Quantitative sentiment analysis leverages large datasets and machine learning algorithms to gauge market mood and predict price movements by analyzing social media, news, and financial reports. Fundamental analysis focuses on evaluating a company's intrinsic value through financial statements, industry conditions, and economic indicators to inform investment decisions. Explore the strengths and applications of both approaches to enhance your trading strategy.

Why it is important

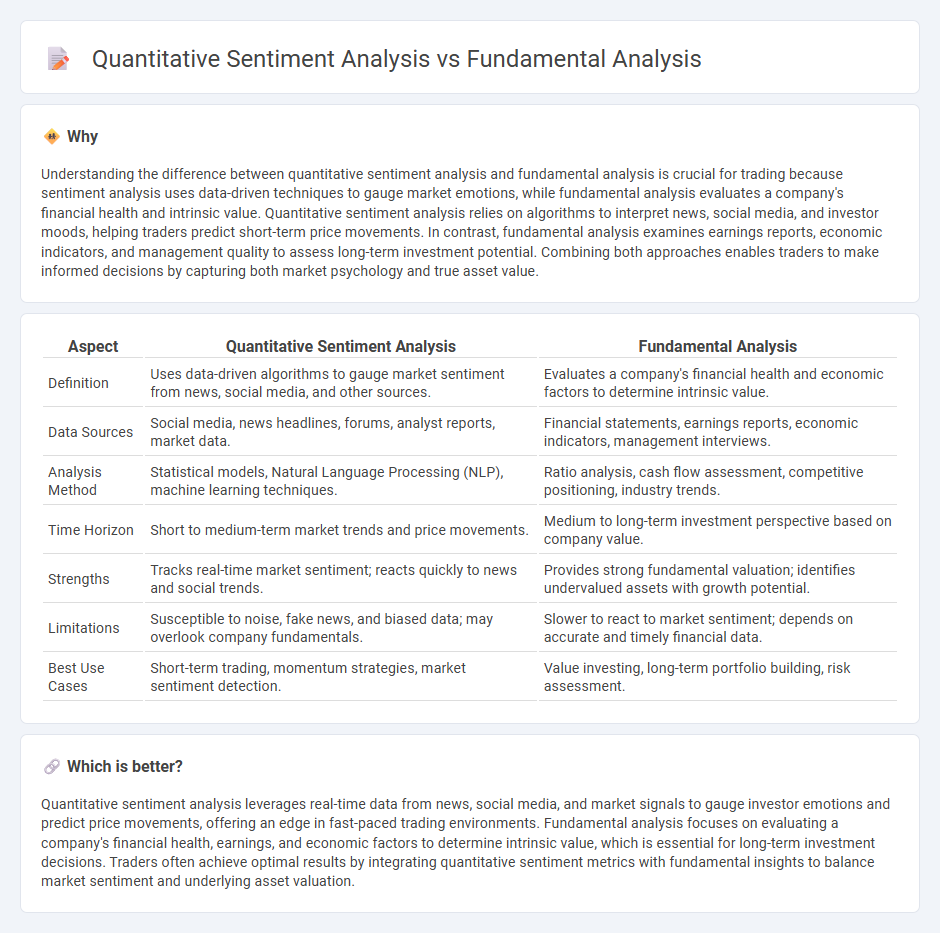

Understanding the difference between quantitative sentiment analysis and fundamental analysis is crucial for trading because sentiment analysis uses data-driven techniques to gauge market emotions, while fundamental analysis evaluates a company's financial health and intrinsic value. Quantitative sentiment analysis relies on algorithms to interpret news, social media, and investor moods, helping traders predict short-term price movements. In contrast, fundamental analysis examines earnings reports, economic indicators, and management quality to assess long-term investment potential. Combining both approaches enables traders to make informed decisions by capturing both market psychology and true asset value.

