Liquidity mining enables traders to earn rewards by providing assets to decentralized exchanges, enhancing market depth and trading efficiency. Perpetual swaps are derivative contracts that allow continuous exposure to an asset's price movements without expiry, facilitating leveraged trading on crypto platforms. Explore the differences to optimize your trading strategy and maximize returns.

Why it is important

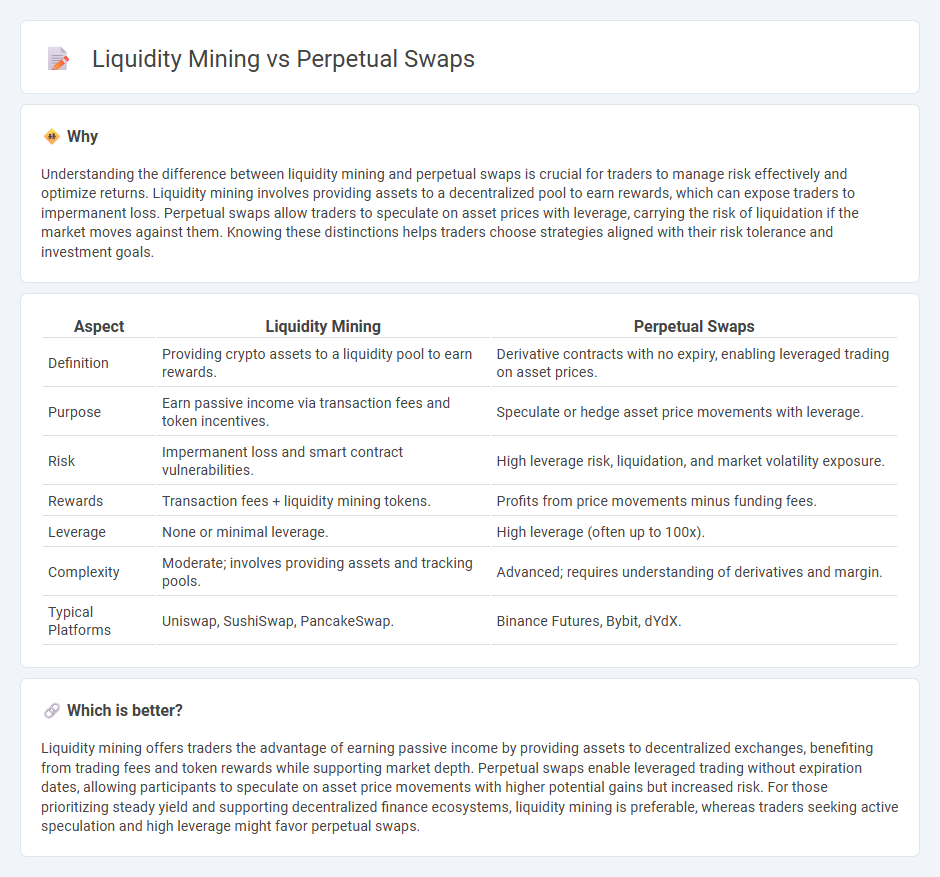

Understanding the difference between liquidity mining and perpetual swaps is crucial for traders to manage risk effectively and optimize returns. Liquidity mining involves providing assets to a decentralized pool to earn rewards, which can expose traders to impermanent loss. Perpetual swaps allow traders to speculate on asset prices with leverage, carrying the risk of liquidation if the market moves against them. Knowing these distinctions helps traders choose strategies aligned with their risk tolerance and investment goals.

Comparison Table

| Aspect | Liquidity Mining | Perpetual Swaps |

|---|---|---|

| Definition | Providing crypto assets to a liquidity pool to earn rewards. | Derivative contracts with no expiry, enabling leveraged trading on asset prices. |

| Purpose | Earn passive income via transaction fees and token incentives. | Speculate or hedge asset price movements with leverage. |

| Risk | Impermanent loss and smart contract vulnerabilities. | High leverage risk, liquidation, and market volatility exposure. |

| Rewards | Transaction fees + liquidity mining tokens. | Profits from price movements minus funding fees. |

| Leverage | None or minimal leverage. | High leverage (often up to 100x). |

| Complexity | Moderate; involves providing assets and tracking pools. | Advanced; requires understanding of derivatives and margin. |

| Typical Platforms | Uniswap, SushiSwap, PancakeSwap. | Binance Futures, Bybit, dYdX. |

Which is better?

Liquidity mining offers traders the advantage of earning passive income by providing assets to decentralized exchanges, benefiting from trading fees and token rewards while supporting market depth. Perpetual swaps enable leveraged trading without expiration dates, allowing participants to speculate on asset price movements with higher potential gains but increased risk. For those prioritizing steady yield and supporting decentralized finance ecosystems, liquidity mining is preferable, whereas traders seeking active speculation and high leverage might favor perpetual swaps.

Connection

Liquidity mining enhances decentralized exchange platforms by incentivizing users to provide capital, which increases liquidity essential for smooth trading of perpetual swaps. Perpetual swaps depend on deep liquidity pools to maintain price stability and minimize slippage during high-frequency trading. The synergy between liquidity mining and perpetual swaps boosts market efficiency and trading volume in decentralized finance ecosystems.

Key Terms

Leverage

Perpetual swaps offer high leverage, often up to 125x, enabling traders to amplify gains or losses on cryptocurrency positions without expiration dates. Liquidity mining, while less focused on leverage, provides participants with rewards by staking assets in liquidity pools to facilitate decentralized trading and earn transaction fees and token incentives. Explore how leverage impacts risk and returns in these DeFi mechanisms for better trading strategies.

Yield

Perpetual swaps offer yield through leverage and continuous trading fees, enabling traders to capitalize on market volatility without expiration dates. Liquidity mining provides yield by rewarding users with tokens for supplying assets to decentralized finance pools, enhancing market liquidity and incentivizing participation. Explore the detailed mechanisms and yield strategies of both to optimize your DeFi investment approach.

Funding Rate

Perpetual swaps feature a funding rate mechanism that regularly balances long and short positions through periodic payments between traders based on market conditions. Liquidity mining, by contrast, rewards users with tokens for providing liquidity in decentralized finance (DeFi) pools, without direct exposure to funding rate fluctuations. Explore the detailed dynamics and strategic benefits of funding rates in both perpetual swaps and liquidity mining to optimize your crypto investments.

Source and External Links

Understanding Perpetual Swaps Funding Rates - BlockFills - Perpetual swaps are derivative contracts without expiration that allow traders to use leverage and go short without borrowing, with a funding rate mechanism that keeps contract prices aligned with spot prices and supports advanced arbitrage strategies in crypto markets.

What are perpetual futures contracts? - Kraken - Perpetual futures contracts are leveraged derivatives with no expiration date, whose prices are anchored to the underlying asset's spot price by a regular funding rate exchange between long and short position holders, incentivizing market efficiency and price convergence.

How to Use Perpetual Futures in Crypto Trading - Bitstamp - Perpetual futures (or perps) are crypto derivatives allowing indefinite bullish or bearish positions with leverage, distinguished from traditional futures by having no expiration date and settling through funding payments to keep prices close to spot.

dowidth.com

dowidth.com