Volatility harvesting leverages price fluctuations to generate consistent returns by strategically timing trades during market swings. Quantitative trading employs mathematical models and algorithms to analyze large datasets and execute trades based on statistical patterns. Explore more to understand how these strategies can enhance your trading portfolio.

Why it is important

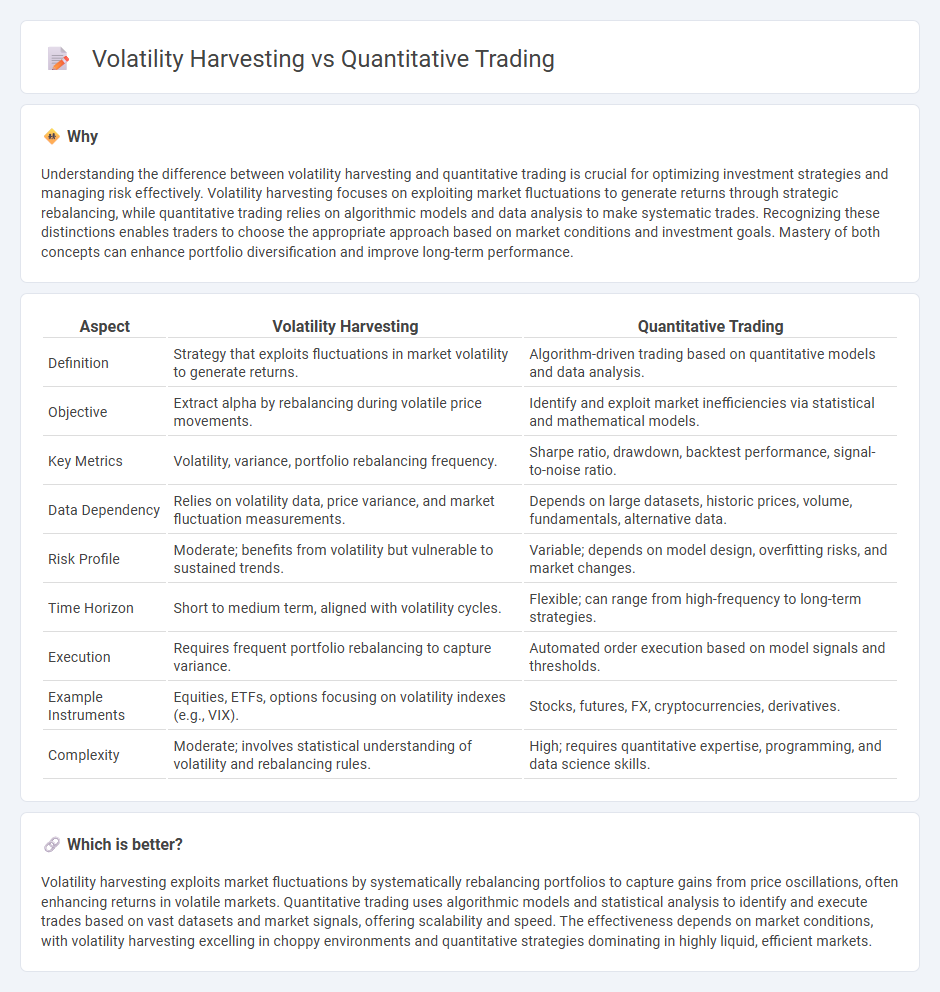

Understanding the difference between volatility harvesting and quantitative trading is crucial for optimizing investment strategies and managing risk effectively. Volatility harvesting focuses on exploiting market fluctuations to generate returns through strategic rebalancing, while quantitative trading relies on algorithmic models and data analysis to make systematic trades. Recognizing these distinctions enables traders to choose the appropriate approach based on market conditions and investment goals. Mastery of both concepts can enhance portfolio diversification and improve long-term performance.

