Zero knowledge proof trading enhances privacy by enabling transactions without revealing sensitive details, contrasting sharply with centralized exchange (CEX) trading where user data is stored and managed by third-party intermediaries. CEX platforms offer high liquidity and user-friendly interfaces but often expose traders to risks of data breaches and regulatory scrutiny. Explore the advantages and challenges of zero knowledge proof trading versus centralized exchanges to understand which method suits your trading strategy best.

Why it is important

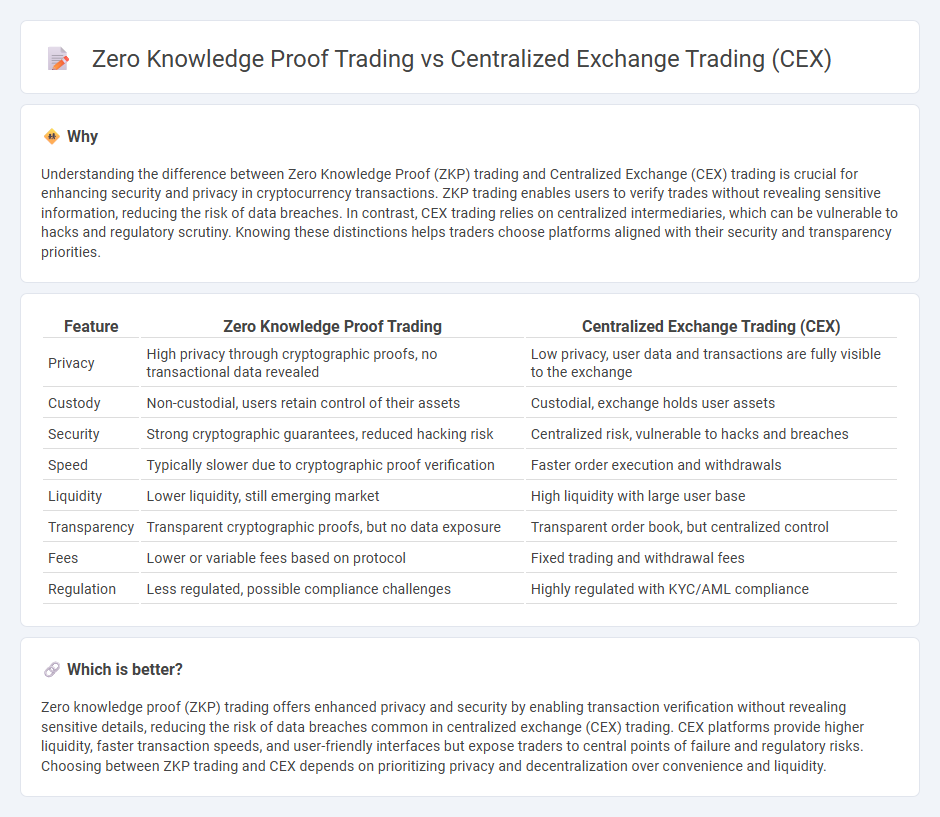

Understanding the difference between Zero Knowledge Proof (ZKP) trading and Centralized Exchange (CEX) trading is crucial for enhancing security and privacy in cryptocurrency transactions. ZKP trading enables users to verify trades without revealing sensitive information, reducing the risk of data breaches. In contrast, CEX trading relies on centralized intermediaries, which can be vulnerable to hacks and regulatory scrutiny. Knowing these distinctions helps traders choose platforms aligned with their security and transparency priorities.

Comparison Table

| Feature | Zero Knowledge Proof Trading | Centralized Exchange Trading (CEX) |

|---|---|---|

| Privacy | High privacy through cryptographic proofs, no transactional data revealed | Low privacy, user data and transactions are fully visible to the exchange |

| Custody | Non-custodial, users retain control of their assets | Custodial, exchange holds user assets |

| Security | Strong cryptographic guarantees, reduced hacking risk | Centralized risk, vulnerable to hacks and breaches |

| Speed | Typically slower due to cryptographic proof verification | Faster order execution and withdrawals |

| Liquidity | Lower liquidity, still emerging market | High liquidity with large user base |

| Transparency | Transparent cryptographic proofs, but no data exposure | Transparent order book, but centralized control |

| Fees | Lower or variable fees based on protocol | Fixed trading and withdrawal fees |

| Regulation | Less regulated, possible compliance challenges | Highly regulated with KYC/AML compliance |

Which is better?

Zero knowledge proof (ZKP) trading offers enhanced privacy and security by enabling transaction verification without revealing sensitive details, reducing the risk of data breaches common in centralized exchange (CEX) trading. CEX platforms provide higher liquidity, faster transaction speeds, and user-friendly interfaces but expose traders to central points of failure and regulatory risks. Choosing between ZKP trading and CEX depends on prioritizing privacy and decentralization over convenience and liquidity.

Connection

Zero knowledge proof trading enhances privacy and security in Centralized Exchange (CEX) environments by allowing users to verify transaction validity without revealing sensitive information. CEX platforms can integrate zero knowledge proofs to reduce risks of data breaches and regulatory non-compliance while maintaining efficient order matching and liquidity. This connection fosters trust and compliance in digital asset trading by combining cryptographic privacy with centralized operational control.

Key Terms

Source and External Links

What is a Centralized Cryptocurrency Exchange (CEX)? - Ledger - A centralized exchange (CEX) is a platform operated by a single entity acting as an intermediary and custodian between buyers and sellers, matching orders and providing liquidity using an order book system, where users deposit funds held in custody by the exchange itself.

Centralized Exchange (CEX) Definition - CoinMarketCap - Centralized exchanges are owned and operated by companies in a centralized manner, offering fast and cost-efficient transaction processing but presenting security risks and vulnerability to regulatory actions, with users' assets held in custody by the platform.

Everything you need to know about "Centralized Exchange (CEX)" - OneSafe - Centralized exchanges are platforms controlled by a single organization where users create accounts, deposit funds in crypto or fiat, and trade cryptocurrencies through an internal matching system that holds and manages user assets securely.

dowidth.com

dowidth.com