Front running involves executing trades based on advance knowledge of pending orders to profit from anticipated price movements, often raising ethical and legal concerns. Arbitrage exploits price discrepancies of the same asset across different markets or platforms to secure risk-free profits through simultaneous buying and selling. Explore the distinct strategies, risks, and regulations that differentiate front running from arbitrage to enhance your trading insights.

Why it is important

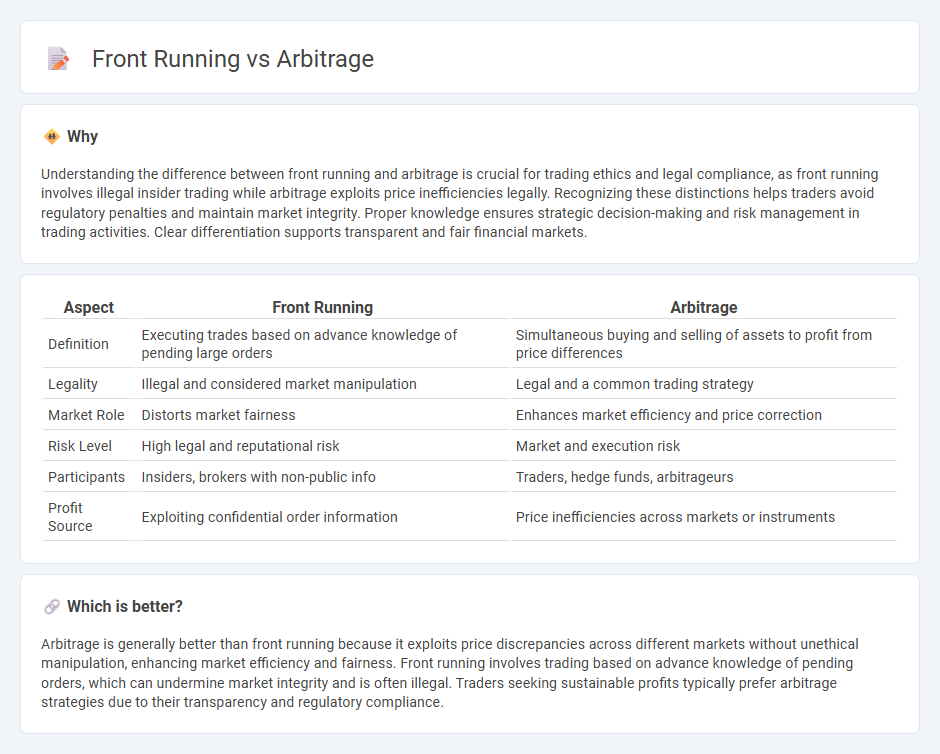

Understanding the difference between front running and arbitrage is crucial for trading ethics and legal compliance, as front running involves illegal insider trading while arbitrage exploits price inefficiencies legally. Recognizing these distinctions helps traders avoid regulatory penalties and maintain market integrity. Proper knowledge ensures strategic decision-making and risk management in trading activities. Clear differentiation supports transparent and fair financial markets.

Comparison Table

| Aspect | Front Running | Arbitrage |

|---|---|---|

| Definition | Executing trades based on advance knowledge of pending large orders | Simultaneous buying and selling of assets to profit from price differences |

| Legality | Illegal and considered market manipulation | Legal and a common trading strategy |

| Market Role | Distorts market fairness | Enhances market efficiency and price correction |

| Risk Level | High legal and reputational risk | Market and execution risk |

| Participants | Insiders, brokers with non-public info | Traders, hedge funds, arbitrageurs |

| Profit Source | Exploiting confidential order information | Price inefficiencies across markets or instruments |

Which is better?

Arbitrage is generally better than front running because it exploits price discrepancies across different markets without unethical manipulation, enhancing market efficiency and fairness. Front running involves trading based on advance knowledge of pending orders, which can undermine market integrity and is often illegal. Traders seeking sustainable profits typically prefer arbitrage strategies due to their transparency and regulatory compliance.

Connection

Front running and arbitrage are connected through their exploitation of market inefficiencies to generate profits. Front running involves a trader using advanced knowledge of pending orders to execute trades ahead of them, capitalizing on expected price movements. Arbitrage exploits price discrepancies of the same asset across different markets or exchanges, ensuring risk-free profit through simultaneous buy and sell transactions.

Key Terms

Price Discrepancy

Arbitrage exploits price discrepancies between different markets to buy low in one and sell high in another, ensuring risk-free profit from simultaneous trades. Front running involves using advance knowledge of pending transactions to trade ahead, capitalizing on expected price movements but often raising ethical and legal concerns. Explore deeper insights into how price discrepancies impact these trading strategies and their market implications.

Execution Speed

Arbitrage exploits price differences across markets, relying on execution speed to quickly buy low and sell high before discrepancies vanish. Front running involves executing trades ahead of pending orders by anticipating market moves, demanding ultra-fast order placement to benefit from short-term price changes. Explore detailed comparisons of execution speed and strategies to master these trading techniques.

Market Manipulation

Arbitrage capitalizes on price differences across markets to generate risk-free profits, while front running is a manipulative trading practice where a trader exploits non-public information about upcoming orders to gain an unfair advantage. Market manipulation through front running undermines market integrity and violates regulatory frameworks, whereas arbitrage is generally considered a legitimate strategy promoting market efficiency. Explore further insights on distinguishing lawful arbitrage from illicit front running tactics in financial markets.

Source and External Links

Arbitrage - Arbitrage is the practice of simultaneously buying and selling an asset in different markets to profit from price differences, often considered risk-free in theory but with practical risks present in real trading.

What Is Arbitrage? 3 Strategies to Know - Arbitrage is an investment strategy exploiting price differences for the same asset across markets, with types including pure arbitrage, merger arbitrage, and convertible arbitrage, commonly used by sophisticated investors like hedge funds.

What is arbitrage and how does it work in financial markets - Arbitrage strategies include pure arbitrage (same asset price difference), merger arbitrage (profiting from mergers & acquisitions stock price gaps), and triangular arbitrage in forex, where price inefficiencies in currency exchange rates are exploited.

dowidth.com

dowidth.com