using tools like economic calendars and sentiment indicators to time entry and exit points effectively. Explore detailed strategies and risk management techniques for mastering news-based trading.

Volatility

News-based trading capitalizes on market volatility triggered by economic announcements, geopolitical events, or earnings reports, aiming for quick profits from sharp price movements. Grid trading, in contrast, systematically places buy and sell orders at predefined intervals, benefiting from consistent price fluctuations regardless of direction. Explore more about how each strategy manages volatility for optimized trading outcomes.

Economic Calendar

News-based trading leverages real-time economic calendar events such as GDP releases, employment reports, and central bank announcements to capitalize on market volatility and trend shifts. Grid trading employs a systematic strategy by placing buy and sell orders at predefined intervals, largely independent of economic news, relying instead on price movement patterns. Explore more to understand how aligning your strategy with economic calendar events can enhance trading performance.

Source and External Links

News Based Trading - Quantra by QuantInsti - News-based trading involves traders exploiting temporary mispricing of securities caused by news events, using algorithms and sentiment analysis to interpret news impact for trading decisions, but it requires strong risk management due to challenges like noisy data and timing.

News Trading Strategies | How To Trade The News | AvaTrade - News trading seeks to capitalize on market volatility triggered by economic data or headlines, focusing on short-term event-driven opportunities distinct from traditional technical or fundamental analysis.

Trading the news - Wikipedia - Trading the news is a method where traders profit by quickly responding to financial news and events, using manual or automated algorithmic techniques to capture price moves driven by announcements like earnings, mergers, or economic reports.

dowidth.com

dowidth.com