Quantitative trading signals leverage statistical models and historical data to identify market opportunities, focusing on numerical indicators such as moving averages, momentum, and volatility metrics. Algorithmic pattern recognition employs machine learning and artificial intelligence to detect complex chart patterns and market behaviors that traditional quantitative methods might overlook. Discover more about how these advanced techniques revolutionize trading strategies and enhance decision-making accuracy.

Why it is important

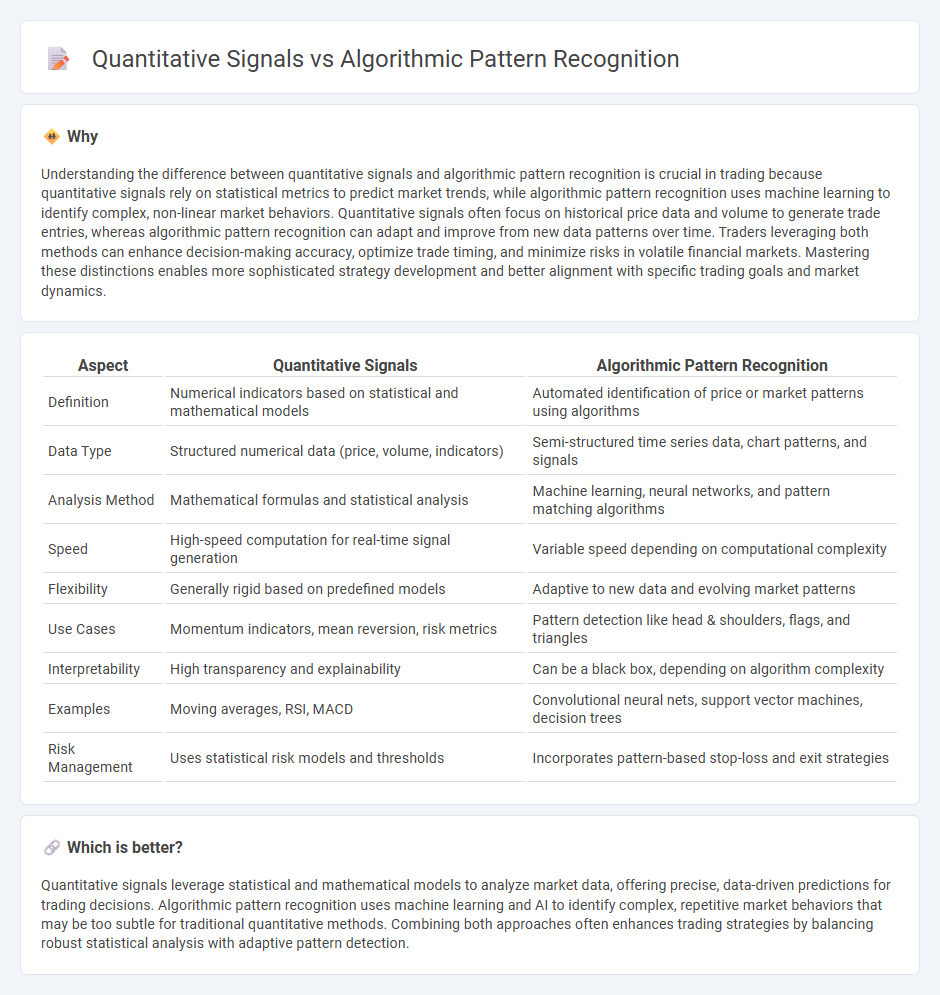

Understanding the difference between quantitative signals and algorithmic pattern recognition is crucial in trading because quantitative signals rely on statistical metrics to predict market trends, while algorithmic pattern recognition uses machine learning to identify complex, non-linear market behaviors. Quantitative signals often focus on historical price data and volume to generate trade entries, whereas algorithmic pattern recognition can adapt and improve from new data patterns over time. Traders leveraging both methods can enhance decision-making accuracy, optimize trade timing, and minimize risks in volatile financial markets. Mastering these distinctions enables more sophisticated strategy development and better alignment with specific trading goals and market dynamics.

