Degen trading involves high-risk, speculative trades often driven by short-term market sentiment and rapid decision-making without extensive research. Technical analysis trading relies on analyzing historical price data, chart patterns, and technical indicators to make informed trading decisions based on market trends and signals. Explore more to understand the strategies and risks associated with each trading style.

Why it is important

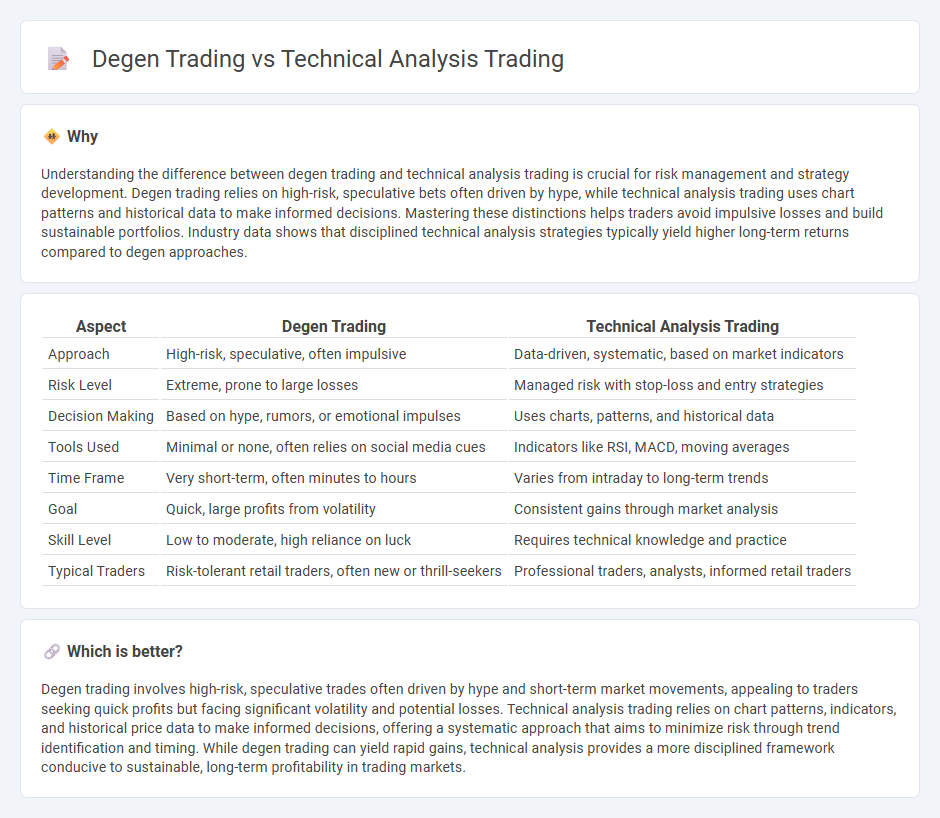

Understanding the difference between degen trading and technical analysis trading is crucial for risk management and strategy development. Degen trading relies on high-risk, speculative bets often driven by hype, while technical analysis trading uses chart patterns and historical data to make informed decisions. Mastering these distinctions helps traders avoid impulsive losses and build sustainable portfolios. Industry data shows that disciplined technical analysis strategies typically yield higher long-term returns compared to degen approaches.

Comparison Table

| Aspect | Degen Trading | Technical Analysis Trading |

|---|---|---|

| Approach | High-risk, speculative, often impulsive | Data-driven, systematic, based on market indicators |

| Risk Level | Extreme, prone to large losses | Managed risk with stop-loss and entry strategies |

| Decision Making | Based on hype, rumors, or emotional impulses | Uses charts, patterns, and historical data |

| Tools Used | Minimal or none, often relies on social media cues | Indicators like RSI, MACD, moving averages |

| Time Frame | Very short-term, often minutes to hours | Varies from intraday to long-term trends |

| Goal | Quick, large profits from volatility | Consistent gains through market analysis |

| Skill Level | Low to moderate, high reliance on luck | Requires technical knowledge and practice |

| Typical Traders | Risk-tolerant retail traders, often new or thrill-seekers | Professional traders, analysts, informed retail traders |

Which is better?

Degen trading involves high-risk, speculative trades often driven by hype and short-term market movements, appealing to traders seeking quick profits but facing significant volatility and potential losses. Technical analysis trading relies on chart patterns, indicators, and historical price data to make informed decisions, offering a systematic approach that aims to minimize risk through trend identification and timing. While degen trading can yield rapid gains, technical analysis provides a more disciplined framework conducive to sustainable, long-term profitability in trading markets.

Connection

Degen trading relies heavily on high-risk, speculative strategies often driven by short-term market movements and social sentiment, while technical analysis trading uses historical price data, chart patterns, and indicators to identify trends and make informed decisions. Both approaches intersect through the use of technical indicators like moving averages, RSI, and volume analysis to time entry and exit points. By combining the high-risk, rapid nature of degen trading with the structured framework of technical analysis, traders attempt to capitalize on volatile market conditions with calculated risk management.

Key Terms

**Technical Analysis Trading:**

Technical Analysis Trading relies on chart patterns, indicators like Moving Averages and RSI, and historical price data to predict future market movements. This method emphasizes risk management, trend identification, and informed entry and exit points to optimize trades for consistent profitability. Explore key strategies and tools used by professional traders to enhance your technical analysis skills.

Support and Resistance

Technical analysis trading predominantly relies on well-established Support and Resistance levels derived from historical price data, enabling traders to make informed decisions based on market trends and patterns. In contrast, degen trading often disregards these critical levels, favoring high-risk, speculative moves that can lead to rapid gains or losses without structured risk management. Explore deeper insights into how Support and Resistance impact both trading styles to enhance your market strategies.

Moving Averages

Moving averages in technical analysis trading serve as key indicators to identify trends and potential entry or exit points based on historical price data and smoothing out volatility. Degen trading often uses moving averages more opportunistically, relying on shorter periods and rapid shifts for speculative gains despite higher risks and less emphasis on long-term trend validation. Discover more about the strategic application of moving averages in different trading styles for optimized decision-making.

Source and External Links

Technical Analysis - A Beginner's Guide - Corporate Finance Institute - Technical analysis uses historical market data, especially price movements and volume, to predict future price action of securities, with traders selecting time frames and indicators based on their trading style to identify potential buy or sell points.

Beginners Guide to Technical Analysis | Learn to Trade - Oanda - Technical analysis evaluates price trends and trading volumes using tools like moving averages and oscillators to identify support, resistance, and trading opportunities, often complementing fundamental analysis for an integrated trading strategy.

Technical analysis - Wikipedia - Technical analysis is based on the principle that all known information is reflected in market prices, and that prices move in identifiable trends, with traders analyzing past price patterns to forecast future movements.

dowidth.com

dowidth.com