Funding rate arbitrage exploits the periodic payments between long and short positions in perpetual futures contracts to generate risk-free profits. Futures arbitrage involves exploiting price discrepancies between futures contracts and the underlying asset to secure arbitrage gains with minimal risk. Discover more about how these trading strategies optimize returns in different market conditions.

Why it is important

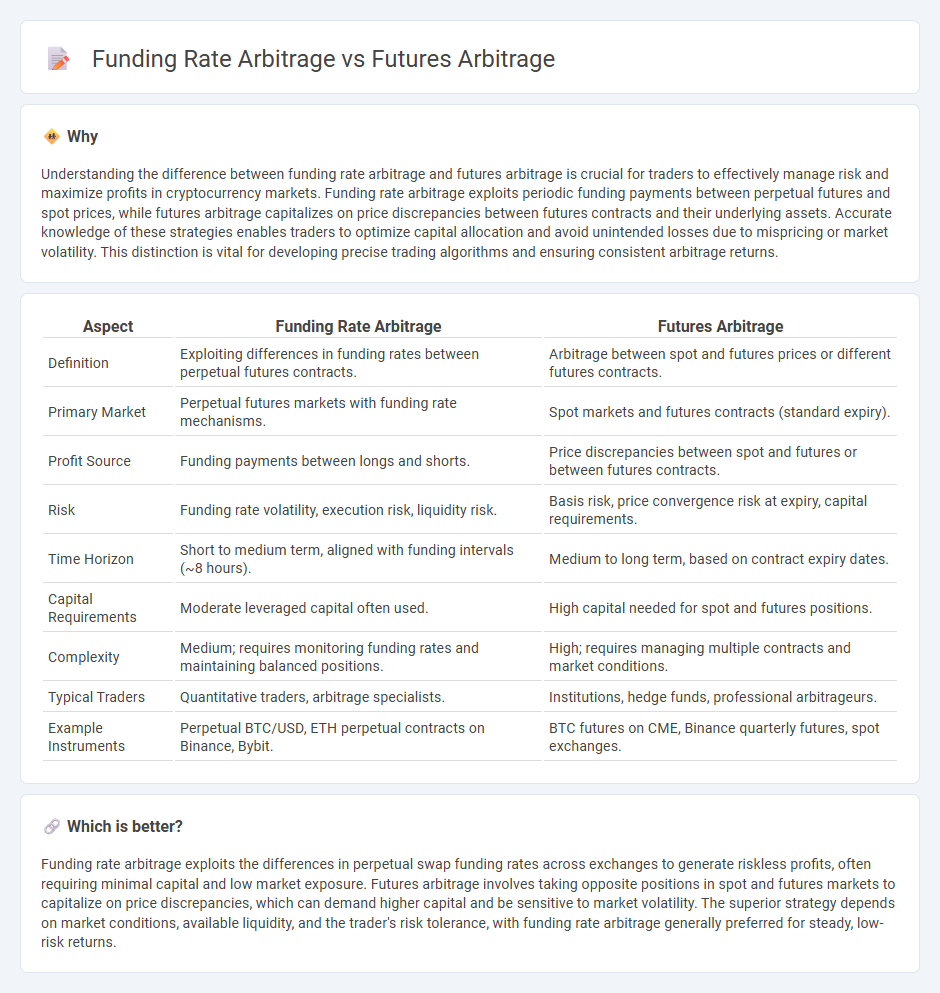

Understanding the difference between funding rate arbitrage and futures arbitrage is crucial for traders to effectively manage risk and maximize profits in cryptocurrency markets. Funding rate arbitrage exploits periodic funding payments between perpetual futures and spot prices, while futures arbitrage capitalizes on price discrepancies between futures contracts and their underlying assets. Accurate knowledge of these strategies enables traders to optimize capital allocation and avoid unintended losses due to mispricing or market volatility. This distinction is vital for developing precise trading algorithms and ensuring consistent arbitrage returns.

