Microstructure trading focuses on analyzing the detailed mechanics of order flow, bid-ask spreads, and market depth to optimize trade execution and capture short-term opportunities. Technical analysis evaluates historical price charts, patterns, and indicators to predict future market movements and guide strategic entries and exits. Explore how combining these methods can enhance your trading performance and market understanding.

Why it is important

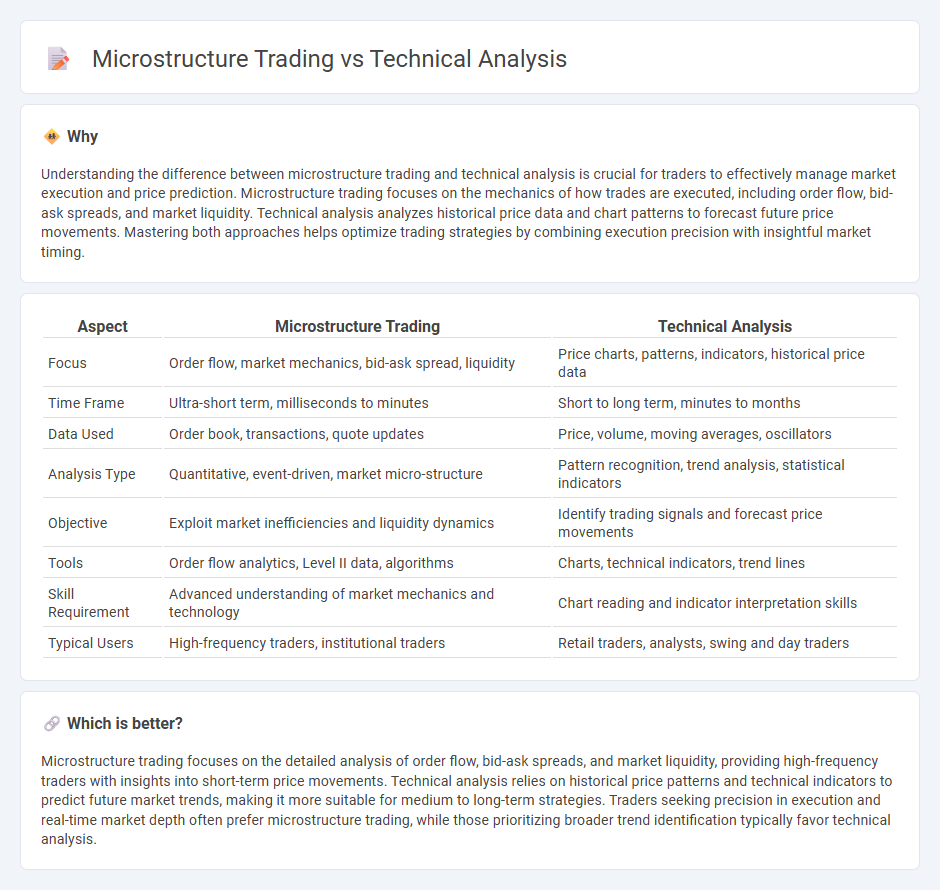

Understanding the difference between microstructure trading and technical analysis is crucial for traders to effectively manage market execution and price prediction. Microstructure trading focuses on the mechanics of how trades are executed, including order flow, bid-ask spreads, and market liquidity. Technical analysis analyzes historical price data and chart patterns to forecast future price movements. Mastering both approaches helps optimize trading strategies by combining execution precision with insightful market timing.

Comparison Table

| Aspect | Microstructure Trading | Technical Analysis |

|---|---|---|

| Focus | Order flow, market mechanics, bid-ask spread, liquidity | Price charts, patterns, indicators, historical price data |

| Time Frame | Ultra-short term, milliseconds to minutes | Short to long term, minutes to months |

| Data Used | Order book, transactions, quote updates | Price, volume, moving averages, oscillators |

| Analysis Type | Quantitative, event-driven, market micro-structure | Pattern recognition, trend analysis, statistical indicators |

| Objective | Exploit market inefficiencies and liquidity dynamics | Identify trading signals and forecast price movements |

| Tools | Order flow analytics, Level II data, algorithms | Charts, technical indicators, trend lines |

| Skill Requirement | Advanced understanding of market mechanics and technology | Chart reading and indicator interpretation skills |

| Typical Users | High-frequency traders, institutional traders | Retail traders, analysts, swing and day traders |

Which is better?

Microstructure trading focuses on the detailed analysis of order flow, bid-ask spreads, and market liquidity, providing high-frequency traders with insights into short-term price movements. Technical analysis relies on historical price patterns and technical indicators to predict future market trends, making it more suitable for medium to long-term strategies. Traders seeking precision in execution and real-time market depth often prefer microstructure trading, while those prioritizing broader trend identification typically favor technical analysis.

Connection

Microstructure trading examines the detailed mechanisms of order execution and market liquidity, providing granular insights into price formation and trading behavior. Technical analysis relies on price patterns and volume data that are directly influenced by microstructure factors such as bid-ask spreads, order flow, and market depth. Integrating microstructure trading concepts enhances the accuracy of technical analysis by accounting for underlying market dynamics that shape price movements.

Key Terms

**Technical Analysis:**

Technical Analysis examines historical price charts, volume patterns, and key indicators such as moving averages and Relative Strength Index (RSI) to predict future market movements. It primarily relies on publicly available data and chart patterns, emphasizing trends, support and resistance levels, and momentum signals for decision-making. Explore detailed strategies and tools in technical analysis to enhance your trading precision.

Chart Patterns

Technical analysis employs chart patterns such as head and shoulders, double tops, and triangles to predict market trends by analyzing historical price data and volume. Microstructure trading focuses on order flow, bid-ask spreads, and trade execution details to gain insights into short-term market dynamics and liquidity. Explore more to understand how combining chart patterns with microstructure insights can enhance trading strategies.

Moving Averages

Moving Averages serve as a fundamental tool in both Technical Analysis and Microstructure Trading, smoothing price data to identify trends and potential entry points. In Technical Analysis, they primarily indicate market direction over specified periods, while Microstructure Trading applies Moving Averages to high-frequency data for precision in detecting short-term price movements. Explore the nuances and applications of Moving Averages to enhance your trading strategy.

Source and External Links

Technical Analysis - A Beginner's Guide - Corporate Finance Institute - Technical analysis is a method used to predict future price movements of securities by analyzing market data and price action, emphasizing that historical prices reflect all relevant information and that traders use various time frames and indicators based on their trading style.

Technical analysis - Wikipedia - Technical analysis studies past market data, primarily price and volume, under the principle that all relevant information is reflected in price, focusing on trends and patterns repeated due to investor behavior.

Beginners Guide to Technical Analysis | Learn to Trade - Oanda - This guide introduces technical analysis by emphasizing the identification of price trends, support and resistance areas, and the use of tools like moving averages and momentum indicators to make high-probability trades.

dowidth.com

dowidth.com