High-frequency trading bots execute rapid, algorithm-driven trades that capitalize on minute price fluctuations within milliseconds, using advanced technology and low-latency systems. Quantitative trading employs mathematical models and statistical analysis to identify trading opportunities over varied timeframes, often incorporating fundamental data and market trends. Explore the distinctions and advantages of both strategies to optimize your trading approach.

Why it is important

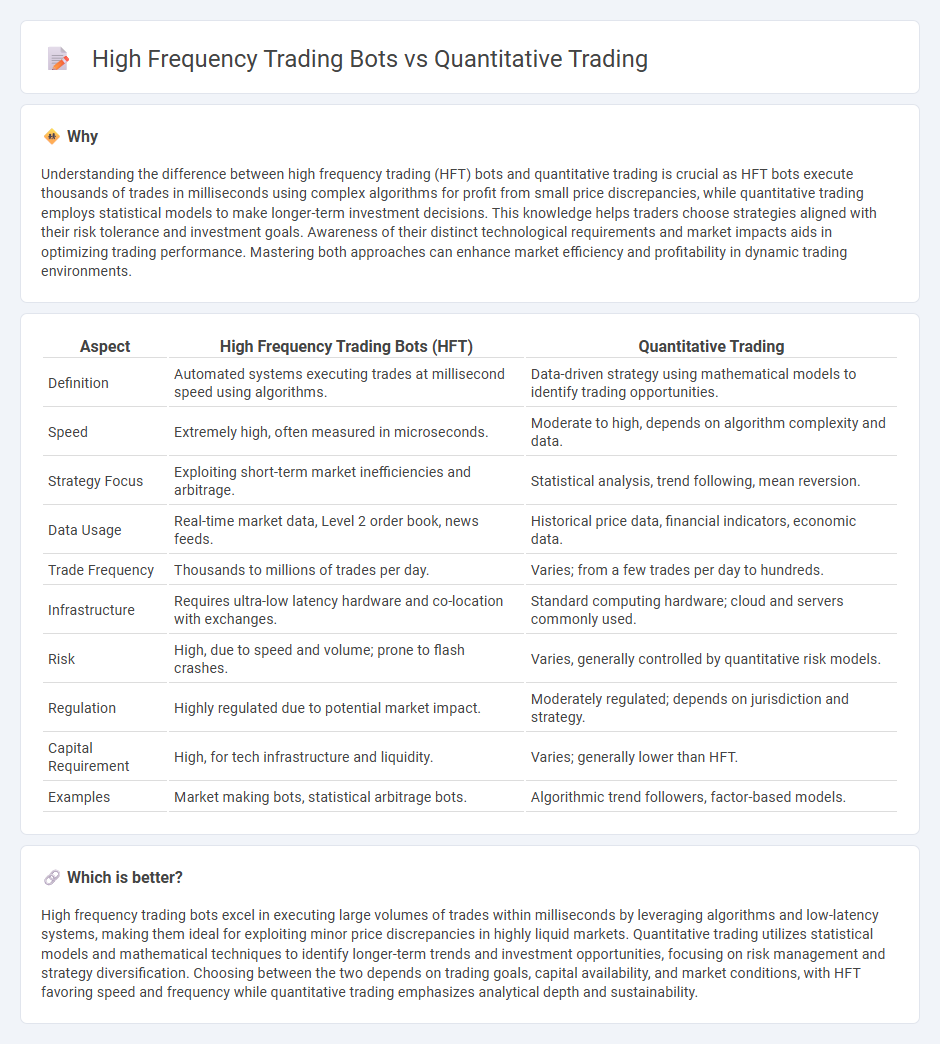

Understanding the difference between high frequency trading (HFT) bots and quantitative trading is crucial as HFT bots execute thousands of trades in milliseconds using complex algorithms for profit from small price discrepancies, while quantitative trading employs statistical models to make longer-term investment decisions. This knowledge helps traders choose strategies aligned with their risk tolerance and investment goals. Awareness of their distinct technological requirements and market impacts aids in optimizing trading performance. Mastering both approaches can enhance market efficiency and profitability in dynamic trading environments.

