Funding rate arbitrage exploits differences in perpetual futures funding rates across exchanges to generate risk-free profits, while index arbitrage capitalizes on price discrepancies between spot markets and futures index values. Traders in funding rate arbitrage focus on capturing periodic payments linked to funding rates, whereas index arbitrageurs leverage mispricings to execute simultaneous buy and sell orders for price convergence. Explore deeper insights on how these arbitrage strategies optimize trading execution and yield potential.

Why it is important

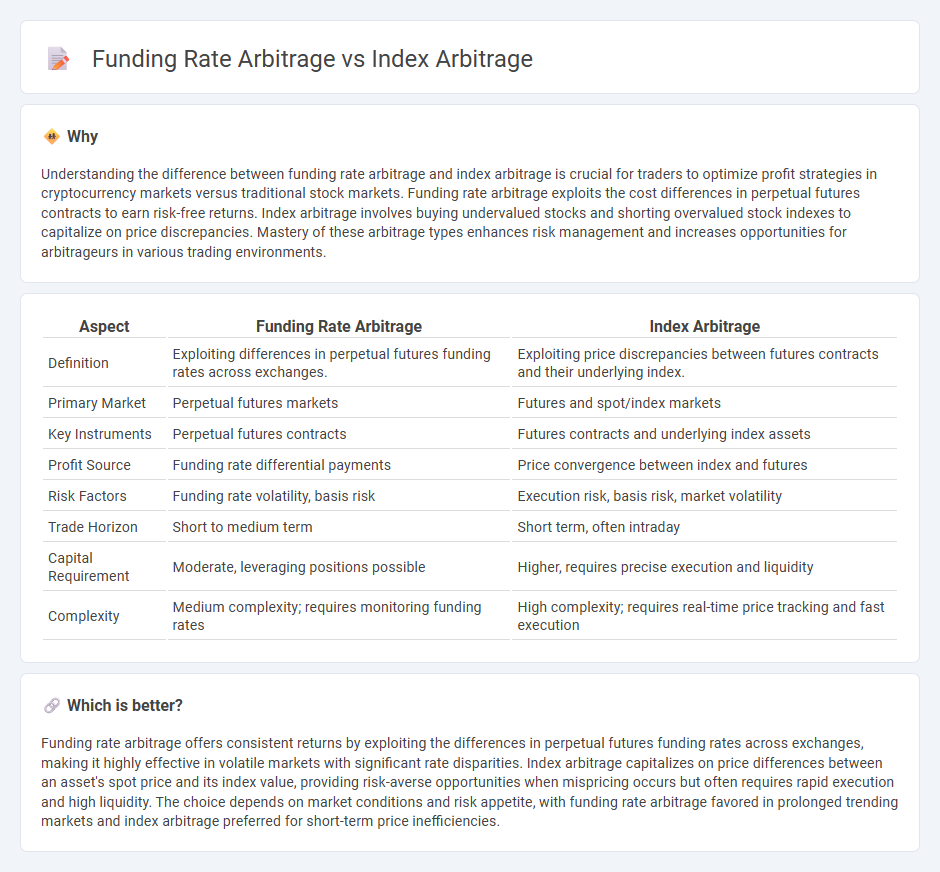

Understanding the difference between funding rate arbitrage and index arbitrage is crucial for traders to optimize profit strategies in cryptocurrency markets versus traditional stock markets. Funding rate arbitrage exploits the cost differences in perpetual futures contracts to earn risk-free returns. Index arbitrage involves buying undervalued stocks and shorting overvalued stock indexes to capitalize on price discrepancies. Mastery of these arbitrage types enhances risk management and increases opportunities for arbitrageurs in various trading environments.

Comparison Table

| Aspect | Funding Rate Arbitrage | Index Arbitrage |

|---|---|---|

| Definition | Exploiting differences in perpetual futures funding rates across exchanges. | Exploiting price discrepancies between futures contracts and their underlying index. |

| Primary Market | Perpetual futures markets | Futures and spot/index markets |

| Key Instruments | Perpetual futures contracts | Futures contracts and underlying index assets |

| Profit Source | Funding rate differential payments | Price convergence between index and futures |

| Risk Factors | Funding rate volatility, basis risk | Execution risk, basis risk, market volatility |

| Trade Horizon | Short to medium term | Short term, often intraday |

| Capital Requirement | Moderate, leveraging positions possible | Higher, requires precise execution and liquidity |

| Complexity | Medium complexity; requires monitoring funding rates | High complexity; requires real-time price tracking and fast execution |

Which is better?

Funding rate arbitrage offers consistent returns by exploiting the differences in perpetual futures funding rates across exchanges, making it highly effective in volatile markets with significant rate disparities. Index arbitrage capitalizes on price differences between an asset's spot price and its index value, providing risk-averse opportunities when mispricing occurs but often requires rapid execution and high liquidity. The choice depends on market conditions and risk appetite, with funding rate arbitrage favored in prolonged trending markets and index arbitrage preferred for short-term price inefficiencies.

Connection

Funding rate arbitrage exploits the differences in perpetual futures funding rates across various exchanges to generate risk-free profits by simultaneously holding opposing positions. Index arbitrage involves capitalizing on discrepancies between the spot price of an underlying asset and its corresponding futures index value. Both strategies rely on price inefficiencies and market mispricings, linking funding rate arbitrage and index arbitrage through their dependence on exploiting divergences between derivative prices and underlying asset values.

Key Terms

**Index Arbitrage:**

Index arbitrage exploits price discrepancies between a futures contract and its underlying index, leveraging rapid trades to capture risk-free profits in highly liquid markets. Traders monitor the basis, the difference between futures and spot index prices, executing simultaneous buy and sell orders to capitalize on mispricing before convergence at expiration. Explore deeper insights into how index arbitrage strategies optimize returns amidst market efficiency.

Price Convergence

Index arbitrage exploits the price convergence between futures contracts and their underlying asset indices to capture risk-free profits when discrepancies occur. Funding rate arbitrage capitalizes on the periodic interest payments between long and short positions in perpetual futures, profiting from differences in funding rates rather than price alignment. Explore detailed strategies and market impacts of these arbitrage techniques to optimize trading performance.

Basket Trading

Index arbitrage exploits price discrepancies between index futures and the underlying basket of stocks, enabling traders to balance risk and execute basket trading strategies efficiently. Funding rate arbitrage targets differences in perpetual swap funding rates across exchanges, allowing traders to capitalize on interest rate imbalances without direct exposure to the underlying assets. Explore detailed comparisons and strategies in basket trading to optimize arbitrage opportunities.

Source and External Links

Index Arbitrage - QuantInsti - Index arbitrage is a trading strategy exploiting price discrepancies between a stock index and its futures contract by taking simultaneous opposite positions to profit from price convergence.

Index arbitrage - Wikipedia - Index arbitrage involves exploiting price differences between the market price of an index-related product (like futures or ETFs) and the underlying stocks that compose the index, often using synthetic calculations of fair value to guide trades.

What is Stock Index Arbitrage? Definition and Examples - Groww - Index arbitrage profits from disparities between an index and its futures by buying undervalued assets and selling overvalued futures, guided by the concept of index fair value factoring in costs like interest and dividends.

dowidth.com

dowidth.com