Order flow analysis focuses on real-time market data to interpret buying and selling pressure, allowing traders to anticipate short-term price movements. Position trading, in contrast, relies on long-term trends and fundamental analysis to hold assets for extended periods, aiming for substantial gains over time. Explore the nuances of both strategies to determine which suits your trading goals best.

Why it is important

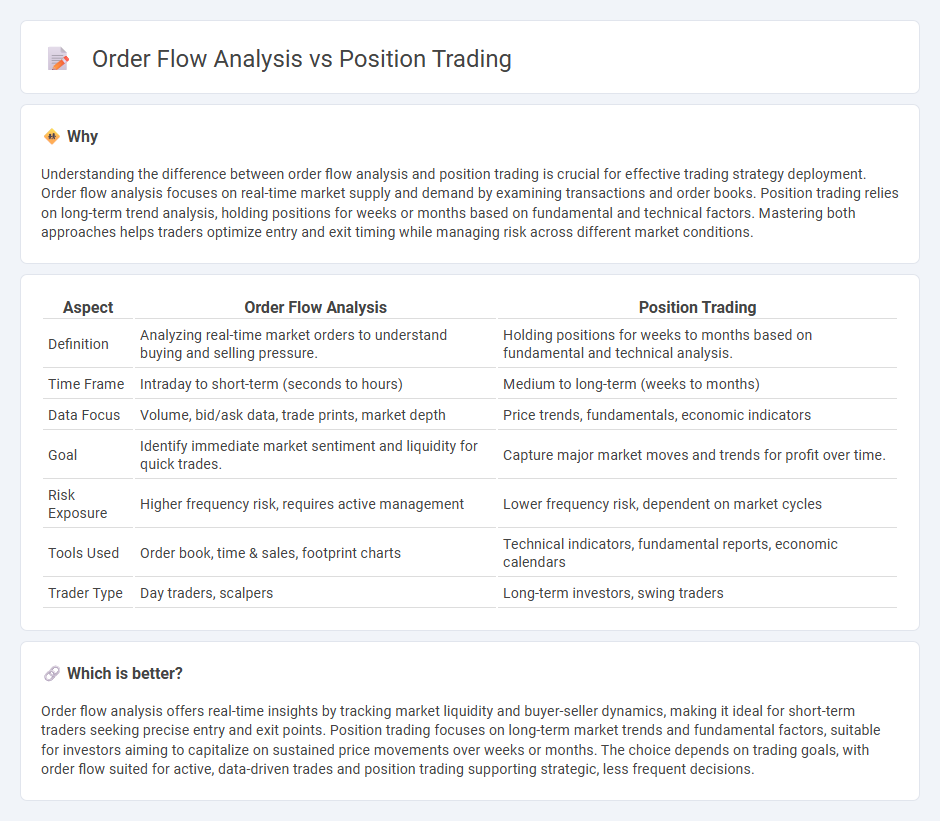

Understanding the difference between order flow analysis and position trading is crucial for effective trading strategy deployment. Order flow analysis focuses on real-time market supply and demand by examining transactions and order books. Position trading relies on long-term trend analysis, holding positions for weeks or months based on fundamental and technical factors. Mastering both approaches helps traders optimize entry and exit timing while managing risk across different market conditions.

Comparison Table

| Aspect | Order Flow Analysis | Position Trading |

|---|---|---|

| Definition | Analyzing real-time market orders to understand buying and selling pressure. | Holding positions for weeks to months based on fundamental and technical analysis. |

| Time Frame | Intraday to short-term (seconds to hours) | Medium to long-term (weeks to months) |

| Data Focus | Volume, bid/ask data, trade prints, market depth | Price trends, fundamentals, economic indicators |

| Goal | Identify immediate market sentiment and liquidity for quick trades. | Capture major market moves and trends for profit over time. |

| Risk Exposure | Higher frequency risk, requires active management | Lower frequency risk, dependent on market cycles |

| Tools Used | Order book, time & sales, footprint charts | Technical indicators, fundamental reports, economic calendars |

| Trader Type | Day traders, scalpers | Long-term investors, swing traders |

Which is better?

Order flow analysis offers real-time insights by tracking market liquidity and buyer-seller dynamics, making it ideal for short-term traders seeking precise entry and exit points. Position trading focuses on long-term market trends and fundamental factors, suitable for investors aiming to capitalize on sustained price movements over weeks or months. The choice depends on trading goals, with order flow suited for active, data-driven trades and position trading supporting strategic, less frequent decisions.

Connection

Order flow analysis provides real-time insights into market liquidity and trader intentions by examining the buying and selling pressure within the order book, which position traders use to identify optimal entry and exit points for medium to long-term trades. Position trading relies on the detailed understanding of order flow to anticipate sustained market trends, allowing traders to align their positions with underlying supply and demand dynamics. By integrating order flow data with technical and fundamental analysis, position traders enhance their decision-making accuracy and risk management strategies.

Key Terms

Holding Period

Position trading typically involves holding assets for weeks to months, relying on long-term market trends and fundamental analysis to make informed decisions. Order flow analysis concentrates on short-term market dynamics by examining the real-time buying and selling activity to capitalize on immediate price movements. Explore further to understand how holding period impacts strategy effectiveness and risk management in trading.

Liquidity

Position trading focuses on capturing long-term trends by analyzing liquidity zones where large buy or sell orders accumulate, providing key support and resistance levels. Order flow analysis examines real-time transaction data to identify shifts in supply and demand, revealing short-term liquidity imbalances that can indicate market direction changes. Explore the detailed mechanisms of liquidity in position trading and order flow analysis to enhance your trading strategy effectiveness.

Trade Execution

Position trading involves holding assets for extended periods to capture long-term trends, relying on technical and fundamental analysis to determine entry and exit points. Order flow analysis emphasizes real-time market data, such as bid-ask volumes, to execute trades more precisely and exploit short-term price movements. Explore how combining these strategies can optimize trade execution and enhance overall trading performance.

Source and External Links

Position Trading 101: A Beginner's Guide With Examples - Position trading is a medium- to long-term trading strategy involving holding financial products for weeks to months to profit from upward or downward market trends, allowing both long and short positions and involving risks such as overnight gaps.

A guide to position trading: definition, examples and strategies - Position trading focuses on identifying and benefiting from ongoing trends over time, using strategies like trend trading, breakout trading, and pullback trading, and applies well to indices and commodities.

Position Trading: Long-Term Trading Strategies | CMC Markets - Position trading is a long-term strategy opposite to day trading, where traders hold positions ignoring minor price fluctuations and can use spread bets or CFDs to capture gains from lasting market moves, suitable for beginners due to its simplicity.

dowidth.com

dowidth.com