Comparison Table

| Aspect | High Frequency Trading Bots (HFT) | Quantitative Trading |

|---|---|---|

| Definition | Automated systems executing trades at millisecond speed using algorithms. | Data-driven strategy using mathematical models to identify trading opportunities. |

| Speed | Extremely high, often measured in microseconds. | Moderate to high, depends on algorithm complexity and data. |

| Strategy Focus | Exploiting short-term market inefficiencies and arbitrage. | Statistical analysis, trend following, mean reversion. |

| Data Usage | Real-time market data, Level 2 order book, news feeds. | Historical price data, financial indicators, economic data. |

| Trade Frequency | Thousands to millions of trades per day. | Varies; from a few trades per day to hundreds. |

| Infrastructure | Requires ultra-low latency hardware and co-location with exchanges. | Standard computing hardware; cloud and servers commonly used. |

| Risk | High, due to speed and volume; prone to flash crashes. | Varies, generally controlled by quantitative risk models. |

| Regulation | Highly regulated due to potential market impact. | Moderately regulated; depends on jurisdiction and strategy. |

| Capital Requirement | High, for tech infrastructure and liquidity. | Varies; generally lower than HFT. |

| Examples | Market making bots, statistical arbitrage bots. | Algorithmic trend followers, factor-based models. |

Which is better?

High frequency trading bots excel in executing large volumes of trades within milliseconds by leveraging algorithms and low-latency systems, making them ideal for exploiting minor price discrepancies in highly liquid markets. Quantitative trading utilizes statistical models and mathematical techniques to identify longer-term trends and investment opportunities, focusing on risk management and strategy diversification. Choosing between the two depends on trading goals, capital availability, and market conditions, with HFT favoring speed and frequency while quantitative trading emphasizes analytical depth and sustainability.

Connection

High frequency trading (HFT) bots rely on quantitative trading strategies that use complex mathematical models and algorithms to execute trades at extremely fast speeds. Quantitative trading provides the data-driven framework and statistical analysis methods that enable HFT bots to identify market inefficiencies and execute trades within milliseconds. The integration of real-time data processing and algorithmic decision-making in quantitative trading is essential for the success and precision of HFT bots in financial markets.

Key Terms

Algorithmic strategies

Quantitative trading utilizes complex mathematical models to identify profitable opportunities, often analyzing vast datasets for strategic decision-making. High frequency trading (HFT) bots implement ultra-fast algorithms that execute thousands of trades per second to capitalize on minute price discrepancies. Explore the nuances and technological advancements of these algorithmic strategies to gain deeper insights.

Latency

Quantitative trading relies on mathematical models to identify trading opportunities, whereas high frequency trading (HFT) bots prioritize ultra-low latency to execute a large volume of trades within milliseconds. Latency, the delay between order initiation and execution, is critically minimized in HFT through co-location services and specialized hardware to gain competitive advantages. Discover how advancements in latency reduction are reshaping the future of algorithmic trading strategies.

Market microstructure

Quantitative trading employs statistical models and historical data analysis to identify profitable strategies, whereas high-frequency trading (HFT) bots exploit market microstructure by executing rapid trades that capitalize on bid-ask spreads and order book dynamics. HFT bots leverage ultra-low latency to react to market signals within microseconds, often engaging in market making, arbitrage, and momentum ignition under fragmented liquidity conditions. Explore deeper insights into how these algorithmic strategies interact with market microstructure for optimized trading performance.

Source and External Links

Quantitative Trading Firms Explained | Hunter Bond - Quantitative trading uses mathematical models, statistics, and algorithms to analyze vast financial and external data, develop trading algorithms, and execute trades automatically at high speed to optimize profitability and minimize risk.

Quantitative analysis (finance) - Wikipedia - Quantitative trading applies mathematical and statistical methods in finance, focusing on identifying patterns like correlations and price movements, with strategies including statistical arbitrage and algorithmic trading used by firms like Renaissance Technologies and AQR Capital Management.

8-Course Guide to Quantitative Trading for Beginners | Quantra - Comprehensive beginner courses teach quantitative trading including strategy building, coding, backtesting, live trading, and risk management across various asset classes using Python and AI technologies.

dowidth.com

dowidth.com