Comparison Table

| Aspect | Quantitative Sentiment Analysis | Fundamental Analysis |

|---|---|---|

| Definition | Uses data-driven algorithms to gauge market sentiment from news, social media, and other sources. | Evaluates a company's financial health and economic factors to determine intrinsic value. |

| Data Sources | Social media, news headlines, forums, analyst reports, market data. | Financial statements, earnings reports, economic indicators, management interviews. |

| Analysis Method | Statistical models, Natural Language Processing (NLP), machine learning techniques. | Ratio analysis, cash flow assessment, competitive positioning, industry trends. |

| Time Horizon | Short to medium-term market trends and price movements. | Medium to long-term investment perspective based on company value. |

| Strengths | Tracks real-time market sentiment; reacts quickly to news and social trends. | Provides strong fundamental valuation; identifies undervalued assets with growth potential. |

| Limitations | Susceptible to noise, fake news, and biased data; may overlook company fundamentals. | Slower to react to market sentiment; depends on accurate and timely financial data. |

| Best Use Cases | Short-term trading, momentum strategies, market sentiment detection. | Value investing, long-term portfolio building, risk assessment. |

Which is better?

Quantitative sentiment analysis leverages real-time data from news, social media, and market signals to gauge investor emotions and predict price movements, offering an edge in fast-paced trading environments. Fundamental analysis focuses on evaluating a company's financial health, earnings, and economic factors to determine intrinsic value, which is essential for long-term investment decisions. Traders often achieve optimal results by integrating quantitative sentiment metrics with fundamental insights to balance market sentiment and underlying asset valuation.

Connection

Quantitative sentiment analysis leverages large datasets from news, social media, and financial reports to gauge market mood, directly influencing fundamental analysis by providing real-time insights into investor sentiment that impact stock valuations. Fundamental analysis evaluates a company's intrinsic value through financial statements, economic indicators, and industry trends, which can be enhanced by incorporating sentiment data to better predict market reactions to financial events. Integrating sentiment analysis with fundamental analysis allows traders to refine decision-making by combining objective financial metrics with subjective market psychology.

Key Terms

**Fundamental analysis:**

Fundamental analysis evaluates a company's intrinsic value by examining financial statements, management quality, industry conditions, and economic factors, focusing on metrics such as earnings, revenue growth, and debt levels. It helps investors identify undervalued or overvalued stocks based on tangible data and long-term performance potential. Explore deeper insights into how fundamental analysis shapes investment decisions by learning more here.

Earnings Reports

Fundamental analysis evaluates a company's intrinsic value by examining financial statements, including earnings reports, to assess profitability, revenue growth, and cash flow stability. Quantitative sentiment analysis leverages natural language processing algorithms to extract sentiment scores from earnings call transcripts and management commentary, providing real-time insights into market perception. Explore how integrating these methodologies can enhance investment decisions by visiting our in-depth guide.

Economic Indicators

Economic indicators such as GDP growth, inflation rates, unemployment figures, and consumer confidence indexes are critical in fundamental analysis to assess a country's economic health and investment potential. Quantitative sentiment analysis leverages data from social media trends, news sentiment scores, and market sentiment indexes to gauge investor mood and predict market movements. Explore in-depth comparisons to understand how combining these approaches can enhance financial decision-making accuracy.

Source and External Links

Fundamental Analysis - Corporate Finance Institute - Fundamental analysis is a method to assess the intrinsic value of a security by analyzing macroeconomic and microeconomic factors, aiming to find the "correct price" to make informed investment decisions, using either a top-down or bottom-up approach.

Fundamental analysis - Wikipedia - It involves economic, industry, and company analyses to determine a stock's intrinsic value for investment decisions, contrasting with technical analysis which focuses on price trends and market sentiment.

Beginners Guide to Fundamental Analysis | Learn to Trade - Oanda - Fundamental analysis examines broad or narrow factors affecting an asset's price, using top-down (macroeconomic first) or bottom-up (instrument first) methods, considering drivers like interest rates and trade balances that influence market prices.

dowidth.com

dowidth.com