Liquidity sweep involves executing large orders by accessing multiple liquidity sources simultaneously to minimize market impact and optimize execution price. Trade-through occurs when an order is executed at a price worse than the best available quoted price, violating trade-through rules designed to protect market fairness. Explore the nuances and regulations shaping these trading practices to enhance your market strategy.

Why it is important

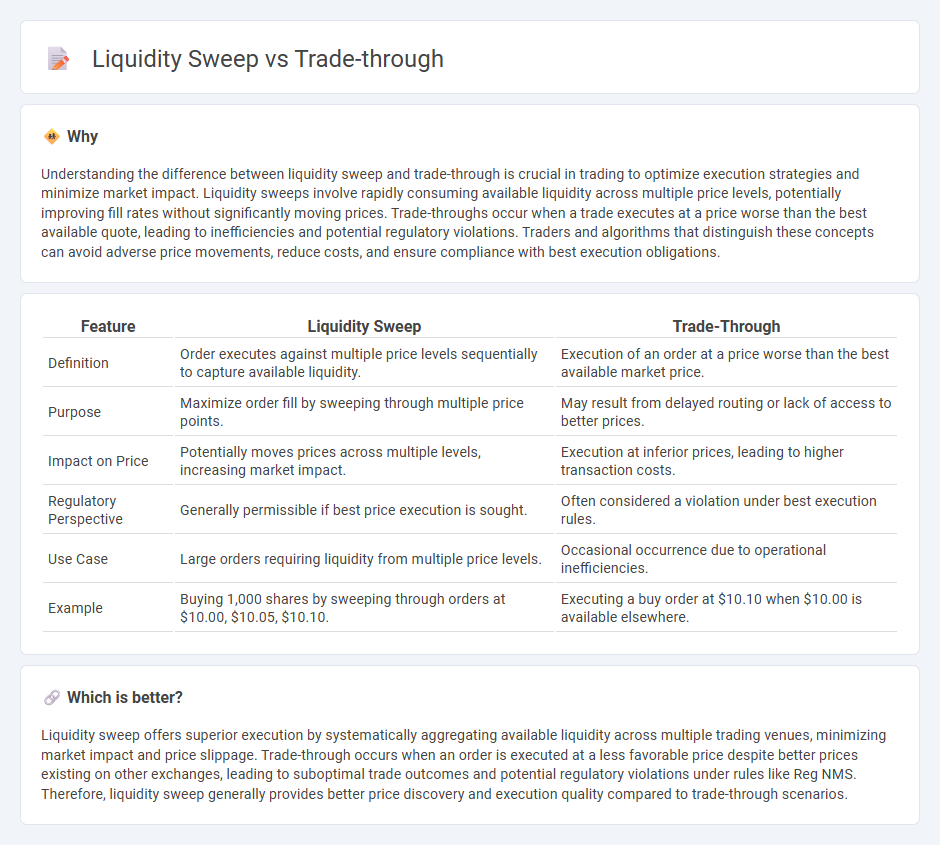

Understanding the difference between liquidity sweep and trade-through is crucial in trading to optimize execution strategies and minimize market impact. Liquidity sweeps involve rapidly consuming available liquidity across multiple price levels, potentially improving fill rates without significantly moving prices. Trade-throughs occur when a trade executes at a price worse than the best available quote, leading to inefficiencies and potential regulatory violations. Traders and algorithms that distinguish these concepts can avoid adverse price movements, reduce costs, and ensure compliance with best execution obligations.

Comparison Table

| Feature | Liquidity Sweep | Trade-Through |

|---|---|---|

| Definition | Order executes against multiple price levels sequentially to capture available liquidity. | Execution of an order at a price worse than the best available market price. |

| Purpose | Maximize order fill by sweeping through multiple price points. | May result from delayed routing or lack of access to better prices. |

| Impact on Price | Potentially moves prices across multiple levels, increasing market impact. | Execution at inferior prices, leading to higher transaction costs. |

| Regulatory Perspective | Generally permissible if best price execution is sought. | Often considered a violation under best execution rules. |

| Use Case | Large orders requiring liquidity from multiple price levels. | Occasional occurrence due to operational inefficiencies. |

| Example | Buying 1,000 shares by sweeping through orders at $10.00, $10.05, $10.10. | Executing a buy order at $10.10 when $10.00 is available elsewhere. |

Which is better?

Liquidity sweep offers superior execution by systematically aggregating available liquidity across multiple trading venues, minimizing market impact and price slippage. Trade-through occurs when an order is executed at a less favorable price despite better prices existing on other exchanges, leading to suboptimal trade outcomes and potential regulatory violations under rules like Reg NMS. Therefore, liquidity sweep generally provides better price discovery and execution quality compared to trade-through scenarios.

Connection

Liquidity sweeps occur when large orders are executed across multiple venues to access hidden liquidity, minimizing market impact and improving execution quality. Trade-through violations happen when an order executes at a price worse than the best available price on another market, often prevented by effective liquidity sweeps. Efficient liquidity sweeps help reduce trade-through incidents by ensuring orders capture the best prices across fragmented trading venues.

Key Terms

Order Routing

Trade-through refers to an order routing scenario where a trade executes at a price worse than a better available price on another venue, violating best execution rules. Liquidity sweep is a strategy designed to capture available liquidity across multiple venues by sweeping through order books, ensuring execution at the best available prices and minimizing market impact. Explore deeper insights into order routing mechanisms and best execution compliance to optimize trading strategies.

Best Execution

Trade-through occurs when a broker executes an order at a price inferior to a protected quotation displayed by another market center, violating the SEC's Order Protection Rule designed to ensure Best Execution. In contrast, a liquidity sweep involves simultaneously accessing multiple venues to capture hidden liquidity and optimize order fulfillment, enhancing execution quality without breaching price protection rules. Discover how these mechanisms influence your trading strategy and regulatory compliance to achieve superior Best Execution.

Market Impact

Trade-through occurs when an order is executed at a price worse than the best available bid or offer, causing inefficiencies and increased market impact due to suboptimal price execution. Liquidity sweep strategies target multiple price levels swiftly, reducing market impact by absorbing available liquidity without significantly moving the price. Explore more about how optimizing order execution can minimize market impact in volatile trading environments.

Source and External Links

Trade-Through | IBKR Glossary | IBKR Campus - A trade-through occurs when a market center executes a buy order at a price higher than the lowest offer or a sell order at a price lower than the highest bid, meaning the trade is made at an inferior price compared to the current inside market.

Rule 611 of Regulation NMS - The SEC's Rule 611 prohibits trade-throughs by requiring orders to be executed at the best available price during regular trading hours, either by routing the order to a better venue or canceling it, ensuring trades do not execute at prices outside the national best bid and offer.

Regulation NMS and Rule 611 - The Order Protection Rule under Regulation NMS mandates trading centers to prevent trade-throughs, although some exceptions exist; this rule is designed to protect investors by ensuring orders are executed at the best available prices.

dowidth.com

dowidth.com