Paper trading platforms simulate real market conditions without financial risk, allowing traders to test strategies and gain experience using virtual funds. Retail trading platforms enable actual transactions with real money, offering access to market data, order execution, and portfolio management tools. Explore the key features and advantages of both platforms to determine which suits your trading goals.

Why it is important

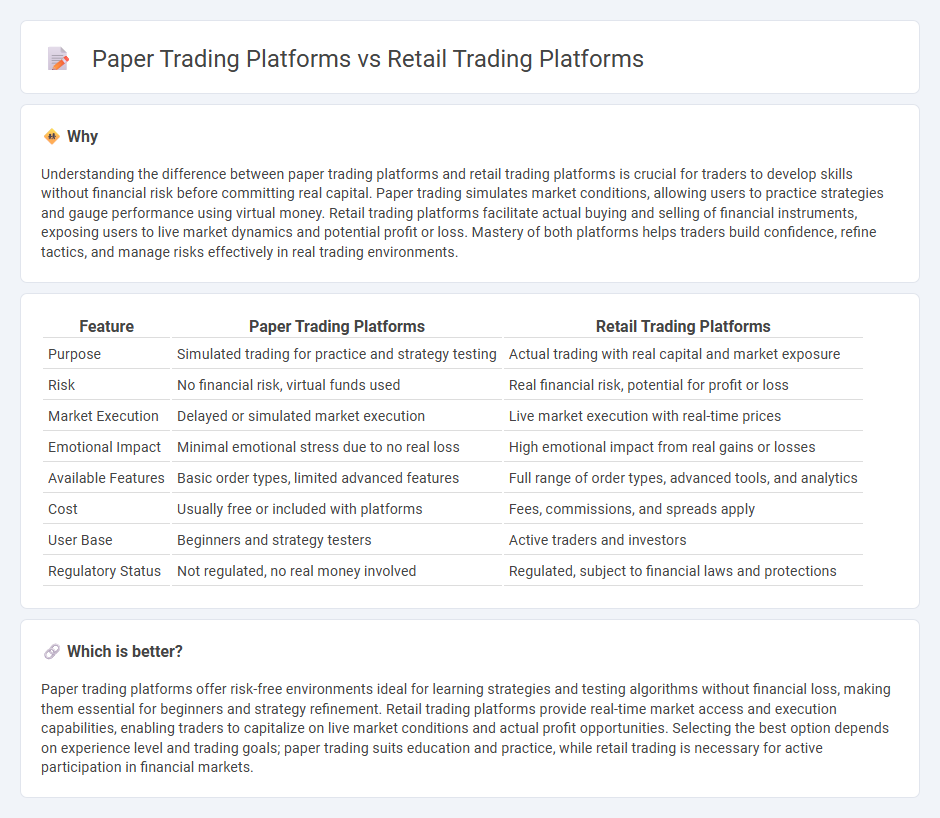

Understanding the difference between paper trading platforms and retail trading platforms is crucial for traders to develop skills without financial risk before committing real capital. Paper trading simulates market conditions, allowing users to practice strategies and gauge performance using virtual money. Retail trading platforms facilitate actual buying and selling of financial instruments, exposing users to live market dynamics and potential profit or loss. Mastery of both platforms helps traders build confidence, refine tactics, and manage risks effectively in real trading environments.

Comparison Table

| Feature | Paper Trading Platforms | Retail Trading Platforms |

|---|---|---|

| Purpose | Simulated trading for practice and strategy testing | Actual trading with real capital and market exposure |

| Risk | No financial risk, virtual funds used | Real financial risk, potential for profit or loss |

| Market Execution | Delayed or simulated market execution | Live market execution with real-time prices |

| Emotional Impact | Minimal emotional stress due to no real loss | High emotional impact from real gains or losses |

| Available Features | Basic order types, limited advanced features | Full range of order types, advanced tools, and analytics |

| Cost | Usually free or included with platforms | Fees, commissions, and spreads apply |

| User Base | Beginners and strategy testers | Active traders and investors |

| Regulatory Status | Not regulated, no real money involved | Regulated, subject to financial laws and protections |

Which is better?

Paper trading platforms offer risk-free environments ideal for learning strategies and testing algorithms without financial loss, making them essential for beginners and strategy refinement. Retail trading platforms provide real-time market access and execution capabilities, enabling traders to capitalize on live market conditions and actual profit opportunities. Selecting the best option depends on experience level and trading goals; paper trading suits education and practice, while retail trading is necessary for active participation in financial markets.

Connection

Paper trading platforms and retail trading platforms are interconnected by allowing traders to simulate real market conditions without risking actual capital, enabling skill development and strategy testing. Retail trading platforms often integrate paper trading features to provide users with a seamless transition from simulated to live trading environments. This connection enhances user confidence and decision-making by offering practical experience and analytics before deploying real funds.

Key Terms

Real Money Execution

Retail trading platforms provide real money execution, allowing investors to buy and sell actual securities with live market data and real-time order processing. Paper trading platforms simulate market conditions without financial risk, enabling users to practice strategies using virtual funds but without real monetary consequences. Explore our detailed comparison to understand which platform best matches your trading goals and risk tolerance.

Simulated Trading

Simulated trading platforms offer a risk-free environment for users to practice and refine strategies using virtual money, unlike retail trading platforms where real capital is at stake. These simulated platforms replicate market conditions with real-time data, helping traders understand order execution and market dynamics without financial loss. Explore the benefits and features of simulated trading to enhance your market skills confidently.

Market Data Access

Retail trading platforms provide real-time market data, enabling traders to make informed decisions based on live price movements and order book depth. Paper trading platforms often use delayed or simulated market data, which may not reflect actual market conditions and can limit the accuracy of strategy testing. Explore how different platforms handle market data to choose the best option for your trading goals.

Source and External Links

Best Online Trading Platforms In July 2025 - Bankrate - Highlights top retail trading platforms such as Charles Schwab, Fidelity, Interactive Brokers, E-Trade, Merrill Edge, Ally Invest, and Tastytrade, noting features like commission structures, powerful tools, and multi-device access for various trader levels.

Trading | Charles Schwab - Details Schwab's award-winning trading platforms, including the thinkorswim platform and Schwab Mobile app, offering advanced tools, 24/5 access to popular stocks, ETFs, futures, and competitive margin rates for retail traders.

Trading platforms and research - Fidelity Investments - Describes Fidelity's suite of trading platforms like Fidelity Mobile, Fidelity.com, Trading Dashboard, and Active Trader Pro, providing customizable, research-rich environments suited for beginner to advanced retail investors.

dowidth.com

dowidth.com