Liquidity mining involves providing cryptocurrency assets to decentralized finance (DeFi) pools in exchange for rewards, often in the form of additional tokens, fostering active market participation and enhanced asset liquidity. Lending, on the other hand, allows users to earn interest by loaning out their crypto holdings to borrowers, offering a more predictable income stream without directly impacting market trading volume. Explore the key differences and benefits of liquidity mining versus lending to optimize your trading strategy.

Why it is important

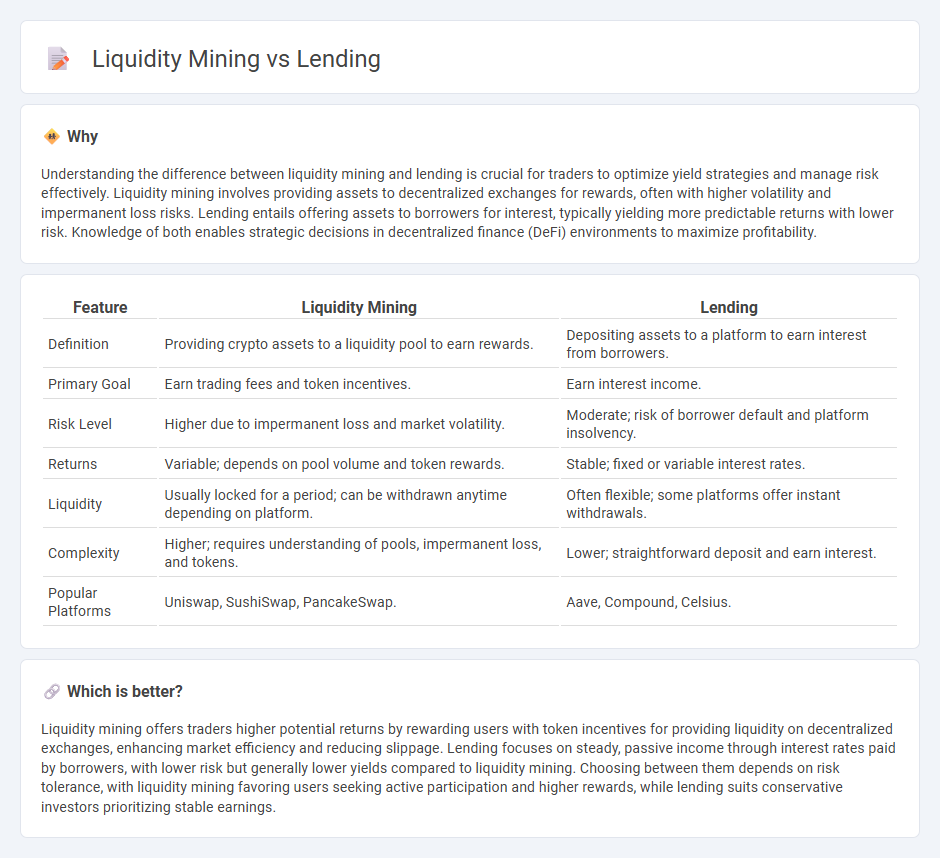

Understanding the difference between liquidity mining and lending is crucial for traders to optimize yield strategies and manage risk effectively. Liquidity mining involves providing assets to decentralized exchanges for rewards, often with higher volatility and impermanent loss risks. Lending entails offering assets to borrowers for interest, typically yielding more predictable returns with lower risk. Knowledge of both enables strategic decisions in decentralized finance (DeFi) environments to maximize profitability.

Comparison Table

| Feature | Liquidity Mining | Lending |

|---|---|---|

| Definition | Providing crypto assets to a liquidity pool to earn rewards. | Depositing assets to a platform to earn interest from borrowers. |

| Primary Goal | Earn trading fees and token incentives. | Earn interest income. |

| Risk Level | Higher due to impermanent loss and market volatility. | Moderate; risk of borrower default and platform insolvency. |

| Returns | Variable; depends on pool volume and token rewards. | Stable; fixed or variable interest rates. |

| Liquidity | Usually locked for a period; can be withdrawn anytime depending on platform. | Often flexible; some platforms offer instant withdrawals. |

| Complexity | Higher; requires understanding of pools, impermanent loss, and tokens. | Lower; straightforward deposit and earn interest. |

| Popular Platforms | Uniswap, SushiSwap, PancakeSwap. | Aave, Compound, Celsius. |

Which is better?

Liquidity mining offers traders higher potential returns by rewarding users with token incentives for providing liquidity on decentralized exchanges, enhancing market efficiency and reducing slippage. Lending focuses on steady, passive income through interest rates paid by borrowers, with lower risk but generally lower yields compared to liquidity mining. Choosing between them depends on risk tolerance, with liquidity mining favoring users seeking active participation and higher rewards, while lending suits conservative investors prioritizing stable earnings.

Connection

Liquidity mining involves providing cryptocurrencies to decentralized finance (DeFi) protocols, which increases market liquidity and enables users to earn rewards. Lending platforms benefit from liquidity mining by using the supplied assets to offer loans, creating a symbiotic relationship that enhances capital efficiency. This connection boosts trading volume and stabilizes asset prices through increased available liquidity in decentralized exchanges.

Key Terms

Interest Rate

Lending typically offers a fixed or variable interest rate determined by market demand, providing predictable returns for investors. Liquidity mining rewards participants with interest plus additional tokens, often resulting in higher but more volatile yields influenced by token price fluctuations. Explore detailed comparisons to understand which strategy aligns best with your financial goals.

Collateral

Lending platforms require borrowers to provide collateral assets, ensuring loan security and reducing default risk, while liquidity mining incentivizes users to supply liquidity by offering rewards, often without mandatory collateral. Collateral plays a critical role in lending by maintaining systemic stability and protecting lenders, whereas liquidity mining focuses on boosting token adoption and market depth through staking or pooling tokens. Explore more about how collateral impacts DeFi strategies and user risk management.

Yield

Lending and liquidity mining are prominent DeFi strategies focused on yield generation, with lending typically offering stable returns through interest payments by borrowers utilizing platforms like Aave or Compound. Liquidity mining incentivizes users to provide liquidity in decentralized exchanges such as Uniswap or SushiSwap by rewarding them with additional tokens, potentially leading to higher, but more volatile, yields. Explore the nuances of these yield-focused activities to optimize your decentralized finance investment strategy.

Source and External Links

Marketplace Lending - FDIC - Marketplace lending is an alternative financial service connecting borrowers and lenders through online platforms without traditional banks, using proprietary credit scoring to assess risk and attract both retail and institutional investors.

Apply for a Personal Loan - Lending Club - Personal loans are fixed-term, fixed-rate loans that can be used for multiple purposes such as debt consolidation or unexpected expenses and require evaluation of creditworthiness to qualify.

Investment Lending - Inter-American Development Bank - The IDB provides different loans to finance development projects by supporting micro, small, and medium-sized enterprises and subnational entities with funds disbursed based on proof of eligible expenditures.

dowidth.com

dowidth.com