Comparison Table

| Aspect | Quantitative Signals | Algorithmic Pattern Recognition |

|---|---|---|

| Definition | Numerical indicators based on statistical and mathematical models | Automated identification of price or market patterns using algorithms |

| Data Type | Structured numerical data (price, volume, indicators) | Semi-structured time series data, chart patterns, and signals |

| Analysis Method | Mathematical formulas and statistical analysis | Machine learning, neural networks, and pattern matching algorithms |

| Speed | High-speed computation for real-time signal generation | Variable speed depending on computational complexity |

| Flexibility | Generally rigid based on predefined models | Adaptive to new data and evolving market patterns |

| Use Cases | Momentum indicators, mean reversion, risk metrics | Pattern detection like head & shoulders, flags, and triangles |

| Interpretability | High transparency and explainability | Can be a black box, depending on algorithm complexity |

| Examples | Moving averages, RSI, MACD | Convolutional neural nets, support vector machines, decision trees |

| Risk Management | Uses statistical risk models and thresholds | Incorporates pattern-based stop-loss and exit strategies |

Which is better?

Quantitative signals leverage statistical and mathematical models to analyze market data, offering precise, data-driven predictions for trading decisions. Algorithmic pattern recognition uses machine learning and AI to identify complex, repetitive market behaviors that may be too subtle for traditional quantitative methods. Combining both approaches often enhances trading strategies by balancing robust statistical analysis with adaptive pattern detection.

Connection

Quantitative signals in trading harness statistical and mathematical models to identify potential market opportunities by analyzing historical price data and volume patterns. Algorithmic pattern recognition enhances this process by using machine learning algorithms to detect complex and recurring market structures, enabling more precise and timely trade execution. The integration of these technologies allows traders to systematically optimize strategies, reduce emotional bias, and improve overall portfolio performance.

Key Terms

Algorithmic Pattern Recognition:

Algorithmic pattern recognition leverages advanced machine learning techniques to identify complex data structures and trends, outperforming traditional quantitative signals that rely solely on numerical thresholds and indicators. This method enhances predictive accuracy by analyzing intricate relationships within datasets, enabling more robust decision-making in fields like finance, healthcare, and security. Explore how algorithmic pattern recognition transforms data analysis and drives innovation across industries.

Machine Learning

Algorithmic pattern recognition leverages machine learning models to identify complex data structures and trends, improving accuracy through feature extraction and adaptive learning techniques. Quantitative signals involve statistical and numerical measures that serve as input variables for machine learning algorithms to predict outcomes based on data-driven evidence. Discover how integrating both approaches enhances predictive analytics and decision-making in advanced machine learning frameworks.

Feature Extraction

Algorithmic pattern recognition employs advanced mathematical models to identify complex data structures, enhancing feature extraction through techniques like principal component analysis and wavelet transforms. Quantitative signals rely on numerical data analysis to extract measurable characteristics, such as amplitude, frequency, and phase, which serve as critical inputs for classification tasks. Explore more to understand how these methodologies optimize data interpretation and improve predictive accuracy.

Source and External Links

Pattern Recognition Algorithms - Algorithmic pattern recognition involves identifying and classifying patterns in data using techniques like feature extraction, classification, clustering, and decision-making, often applying machine learning models such as decision trees, support vector machines, and neural networks.

What is pattern recognition? A gentle introduction - Pattern recognition algorithms use statistical, syntactic (structural), or neural network approaches to detect patterns in data, where statistical methods treat patterns as points in a feature space and neural methods use artificial neural networks for recognition and classification.

Types of Pattern Recognition Algorithms - Different algorithmic patterns include structural models for hierarchical pattern relationships, neural networks for classification using feed-forward and feedback learning, and template matching techniques to recognize patterns by comparing to stored templates.

dowidth.com

dowidth.com