Social copy trading allows investors to replicate the strategies of experienced traders, offering a hands-off approach with real-time market insights. Day trading demands active involvement, focusing on rapid buy-sell decisions within a single trading day to capitalize on market volatility. Explore the key differences and benefits of each method to find the best fit for your trading goals.

Why it is important

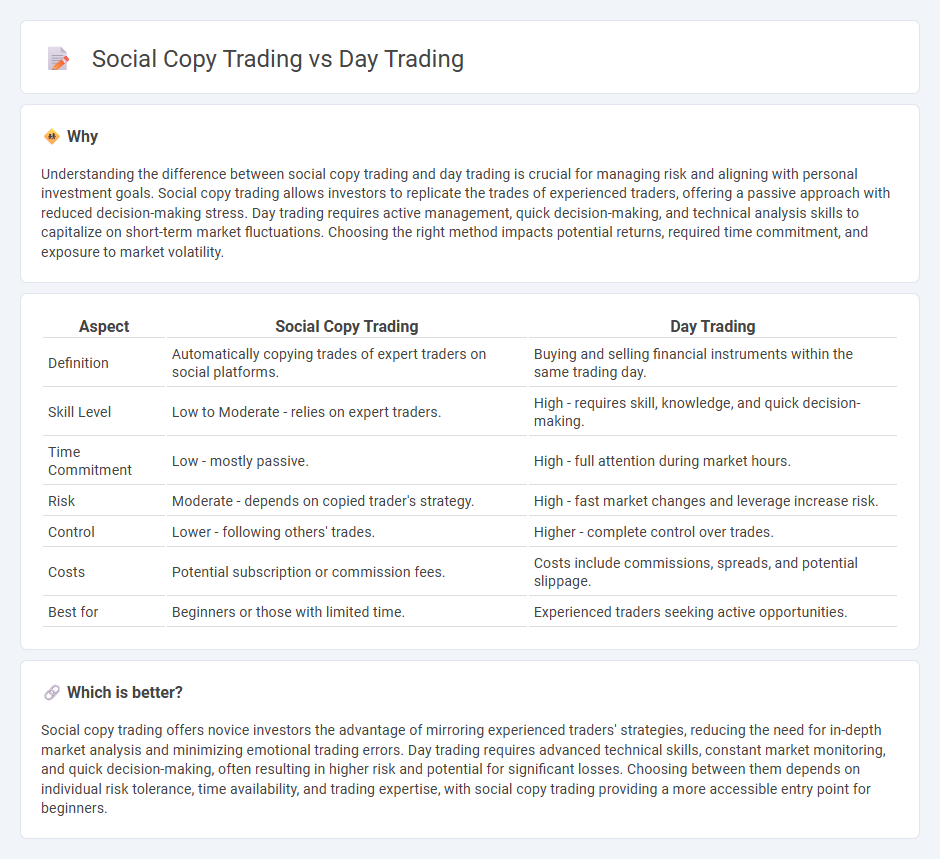

Understanding the difference between social copy trading and day trading is crucial for managing risk and aligning with personal investment goals. Social copy trading allows investors to replicate the trades of experienced traders, offering a passive approach with reduced decision-making stress. Day trading requires active management, quick decision-making, and technical analysis skills to capitalize on short-term market fluctuations. Choosing the right method impacts potential returns, required time commitment, and exposure to market volatility.

Comparison Table

| Aspect | Social Copy Trading | Day Trading |

|---|---|---|

| Definition | Automatically copying trades of expert traders on social platforms. | Buying and selling financial instruments within the same trading day. |

| Skill Level | Low to Moderate - relies on expert traders. | High - requires skill, knowledge, and quick decision-making. |

| Time Commitment | Low - mostly passive. | High - full attention during market hours. |

| Risk | Moderate - depends on copied trader's strategy. | High - fast market changes and leverage increase risk. |

| Control | Lower - following others' trades. | Higher - complete control over trades. |

| Costs | Potential subscription or commission fees. | Costs include commissions, spreads, and potential slippage. |

| Best for | Beginners or those with limited time. | Experienced traders seeking active opportunities. |

Which is better?

Social copy trading offers novice investors the advantage of mirroring experienced traders' strategies, reducing the need for in-depth market analysis and minimizing emotional trading errors. Day trading requires advanced technical skills, constant market monitoring, and quick decision-making, often resulting in higher risk and potential for significant losses. Choosing between them depends on individual risk tolerance, time availability, and trading expertise, with social copy trading providing a more accessible entry point for beginners.

Connection

Social copy trading allows investors to replicate the strategies of experienced day traders in real time, merging collaborative insight with high-frequency market actions. Day trading focuses on rapid buying and selling within the same trading day to exploit price volatility, while social copy trading amplifies this by enabling less skilled traders to mirror expert decisions instantly. This connection fosters an ecosystem where knowledge sharing accelerates profit potential through synchronized, short-term trades.

Key Terms

Intraday

Day trading involves executing multiple trades within the same trading day to capitalize on short-term price fluctuations and requires active market analysis and quick decision-making. Social copy trading allows investors to replicate trades of experienced day traders in real-time, facilitating exposure to intraday strategies without deep market expertise. Explore more on how these approaches differ in risk, strategy, and potential returns for intraday trading.

Signal provider

Signal providers are crucial in both day trading and social copy trading, offering real-time market insights that drive quick decision-making and strategy execution. Day trading relies heavily on these providers for timely, accurate data to capitalize on short-term price movements, while social copy trading leverages their signals for automated trade replication across follower accounts. Discover how selecting the right signal provider can enhance your trading performance and risk management strategies.

Liquidity

Day trading demands high liquidity for rapid entry and exit to capitalize on short-term price movements, ensuring minimal slippage and tight spreads. Social copy trading leverages the liquidity of top traders' portfolios, allowing followers to automatically replicate trades without needing to analyze market depth themselves. Explore how liquidity impacts your trading strategy by understanding the nuances between these two approaches.

Source and External Links

Day trading - Wikipedia - Day trading is a form of speculation where traders buy and sell financial instruments within the same trading day, closing all positions before market close to avoid risks, and pattern day traders must maintain at least $25,000 equity in their accounts.

Day Trading Guide | Warrior Trading - Day trading involves actively buying and selling securities like stocks, futures, forex, or crypto within the same day to profit from short-term price fluctuations, often using technical strategies like momentum or contrarian trading.

What are the rules for day trading? - Merrill Edge - Day trading occurs when you open and close positions within the same day, and pattern day traders (those making four or more day trades in five business days) are subject to a $25,000 minimum equity rule and other margin requirements.

dowidth.com

dowidth.com