Perpetual contracts are a type of derivative in trading that do not have an expiration date, allowing traders to hold positions indefinitely, unlike futures contracts which have fixed settlement dates. Futures contracts obligate traders to buy or sell an asset at a predetermined price on a specific date, often used for hedging or speculating within a defined timeframe. Explore the detailed mechanisms and strategic uses of perpetual and futures contracts to enhance your trading knowledge.

Why it is important

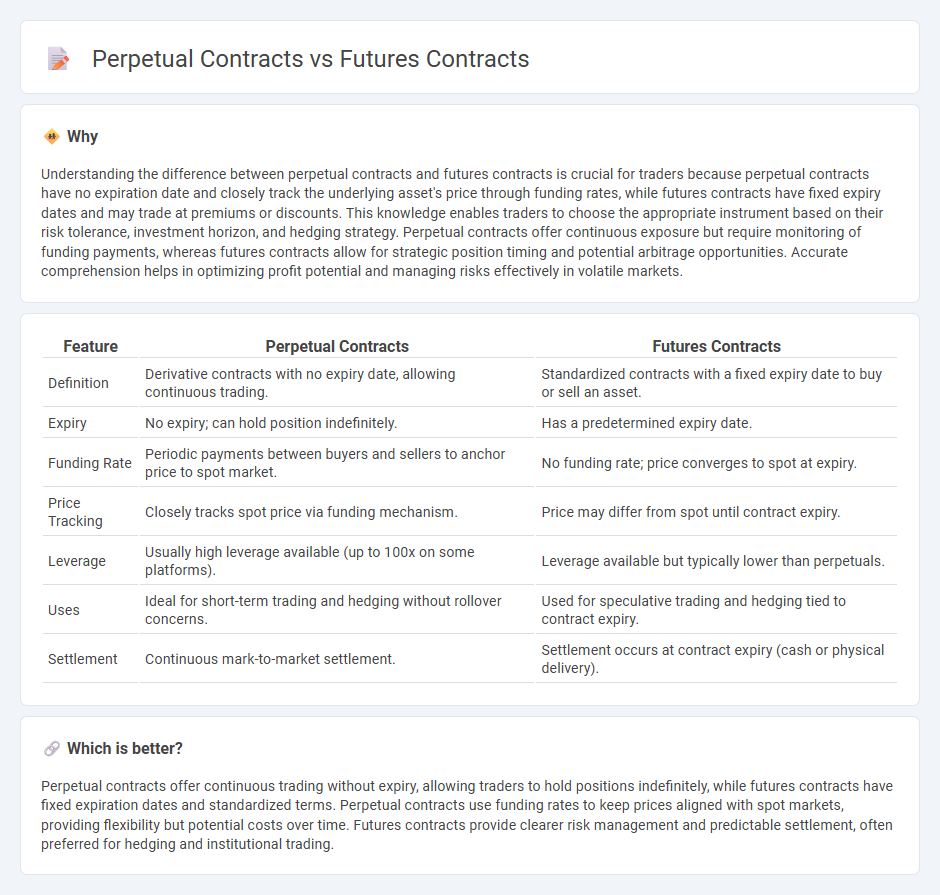

Understanding the difference between perpetual contracts and futures contracts is crucial for traders because perpetual contracts have no expiration date and closely track the underlying asset's price through funding rates, while futures contracts have fixed expiry dates and may trade at premiums or discounts. This knowledge enables traders to choose the appropriate instrument based on their risk tolerance, investment horizon, and hedging strategy. Perpetual contracts offer continuous exposure but require monitoring of funding payments, whereas futures contracts allow for strategic position timing and potential arbitrage opportunities. Accurate comprehension helps in optimizing profit potential and managing risks effectively in volatile markets.

Comparison Table

| Feature | Perpetual Contracts | Futures Contracts |

|---|---|---|

| Definition | Derivative contracts with no expiry date, allowing continuous trading. | Standardized contracts with a fixed expiry date to buy or sell an asset. |

| Expiry | No expiry; can hold position indefinitely. | Has a predetermined expiry date. |

| Funding Rate | Periodic payments between buyers and sellers to anchor price to spot market. | No funding rate; price converges to spot at expiry. |

| Price Tracking | Closely tracks spot price via funding mechanism. | Price may differ from spot until contract expiry. |

| Leverage | Usually high leverage available (up to 100x on some platforms). | Leverage available but typically lower than perpetuals. |

| Uses | Ideal for short-term trading and hedging without rollover concerns. | Used for speculative trading and hedging tied to contract expiry. |

| Settlement | Continuous mark-to-market settlement. | Settlement occurs at contract expiry (cash or physical delivery). |

Which is better?

Perpetual contracts offer continuous trading without expiry, allowing traders to hold positions indefinitely, while futures contracts have fixed expiration dates and standardized terms. Perpetual contracts use funding rates to keep prices aligned with spot markets, providing flexibility but potential costs over time. Futures contracts provide clearer risk management and predictable settlement, often preferred for hedging and institutional trading.

Connection

Perpetual contracts and futures contracts are both derivatives allowing traders to speculate on asset prices without owning the underlying assets, with perpetual contracts lacking an expiry date while futures contracts have fixed settlement dates. Both instruments utilize leverage and margin trading to amplify potential gains and losses, and their prices often converge due to arbitrage opportunities and funding rate mechanisms. The interplay between these contracts enhances liquidity and price discovery in markets such as cryptocurrencies, commodities, and equities.

Key Terms

Expiry Date

Futures contracts have a fixed expiry date, meaning traders must close or roll over their positions by a set deadline, which impacts their trading strategies and risk management. Perpetual contracts, however, do not have an expiry date, allowing continuous holding without liquidation based on time, with funding rates balancing prices between perpetual and spot markets. Explore further to understand how expiry dynamics influence leverage, liquidity, and trading costs in both contract types.

Funding Rate

Futures contracts are standardized agreements with fixed expiry dates, while perpetual contracts have no expiry and use a funding rate mechanism to maintain price alignment between the perpetual contract and the spot market. The funding rate is a periodic payment exchanged between long and short positions, ensuring the perpetual contract price closely follows the underlying asset price, which can vary based on market demand and supply dynamics. Explore deeper insights into how funding rates impact trading strategies and risk management in derivatives markets.

Settlement

Futures contracts have a fixed settlement date where the contract expires, requiring traders to settle either by physical delivery or cash settlement based on the underlying asset's price. Perpetual contracts, common in cryptocurrency trading, do not have an expiration date and use a funding rate mechanism to anchor the contract price to the spot market. Explore the nuances of both contract types to understand their impact on trading strategies and risk management.

Source and External Links

Futures Contract | Definition + Examples - Wall Street Prep - A futures contract is a standardized financial derivative obligating counterparties to exchange an underlying asset at a predetermined price and date, traded on regulated exchanges with centralized clearing to reduce counterparty risk, distinguishing them from forward contracts.

Futures Contracts Compared to Forwards - CME Group - Futures contracts are exchange-traded agreements to buy or sell assets at a future date and price, offering a standardized, regulated, and cleared mechanism for risk management and speculation, unlike customized forward contracts that carry higher default risk.

Futures contract - Wikipedia - Futures contracts require margin deposits and are marked to market daily to mitigate default risk, ensuring obligations are met by both parties through daily settlement of gains and losses until the contract expires or is closed out.

dowidth.com

dowidth.com