Volume profile reading analyzes traded volume at specific price levels to identify support, resistance, and market sentiment, providing a clear visual representation of where significant trading activity occurs. Tape reading involves real-time observation of the time and sales data, focusing on order flow, speed, and trade sizes to gauge market momentum and possible short-term price movements. Explore deeper insights into volume profile and tape reading techniques to enhance your trading strategy and decision-making skills.

Why it is important

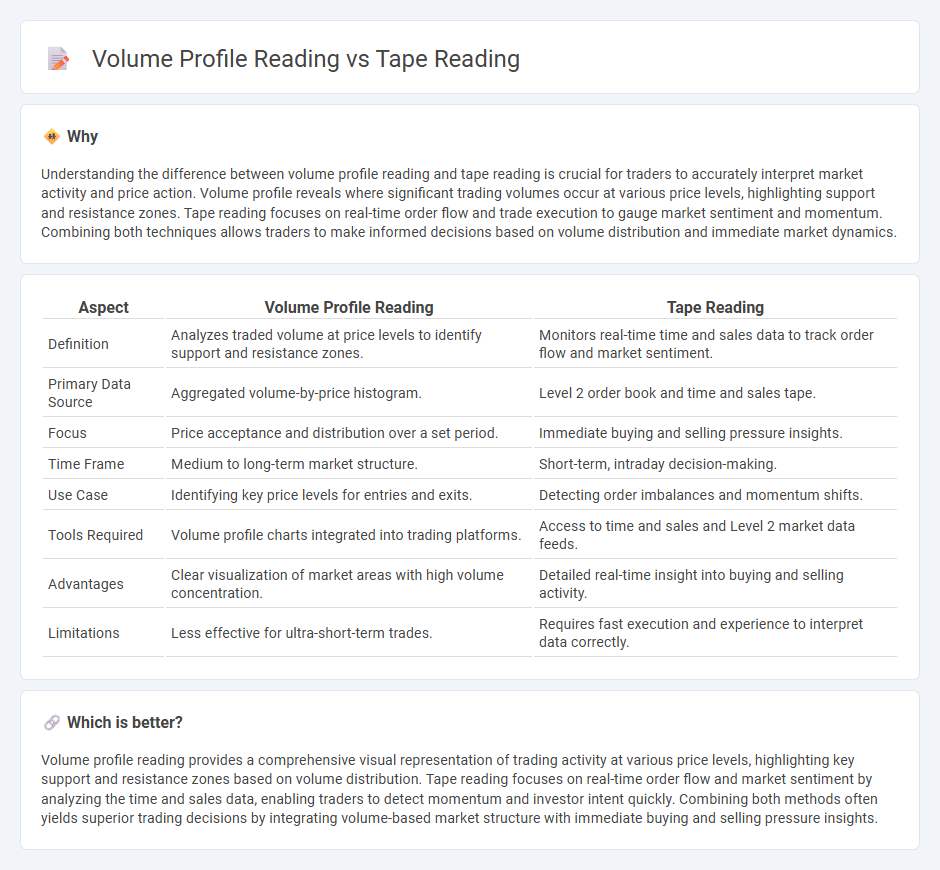

Understanding the difference between volume profile reading and tape reading is crucial for traders to accurately interpret market activity and price action. Volume profile reveals where significant trading volumes occur at various price levels, highlighting support and resistance zones. Tape reading focuses on real-time order flow and trade execution to gauge market sentiment and momentum. Combining both techniques allows traders to make informed decisions based on volume distribution and immediate market dynamics.

Comparison Table

| Aspect | Volume Profile Reading | Tape Reading |

|---|---|---|

| Definition | Analyzes traded volume at price levels to identify support and resistance zones. | Monitors real-time time and sales data to track order flow and market sentiment. |

| Primary Data Source | Aggregated volume-by-price histogram. | Level 2 order book and time and sales tape. |

| Focus | Price acceptance and distribution over a set period. | Immediate buying and selling pressure insights. |

| Time Frame | Medium to long-term market structure. | Short-term, intraday decision-making. |

| Use Case | Identifying key price levels for entries and exits. | Detecting order imbalances and momentum shifts. |

| Tools Required | Volume profile charts integrated into trading platforms. | Access to time and sales and Level 2 market data feeds. |

| Advantages | Clear visualization of market areas with high volume concentration. | Detailed real-time insight into buying and selling activity. |

| Limitations | Less effective for ultra-short-term trades. | Requires fast execution and experience to interpret data correctly. |

Which is better?

Volume profile reading provides a comprehensive visual representation of trading activity at various price levels, highlighting key support and resistance zones based on volume distribution. Tape reading focuses on real-time order flow and market sentiment by analyzing the time and sales data, enabling traders to detect momentum and investor intent quickly. Combining both methods often yields superior trading decisions by integrating volume-based market structure with immediate buying and selling pressure insights.

Connection

Volume profile reading reveals the distribution of traded volumes at different price levels, highlighting key support and resistance zones. Tape reading provides real-time order flow and market sentiment by analyzing the sequence of trades and their sizes. Combining volume profile with tape reading enhances traders' ability to identify high-probability entry and exit points based on both historical volume concentration and live market activity.

Key Terms

Tape Reading:

Tape reading involves analyzing real-time order flow and trade prints to gauge market sentiment and momentum, providing traders with immediate insight into supply and demand dynamics. This technique emphasizes the interpretation of time and sales data, helping anticipate price movements based on the size and speed of transactions. Explore more to master tape reading strategies and enhance your market timing accuracy.

Time and Sales

Time and Sales data provides real-time transaction details, including price, volume, and timestamp, essential for tape reading to identify market sentiment and order flow. Volume Profile reading aggregates traded volume at specific price levels over a set period, revealing key support and resistance areas and market structure. Explore detailed strategies combining Time and Sales with Volume Profile analysis to enhance trading decisions.

Level 2 Quotes

Level 2 Quotes provide a detailed view of market depth, displaying bid and ask prices along with corresponding order sizes, essential for tape reading and volume profile analysis. Tape reading interprets real-time transaction flow and order execution, while volume profile reading maps volume distribution at various price levels to identify key support and resistance zones. Explore the distinct advantages of Level 2 Quotes for enhancing trading strategies and market analysis.

Source and External Links

What Is Tape Reading and How Does It Work - Earn2Trade Blog - Tape reading is an old technique of analyzing price and volume data and involves identifying support and resistance levels by observing large limit orders and small lots of transactions in real time, but it should be complemented with other market and technical analysis tools for a fuller market view.

What is Tape Reading Today? - Bookmap - Tape reading historically referred to reading ticker tape stock quotes but today involves analyzing the Time & Sales data to interpret order flow by observing real-time transaction prices, volumes, and bids/offers, though a full understanding requires integrating market structure and liquidity depth.

Level 2 Trading Secrets (How to Read the Tape Using Time & Sales) - Modern tape reading involves using Time & Sales data representing the original ticker tape transactions combined with Level 2 market depth to understand intraday price action and order flow in real-time trading.

dowidth.com

dowidth.com