Social sentiment analysis trading leverages real-time data from social media, news, and online forums to gauge market sentiment and predict price movements. Algorithmic trading relies on predefined mathematical models and automated systems to execute trades with high speed and precision, minimizing human emotion and error. Explore the differences and advantages of both approaches to enhance your trading strategy.

Why it is important

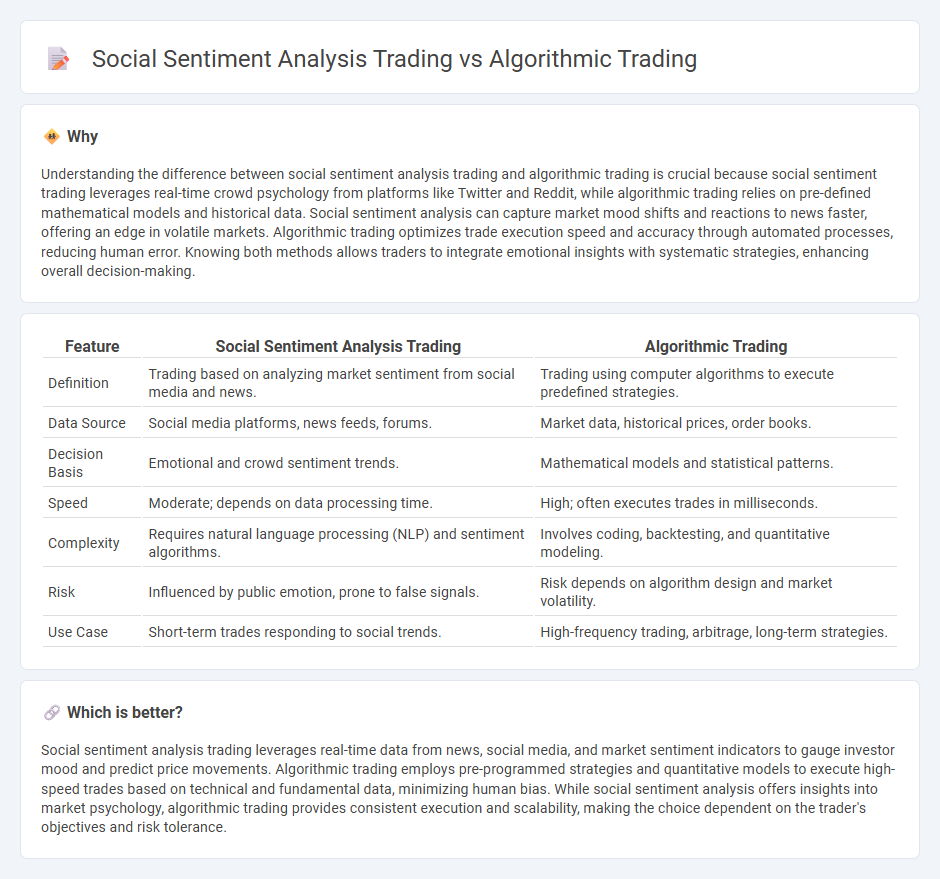

Understanding the difference between social sentiment analysis trading and algorithmic trading is crucial because social sentiment trading leverages real-time crowd psychology from platforms like Twitter and Reddit, while algorithmic trading relies on pre-defined mathematical models and historical data. Social sentiment analysis can capture market mood shifts and reactions to news faster, offering an edge in volatile markets. Algorithmic trading optimizes trade execution speed and accuracy through automated processes, reducing human error. Knowing both methods allows traders to integrate emotional insights with systematic strategies, enhancing overall decision-making.

Comparison Table

| Feature | Social Sentiment Analysis Trading | Algorithmic Trading |

|---|---|---|

| Definition | Trading based on analyzing market sentiment from social media and news. | Trading using computer algorithms to execute predefined strategies. |

| Data Source | Social media platforms, news feeds, forums. | Market data, historical prices, order books. |

| Decision Basis | Emotional and crowd sentiment trends. | Mathematical models and statistical patterns. |

| Speed | Moderate; depends on data processing time. | High; often executes trades in milliseconds. |

| Complexity | Requires natural language processing (NLP) and sentiment algorithms. | Involves coding, backtesting, and quantitative modeling. |

| Risk | Influenced by public emotion, prone to false signals. | Risk depends on algorithm design and market volatility. |

| Use Case | Short-term trades responding to social trends. | High-frequency trading, arbitrage, long-term strategies. |

Which is better?

Social sentiment analysis trading leverages real-time data from news, social media, and market sentiment indicators to gauge investor mood and predict price movements. Algorithmic trading employs pre-programmed strategies and quantitative models to execute high-speed trades based on technical and fundamental data, minimizing human bias. While social sentiment analysis offers insights into market psychology, algorithmic trading provides consistent execution and scalability, making the choice dependent on the trader's objectives and risk tolerance.

Connection

Social sentiment analysis trading leverages real-time data from social media platforms to gauge market sentiment, providing valuable insights for algorithmic trading models. Algorithmic trading systems integrate this sentiment data with quantitative indicators to enhance predictive accuracy and optimize trade execution. The fusion of social sentiment analysis and algorithmic strategies enables traders to respond swiftly to market shifts influenced by public opinion and news events.

Key Terms

**Backtesting**

Backtesting in algorithmic trading involves using historical market data to validate trading strategies based on predefined rules and quantitative models, ensuring their effectiveness before real deployment. In social sentiment analysis trading, backtesting incorporates sentiment data extracted from social media and news sources, evaluating how sentiment-driven signals would have impacted past trades. Explore how combining traditional backtesting and sentiment analysis can enhance strategy robustness and market adaptability.

**Natural Language Processing (NLP)**

Algorithmic trading leverages quantitative models and historical data, while social sentiment analysis trading integrates **Natural Language Processing (NLP)** to interpret market sentiment from textual data such as news, social media, and financial reports. NLP techniques, including sentiment analysis, entity recognition, and topic modeling, enable traders to extract actionable insights from unstructured data, enhancing decision-making accuracy. Explore advanced NLP applications in trading to unlock innovative strategies and improve market responsiveness.

**Execution Algorithms**

Execution algorithms in algorithmic trading optimize order placement using statistical models and real-time market data to minimize market impact and transaction costs. In contrast, social sentiment analysis trading leverages natural language processing algorithms to gauge market sentiment from social media and news, influencing trade timing and volume based on collective investor mood. Explore the distinctive mechanisms and advantages of these execution techniques to enhance your trading strategy.

Source and External Links

Understanding the Basics of Algorithmic Trading | Market ... - Algorithmic trading uses computer programs that follow defined instructions (algorithms) to execute trades at high speed and frequency, evolving since the 1970s to become a dominant method in financial markets today, supported by APIs that enable seamless trade execution and data access.

Algorithmic Trading - Definition, Example, Pros, Cons - It involves programmed pre-set rules to execute trades automatically, such as moving average strategies that buy or sell based on price relative to the average, avoiding large market impact by breaking trades into smaller batches.

What is Algorithmic Trading and How Do You Get Started? - IG - Main algorithmic strategies include price action, technical analysis, and their combinations, allowing traders to automate decisions based on price levels, technical indicators, and risk management settings for speed and precision.

dowidth.com

dowidth.com