Comparison Table

| Aspect | Volatility Harvesting | Quantitative Trading |

|---|---|---|

| Definition | Strategy that exploits fluctuations in market volatility to generate returns. | Algorithm-driven trading based on quantitative models and data analysis. |

| Objective | Extract alpha by rebalancing during volatile price movements. | Identify and exploit market inefficiencies via statistical and mathematical models. |

| Key Metrics | Volatility, variance, portfolio rebalancing frequency. | Sharpe ratio, drawdown, backtest performance, signal-to-noise ratio. |

| Data Dependency | Relies on volatility data, price variance, and market fluctuation measurements. | Depends on large datasets, historic prices, volume, fundamentals, alternative data. |

| Risk Profile | Moderate; benefits from volatility but vulnerable to sustained trends. | Variable; depends on model design, overfitting risks, and market changes. |

| Time Horizon | Short to medium term, aligned with volatility cycles. | Flexible; can range from high-frequency to long-term strategies. |

| Execution | Requires frequent portfolio rebalancing to capture variance. | Automated order execution based on model signals and thresholds. |

| Example Instruments | Equities, ETFs, options focusing on volatility indexes (e.g., VIX). | Stocks, futures, FX, cryptocurrencies, derivatives. |

| Complexity | Moderate; involves statistical understanding of volatility and rebalancing rules. | High; requires quantitative expertise, programming, and data science skills. |

Which is better?

Volatility harvesting exploits market fluctuations by systematically rebalancing portfolios to capture gains from price oscillations, often enhancing returns in volatile markets. Quantitative trading uses algorithmic models and statistical analysis to identify and execute trades based on vast datasets and market signals, offering scalability and speed. The effectiveness depends on market conditions, with volatility harvesting excelling in choppy environments and quantitative strategies dominating in highly liquid, efficient markets.

Connection

Volatility harvesting leverages the natural price fluctuations in financial markets to generate returns through systematic rebalancing, which is a core principle in quantitative trading strategies. Quantitative trading employs mathematical models and algorithms to identify and exploit patterns in market volatility, enabling traders to optimize risk-adjusted returns. By integrating volatility harvesting techniques, quantitative trading enhances portfolio performance by systematically capturing gains from market dynamics.

Key Terms

Algorithmic Strategies

Quantitative trading employs mathematical models and statistical analysis to execute trades based on historical data, while volatility harvesting exploits market fluctuations by systematically rebalancing portfolios to capture gains from volatility. Algorithmic strategies in quantitative trading often rely on high-frequency data and machine learning, whereas volatility harvesting algorithms focus on risk management and dynamic allocation across asset classes. Explore how these distinct algorithmic approaches enhance portfolio performance and risk-adjusted returns.

Mean Reversion

Quantitative trading leverages statistical models and algorithms to identify mean reversion opportunities, where asset prices tend to revert to their historical averages, enabling systematic entry and exit strategies. Volatility harvesting exploits fluctuations in asset prices by repeatedly buying low and selling high, profiting from volatility without relying on directional price forecasts. Explore detailed methodologies and performance comparisons to enhance your trading strategy insights.

Volatility Risk Premium

Quantitative trading strategies leverage statistical models and algorithms to exploit market inefficiencies, while volatility harvesting specifically targets the Volatility Risk Premium, capturing returns from the difference between implied and realized volatility. Volatility harvesting benefits from systematic rebalancing in volatile markets, allowing investors to harvest excess returns due to market volatility dynamics. Explore deeper insights into the integration of Volatility Risk Premium in quantitative trading techniques for enhanced portfolio performance.

Source and External Links

How To Become a Quantitative Trader in 4 Steps (With Skills) - Indeed - A quantitative trader (quant) uses mathematical models and large data analysis to identify profitable trade opportunities and develop trading strategies, often relying on advanced computer programs and requiring creativity for evolving financial markets.

Quantitative analysis (finance) - Wikipedia - Quantitative analysis applies mathematical and statistical methods to finance, including derivatives pricing, risk management, and investment management, using techniques like algorithmic and statistical arbitrage trading.

8-Course Guide to Quantitative Trading for Beginners - A learning track providing free courses to develop skills in Python-based quant trading, AI trading strategies, backtesting, live trading, and risk management across various asset classes such as stocks, forex, and crypto.

dowidth.com

dowidth.com