Comparison Table

| Aspect | Funding Rate Arbitrage | Futures Arbitrage |

|---|---|---|

| Definition | Exploiting differences in funding rates between perpetual futures contracts. | Arbitrage between spot and futures prices or different futures contracts. |

| Primary Market | Perpetual futures markets with funding rate mechanisms. | Spot markets and futures contracts (standard expiry). |

| Profit Source | Funding payments between longs and shorts. | Price discrepancies between spot and futures or between futures contracts. |

| Risk | Funding rate volatility, execution risk, liquidity risk. | Basis risk, price convergence risk at expiry, capital requirements. |

| Time Horizon | Short to medium term, aligned with funding intervals (~8 hours). | Medium to long term, based on contract expiry dates. |

| Capital Requirements | Moderate leveraged capital often used. | High capital needed for spot and futures positions. |

| Complexity | Medium; requires monitoring funding rates and maintaining balanced positions. | High; requires managing multiple contracts and market conditions. |

| Typical Traders | Quantitative traders, arbitrage specialists. | Institutions, hedge funds, professional arbitrageurs. |

| Example Instruments | Perpetual BTC/USD, ETH perpetual contracts on Binance, Bybit. | BTC futures on CME, Binance quarterly futures, spot exchanges. |

Which is better?

Funding rate arbitrage exploits the differences in perpetual swap funding rates across exchanges to generate riskless profits, often requiring minimal capital and low market exposure. Futures arbitrage involves taking opposite positions in spot and futures markets to capitalize on price discrepancies, which can demand higher capital and be sensitive to market volatility. The superior strategy depends on market conditions, available liquidity, and the trader's risk tolerance, with funding rate arbitrage generally preferred for steady, low-risk returns.

Connection

Funding rate arbitrage and futures arbitrage are interconnected through their exploitation of price discrepancies in derivative markets. Funding rate arbitrage involves profiting from differences in perpetual swap funding rates between exchanges, while futures arbitrage capitalizes on price differences between futures contracts and spot prices. Both strategies rely on hedging positions to minimize directional risk and extract risk-free profits from market inefficiencies.

Key Terms

Price Convergence

Futures arbitrage exploits price differences between the spot market and futures contracts, capitalizing on price convergence as the futures price aligns with the spot price upon contract expiration. Funding rate arbitrage involves profiting from discrepancies in perpetual swap funding rates, where traders earn or pay interest to maintain positions, expecting these rates to revert to neutral levels over time. Explore deeper insights into how price convergence mechanisms drive these arbitrage strategies and their impact on market efficiency.

Spot-Futures Spread

Futures arbitrage exploits price discrepancies between spot and futures markets, capitalizing on the spot-futures spread for risk-free profit by simultaneously buying the undervalued asset and selling the overvalued contract. Funding rate arbitrage involves taking advantage of periodic payments between long and short positions in perpetual futures contracts to earn yields independent of price movement. Explore in-depth strategies and market dynamics to optimize returns in both arbitrage approaches.

Perpetual Swap Funding

Futures arbitrage exploits price differences between traditional futures contracts and their underlying spot assets, often locking in risk-free profits through simultaneous trades. Funding rate arbitrage specifically targets perpetual swaps, utilizing the periodic funding payments exchanged between long and short positions to profit from discrepancies in funding rates across platforms. Explore detailed strategies and risks involved in perpetual swap funding arbitrage to optimize your trading approach.

Source and External Links

Futures Arbitrage - NYU Stern - Futures arbitrage involves exploiting price differences between an index future and the underlying index by using strategies like short selling the stocks and investing at the riskless rate, pushing futures prices toward equilibrium, with the arbitrage price given by \(F* = S (1 + r - y)^t\) where \(S\) is the spot price, \(r\) the riskless rate, and \(y\) the dividend yield.

Introduction to Futures Arbitrage - Futures arbitrage profits come from price differences between spot and futures markets by taking opposite positions, such as buying cheaper spot assets and shorting higher-priced futures, with the price difference representing the arbitrage gain once positions are closed.

Cash Future Arbitrage: Definition & Examples | Angel One - Cash future arbitrage exploits mispricing between an asset's current (cash) price and its futures contract price, where traders monitor the basis (price difference) and execute trades to lock in riskless profits accounting for trade costs.

dowidth.com

dowidth.com