Alternative data signals, derived from unconventional sources such as social media trends, satellite imagery, and web traffic, offer real-time insights that complement traditional macroeconomic indicators like GDP, inflation rates, and employment figures. These unconventional signals enable traders to capture nuanced market movements and anticipate shifts before official data releases, enhancing decision-making accuracy. Explore how integrating alternative and macroeconomic signals can refine your trading strategies for better predictive power.

Why it is important

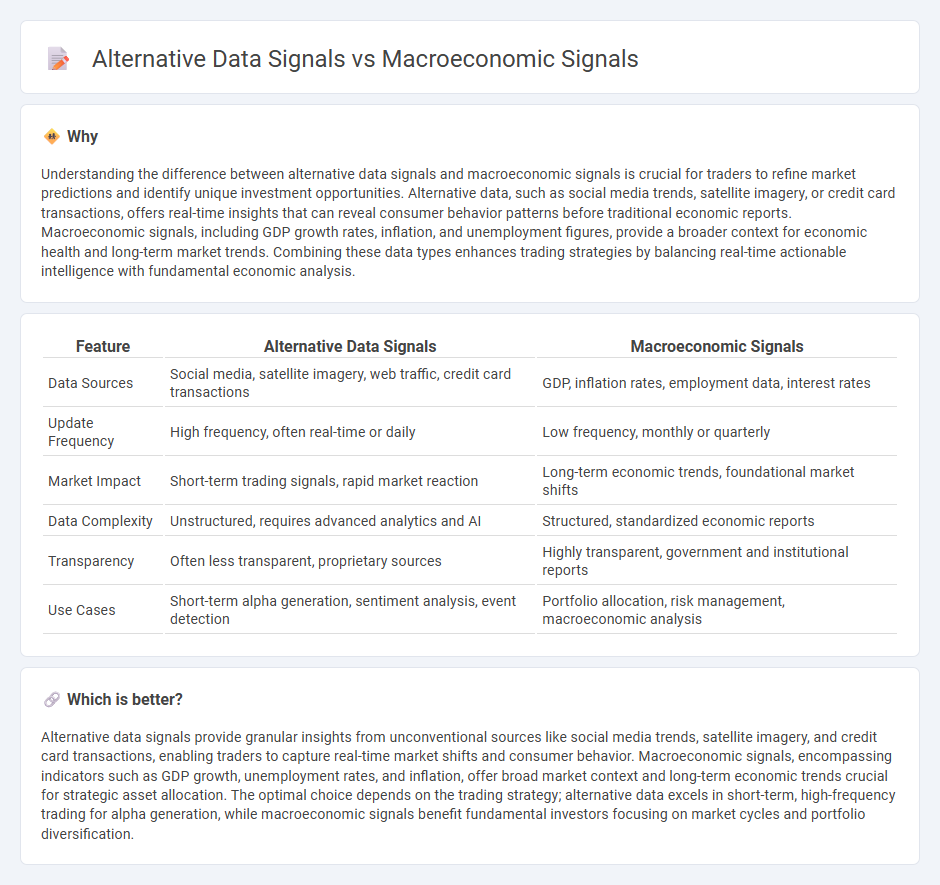

Understanding the difference between alternative data signals and macroeconomic signals is crucial for traders to refine market predictions and identify unique investment opportunities. Alternative data, such as social media trends, satellite imagery, or credit card transactions, offers real-time insights that can reveal consumer behavior patterns before traditional economic reports. Macroeconomic signals, including GDP growth rates, inflation, and unemployment figures, provide a broader context for economic health and long-term market trends. Combining these data types enhances trading strategies by balancing real-time actionable intelligence with fundamental economic analysis.

Comparison Table

| Feature | Alternative Data Signals | Macroeconomic Signals |

|---|---|---|

| Data Sources | Social media, satellite imagery, web traffic, credit card transactions | GDP, inflation rates, employment data, interest rates |

| Update Frequency | High frequency, often real-time or daily | Low frequency, monthly or quarterly |

| Market Impact | Short-term trading signals, rapid market reaction | Long-term economic trends, foundational market shifts |

| Data Complexity | Unstructured, requires advanced analytics and AI | Structured, standardized economic reports |

| Transparency | Often less transparent, proprietary sources | Highly transparent, government and institutional reports |

| Use Cases | Short-term alpha generation, sentiment analysis, event detection | Portfolio allocation, risk management, macroeconomic analysis |

Which is better?

Alternative data signals provide granular insights from unconventional sources like social media trends, satellite imagery, and credit card transactions, enabling traders to capture real-time market shifts and consumer behavior. Macroeconomic signals, encompassing indicators such as GDP growth, unemployment rates, and inflation, offer broad market context and long-term economic trends crucial for strategic asset allocation. The optimal choice depends on the trading strategy; alternative data excels in short-term, high-frequency trading for alpha generation, while macroeconomic signals benefit fundamental investors focusing on market cycles and portfolio diversification.

Connection

Alternative data signals, derived from non-traditional sources like satellite imagery, social media sentiment, and transaction records, often provide real-time insights into consumer behavior and market trends that complement macroeconomic signals such as GDP growth, unemployment rates, and inflation metrics. The integration of these data types enhances trading strategies by enabling more precise predictions of market movements and economic shifts. Traders leveraging both alternative and macroeconomic signals can improve risk management and capitalize on early indicators of asset price changes.

Key Terms

Source and External Links

Key Macroeconomic Indicators Every Investor Should Track - Macroeconomic signals such as GDP, inflation, interest rates, and labor market data provide crucial insights into economic health, guiding investment strategy, risk management, and portfolio positioning in volatile markets.

What Are the Key Macroeconomic Indicators? | IG International - Important macroeconomic signals include leading indicators like stock market trends, house prices, and manufacturing data, as well as lagging indicators like GDP growth, inflation (CPI), labor market stats, and commodity prices, which together help forecast and confirm economic conditions.

How Macroeconomic Analysts Interpret Economic Indicators - Analysts interpret economic signals such as GDP, inflation rates, and unemployment to assess economic growth, consumer confidence, inflationary pressures, and labor market health, informing asset allocation and sector strategies.

dowidth.com

dowidth.com