Delta hedging manages the sensitivity of an option's price to changes in the underlying asset's price, effectively minimizing directional risk by maintaining a neutral delta position. Rho hedging targets interest rate risk by offsetting the impact of variations in interest rates on option values, ensuring portfolio stability in fluctuating rate environments. Explore further to understand how these hedging strategies optimize risk management in trading.

Why it is important

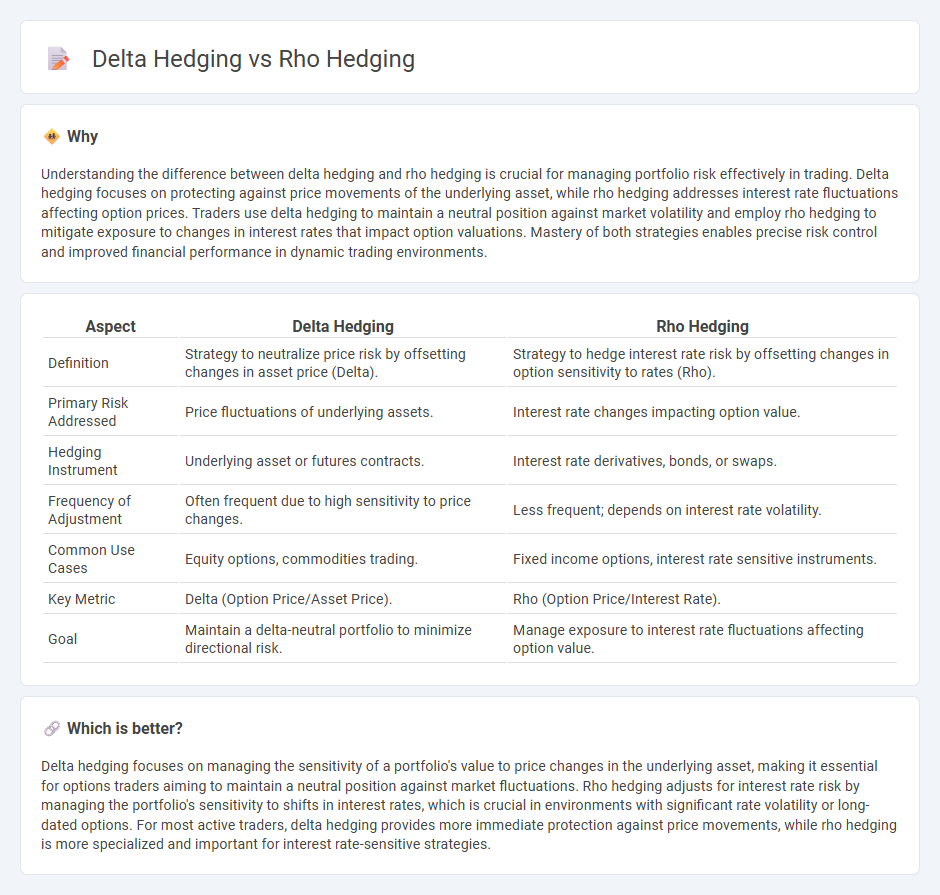

Understanding the difference between delta hedging and rho hedging is crucial for managing portfolio risk effectively in trading. Delta hedging focuses on protecting against price movements of the underlying asset, while rho hedging addresses interest rate fluctuations affecting option prices. Traders use delta hedging to maintain a neutral position against market volatility and employ rho hedging to mitigate exposure to changes in interest rates that impact option valuations. Mastery of both strategies enables precise risk control and improved financial performance in dynamic trading environments.

Comparison Table

| Aspect | Delta Hedging | Rho Hedging |

|---|---|---|

| Definition | Strategy to neutralize price risk by offsetting changes in asset price (Delta). | Strategy to hedge interest rate risk by offsetting changes in option sensitivity to rates (Rho). |

| Primary Risk Addressed | Price fluctuations of underlying assets. | Interest rate changes impacting option value. |

| Hedging Instrument | Underlying asset or futures contracts. | Interest rate derivatives, bonds, or swaps. |

| Frequency of Adjustment | Often frequent due to high sensitivity to price changes. | Less frequent; depends on interest rate volatility. |

| Common Use Cases | Equity options, commodities trading. | Fixed income options, interest rate sensitive instruments. |

| Key Metric | Delta (Option Price/Asset Price). | Rho (Option Price/Interest Rate). |

| Goal | Maintain a delta-neutral portfolio to minimize directional risk. | Manage exposure to interest rate fluctuations affecting option value. |

Which is better?

Delta hedging focuses on managing the sensitivity of a portfolio's value to price changes in the underlying asset, making it essential for options traders aiming to maintain a neutral position against market fluctuations. Rho hedging adjusts for interest rate risk by managing the portfolio's sensitivity to shifts in interest rates, which is crucial in environments with significant rate volatility or long-dated options. For most active traders, delta hedging provides more immediate protection against price movements, while rho hedging is more specialized and important for interest rate-sensitive strategies.

Connection

Delta hedging and rho hedging are connected through their roles in managing financial risk exposure in derivative trading, with delta hedging focusing on neutralizing price movement risk of the underlying asset and rho hedging addressing interest rate risk sensitivity of options or portfolios. Both strategies involve adjusting hedge positions dynamically to maintain a risk-neutral portfolio against market variables--delta hedging primarily targets the underlying asset's price changes, while rho hedging targets fluctuations in interest rates. Together, these hedge techniques optimize a trader's risk management framework by stabilizing portfolio value against both price volatility and interest rate shifts.

Key Terms

Interest Rate Risk

Rho hedging specifically targets exposure to interest rate risk by managing the sensitivity of options' prices to changes in interest rates, an essential strategy for portfolios heavily influenced by rate fluctuations. Delta hedging, on the other hand, focuses on neutralizing the directional risk associated with price movements of the underlying asset but does not address interest rate sensitivity. Explore the nuances of rho and delta hedging techniques to enhance your risk management strategies effectively.

Price Sensitivity

Rho hedging manages the sensitivity of an option's price to changes in interest rates, targeting the impact on option value from shifts in the risk-free rate. Delta hedging, by contrast, focuses on neutralizing price risk related to the underlying asset's price movements, maintaining a delta-neutral position to mitigate directional exposure. Explore further to understand how these distinct hedging strategies optimize risk management in varying market conditions.

Option Greeks

Rho hedging involves managing an options portfolio's sensitivity to interest rate changes, specifically the Greek metric "rho," which measures how option prices fluctuate with interest rate shifts. Delta hedging focuses on neutralizing the portfolio's exposure to the underlying asset price movements by balancing the "delta" value, representing the rate of change of the option's price relative to the underlying asset. Discover more about how these critical option Greeks optimize risk management strategies in dynamic market conditions.

Source and External Links

CoinAPI.io Glossary - Rho Hedging - Rho hedging is a risk management strategy used by options traders to reduce the impact of interest rate fluctuations on their options portfolios by offsetting the option's sensitivity to changes in the risk-free interest rate, particularly important for long-dated options.

Mastering Rho Hedging Strategies - Number Analytics - Implementing rho hedging involves identifying interest rate-related risks of a portfolio, selecting appropriate hedging instruments, and continuously monitoring and adjusting positions to mitigate exposure effectively.

Robust rho hedging - Risk.net - Rho hedging commonly uses interest rate futures for short-term risks and bond futures or swaps for long-term risks, requiring precise decomposition of rho exposure across the yield curve to effectively neutralize interest rate market risks.

dowidth.com

dowidth.com