A gamma squeeze occurs when option market makers hedge their positions by buying the underlying stock as its price moves, causing accelerated price increases driven by high options volume and volatility. In contrast, a long squeeze happens when investors holding long positions are forced to sell rapidly due to falling prices, intensifying downward pressure on the stock. Explore these trading dynamics further to understand their impact on market volatility and investment strategies.

Why it is important

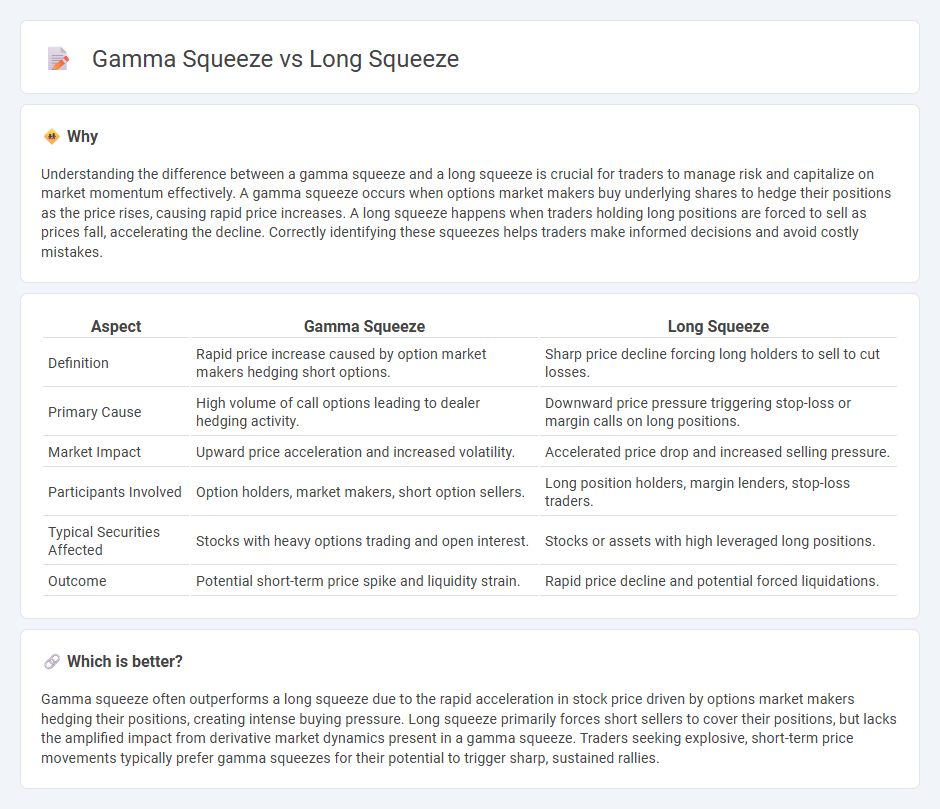

Understanding the difference between a gamma squeeze and a long squeeze is crucial for traders to manage risk and capitalize on market momentum effectively. A gamma squeeze occurs when options market makers buy underlying shares to hedge their positions as the price rises, causing rapid price increases. A long squeeze happens when traders holding long positions are forced to sell as prices fall, accelerating the decline. Correctly identifying these squeezes helps traders make informed decisions and avoid costly mistakes.

Comparison Table

| Aspect | Gamma Squeeze | Long Squeeze |

|---|---|---|

| Definition | Rapid price increase caused by option market makers hedging short options. | Sharp price decline forcing long holders to sell to cut losses. |

| Primary Cause | High volume of call options leading to dealer hedging activity. | Downward price pressure triggering stop-loss or margin calls on long positions. |

| Market Impact | Upward price acceleration and increased volatility. | Accelerated price drop and increased selling pressure. |

| Participants Involved | Option holders, market makers, short option sellers. | Long position holders, margin lenders, stop-loss traders. |

| Typical Securities Affected | Stocks with heavy options trading and open interest. | Stocks or assets with high leveraged long positions. |

| Outcome | Potential short-term price spike and liquidity strain. | Rapid price decline and potential forced liquidations. |

Which is better?

Gamma squeeze often outperforms a long squeeze due to the rapid acceleration in stock price driven by options market makers hedging their positions, creating intense buying pressure. Long squeeze primarily forces short sellers to cover their positions, but lacks the amplified impact from derivative market dynamics present in a gamma squeeze. Traders seeking explosive, short-term price movements typically prefer gamma squeezes for their potential to trigger sharp, sustained rallies.

Connection

Gamma squeeze and long squeeze are connected through the rapid price movements caused by options market dynamics, where a gamma squeeze occurs as traders hedge their positions by buying the underlying asset, intensifying price spikes. This buying pressure can trigger a long squeeze when long holders are forced to sell quickly to limit losses, further accelerating the stock's decline. Both phenomena stem from trader reactions to volatility and leverage in the market, amplifying price swings in opposite directions.

Key Terms

Leverage

Leverage in a long squeeze involves traders using borrowed funds to increase their positional size, amplifying losses as prices fall, which forces them to liquidate and accelerates downward momentum. In contrast, a gamma squeeze relates to options market makers hedging their positions by buying or selling the underlying asset as the option's delta changes, creating a feedback loop that drives price volatility without direct leverage on the spot asset. Understanding the distinct mechanisms of leverage in long squeezes versus gamma squeezes is crucial for navigating market dynamics; explore further to master these concepts.

Short Interest

Short squeeze occurs when heavily shorted stocks with high short interest face rapid price increases, forcing short sellers to cover their positions and driving prices even higher. Gamma squeeze involves options market dynamics where increased buying of short-dated call options pushes market makers to hedge by buying the underlying stock, amplifying price surges. Explore detailed mechanisms and impacts of short interest in both squeezes to deepen your understanding.

Options Delta

A long squeeze occurs when traders holding long positions in stocks or futures rush to sell, triggering a sharp price drop, while a gamma squeeze involves market makers hedging their options positions by buying or selling the underlying asset as the options' delta changes. Options delta measures the sensitivity of an option's price to movements in the underlying asset, playing a crucial role in gamma squeezes as hedgers adjust their positions dynamically to maintain a neutral delta exposure. Explore more about how delta hedging strategies affect market volatility during these squeezes for a deeper understanding.

Source and External Links

Long squeeze - Wikipedia - A long squeeze is a situation where investors holding long positions start selling in a falling market to limit losses, which causes prices to drop further due to selling pressure, often triggered by fears rather than legal obligation to settle like in a short squeeze.

Long squeeze: Explained - TIOmarkets - It occurs when many investors with long positions sell simultaneously after a price drop, causing a self-reinforcing cycle of falling prices and heavy losses for those who don't exit in time, often triggered by negative news or changing market sentiment.

Long Squeeze: Understanding Its Impact on Stock Prices - Tickeron - A long squeeze happens when holders of long positions sell massively, pushing prices down and encouraging further sales, typically occurring in volatile or illiquid markets where quick selling becomes self-reinforcing.

dowidth.com

dowidth.com