Microstructure modeling focuses on the detailed mechanisms of price formation and liquidity provision at the most granular level, analyzing individual trades, quotes, and order executions. Order book dynamics emphasize the interplay between limit orders, market orders, and cancellations within the order book, revealing patterns that influence price movements and market depth. Discover how integrating microstructure models with order book dynamics enhances trading strategies and market understanding.

Why it is important

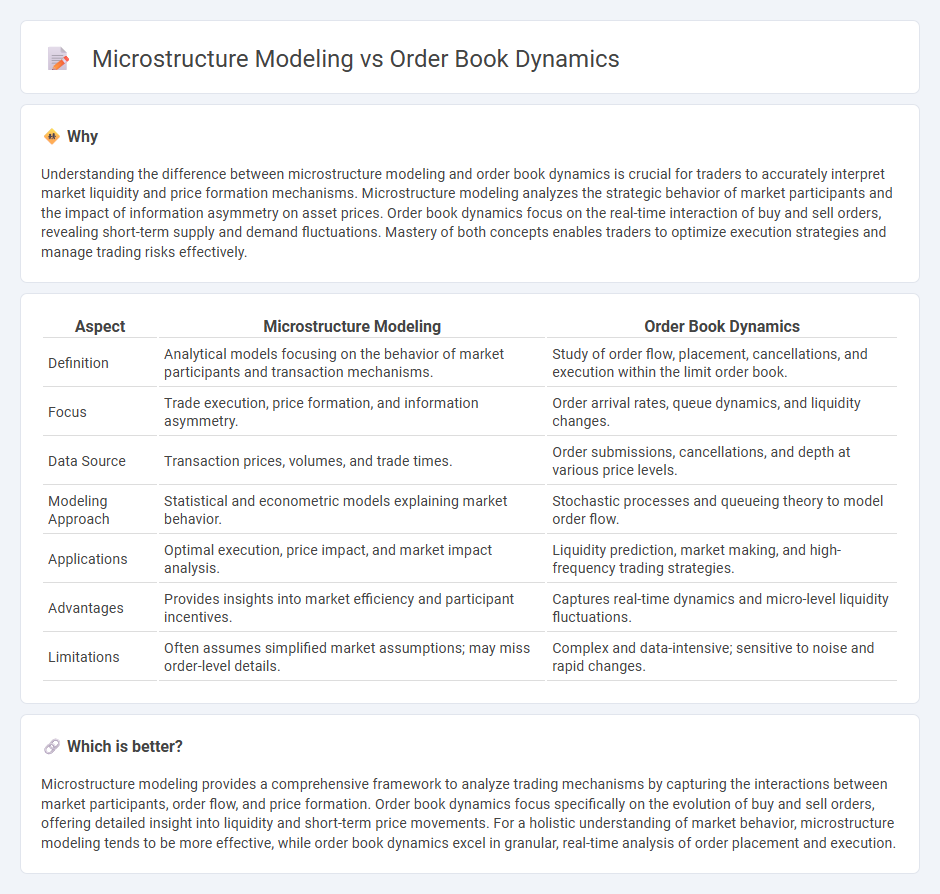

Understanding the difference between microstructure modeling and order book dynamics is crucial for traders to accurately interpret market liquidity and price formation mechanisms. Microstructure modeling analyzes the strategic behavior of market participants and the impact of information asymmetry on asset prices. Order book dynamics focus on the real-time interaction of buy and sell orders, revealing short-term supply and demand fluctuations. Mastery of both concepts enables traders to optimize execution strategies and manage trading risks effectively.

Comparison Table

| Aspect | Microstructure Modeling | Order Book Dynamics |

|---|---|---|

| Definition | Analytical models focusing on the behavior of market participants and transaction mechanisms. | Study of order flow, placement, cancellations, and execution within the limit order book. |

| Focus | Trade execution, price formation, and information asymmetry. | Order arrival rates, queue dynamics, and liquidity changes. |

| Data Source | Transaction prices, volumes, and trade times. | Order submissions, cancellations, and depth at various price levels. |

| Modeling Approach | Statistical and econometric models explaining market behavior. | Stochastic processes and queueing theory to model order flow. |

| Applications | Optimal execution, price impact, and market impact analysis. | Liquidity prediction, market making, and high-frequency trading strategies. |

| Advantages | Provides insights into market efficiency and participant incentives. | Captures real-time dynamics and micro-level liquidity fluctuations. |

| Limitations | Often assumes simplified market assumptions; may miss order-level details. | Complex and data-intensive; sensitive to noise and rapid changes. |

Which is better?

Microstructure modeling provides a comprehensive framework to analyze trading mechanisms by capturing the interactions between market participants, order flow, and price formation. Order book dynamics focus specifically on the evolution of buy and sell orders, offering detailed insight into liquidity and short-term price movements. For a holistic understanding of market behavior, microstructure modeling tends to be more effective, while order book dynamics excel in granular, real-time analysis of order placement and execution.

Connection

Microstructure modeling analyzes the intricate processes within financial markets, focusing on order book dynamics to reveal the behavior of buy and sell orders at different price levels. Order book dynamics provide critical data on liquidity, price discovery, and market depth, serving as the foundation for understanding price formation and volatility through microstructure models. Integrating these concepts enables traders and analysts to improve execution strategies and forecast short-term price movements with higher accuracy.

Key Terms

Order Book Dynamics:

Order book dynamics analyze the real-time interactions between buy and sell orders, capturing the flow, cancellation, and placement of limit orders to reveal market liquidity and price discovery processes. This approach emphasizes the stochastic behavior of order arrivals and executions, providing detailed insights into short-term price movements and bid-ask spread variations. Explore more on how order book dynamics enhance high-frequency trading models and risk management strategies.

Bid-Ask Spread

Order book dynamics capture real-time changes in supply and demand across price levels, providing granular insights into liquidity and market depth that directly influence the bid-ask spread. Microstructure modeling uses theoretical frameworks and empirical data to explain how factors like order flow, inventory risk, and asymmetric information shape the spread. Explore further to understand the quantitative methods that link order book behavior with microstructure theories affecting bid-ask spreads.

Limit Order Flow

Limit order flow provides critical insights into order book dynamics by capturing the arrival, cancellation, and execution of limit orders that shape price formation. Microstructure modeling analyzes these order flows to understand liquidity provision, price impact, and market resilience at a granular level. Explore the intricate relationships between limit order flow and market microstructure to enhance trading strategies and risk management.

Source and External Links

A Mathematical Framework for Modelling Order Book Dynamics - Presents a general mathematical framework combining order flow, modeled as spatial point processes, and market clearing via a mass transport operator to simulate and analyze limit order book dynamics and price formation.

A Stochastic Model for Order Book Dynamics - Proposes a continuous-time stochastic model that captures order arrivals, cancellations, and market orders at various price levels, providing a detailed mechanism for the evolution of the limit order book state.

Multiscale Modeling of Order Book Dynamics - Discusses order book dynamics focusing on bid-ask processes, with statistical rules for buy and sell orders and the role of order patience and cancellation in shaping market microstructure.

dowidth.com

dowidth.com