Perpetual contracts and CFDs are popular derivatives in trading, offering leverage and exposure to asset price movements without ownership. Perpetual contracts trade on cryptocurrency exchanges with no expiration date, making them ideal for long-term speculative strategies, while CFDs are agreements between traders and brokers on traditional assets with defined terms. Explore the differences in margin requirements, liquidity, and risk profiles to optimize your trading decisions.

Why it is important

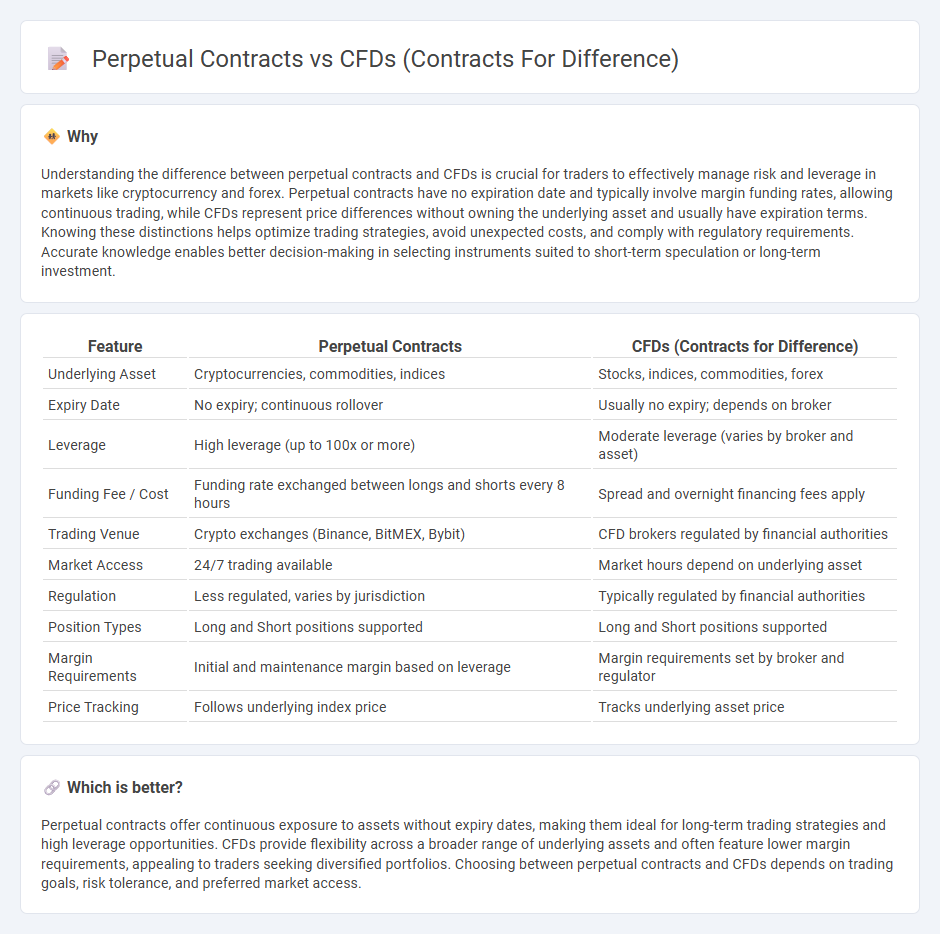

Understanding the difference between perpetual contracts and CFDs is crucial for traders to effectively manage risk and leverage in markets like cryptocurrency and forex. Perpetual contracts have no expiration date and typically involve margin funding rates, allowing continuous trading, while CFDs represent price differences without owning the underlying asset and usually have expiration terms. Knowing these distinctions helps optimize trading strategies, avoid unexpected costs, and comply with regulatory requirements. Accurate knowledge enables better decision-making in selecting instruments suited to short-term speculation or long-term investment.

Comparison Table

| Feature | Perpetual Contracts | CFDs (Contracts for Difference) |

|---|---|---|

| Underlying Asset | Cryptocurrencies, commodities, indices | Stocks, indices, commodities, forex |

| Expiry Date | No expiry; continuous rollover | Usually no expiry; depends on broker |

| Leverage | High leverage (up to 100x or more) | Moderate leverage (varies by broker and asset) |

| Funding Fee / Cost | Funding rate exchanged between longs and shorts every 8 hours | Spread and overnight financing fees apply |

| Trading Venue | Crypto exchanges (Binance, BitMEX, Bybit) | CFD brokers regulated by financial authorities |

| Market Access | 24/7 trading available | Market hours depend on underlying asset |

| Regulation | Less regulated, varies by jurisdiction | Typically regulated by financial authorities |

| Position Types | Long and Short positions supported | Long and Short positions supported |

| Margin Requirements | Initial and maintenance margin based on leverage | Margin requirements set by broker and regulator |

| Price Tracking | Follows underlying index price | Tracks underlying asset price |

Which is better?

Perpetual contracts offer continuous exposure to assets without expiry dates, making them ideal for long-term trading strategies and high leverage opportunities. CFDs provide flexibility across a broader range of underlying assets and often feature lower margin requirements, appealing to traders seeking diversified portfolios. Choosing between perpetual contracts and CFDs depends on trading goals, risk tolerance, and preferred market access.

Connection

Perpetual contracts and CFDs (Contracts for Difference) both enable traders to speculate on asset price movements without owning the underlying asset, offering leverage and flexibility in trading cryptocurrencies, stocks, and commodities. These derivatives allow for long and short positions, with perpetual contracts featuring no expiration date and often including funding rates to anchor prices to spot markets. CFDs provide similar benefits with varied contract terms, making both instruments popular for hedging and speculative strategies in global financial markets.

Key Terms

Leverage

CFDs (Contracts for Difference) offer variable leverage typically ranging from 5x to 30x depending on the asset class and regulatory environment, enabling traders to amplify exposure to price movements without owning the underlying asset. Perpetual contracts, commonly used in cryptocurrency markets, often provide higher leverage options, sometimes exceeding 100x, but carry increased risk due to funding fees and potential liquidation. Explore detailed leverage mechanisms and risk management strategies in CFDs and perpetual contracts to optimize trading performance.

Expiration

CFDs (Contracts for Difference) do not have fixed expiration dates, allowing traders to hold positions indefinitely as long as margin requirements are met. Perpetual contracts also lack expiration dates but often include funding rates exchanged between long and short positions to keep contract prices aligned with underlying asset prices. Explore the differences between CFDs and perpetual contracts to optimize your trading strategy effectively.

Funding Fees

CFDs (Contracts for Difference) do not typically incur funding fees, allowing traders to hold positions without ongoing costs, contrasting with perpetual contracts which require periodic funding payments every 8 hours to maintain price alignment with the underlying asset. These funding fees can be positive or negative, depending on market demand and supply, impacting trader profitability over time in perpetual markets like Bitcoin futures. Explore comprehensive comparisons of CFDs and perpetual contracts to optimize your trading strategy based on fee structures and market exposure.

Source and External Links

Contract for Difference (CFD) - Corporate Finance Institute - A CFD is an agreement where two parties trade the difference in price of a financial instrument between the contract's opening and closing, allowing leveraged trading without owning the underlying asset.

Contracts for Difference (CFD) - MFSA - CFDs are leveraged products enabling investors to profit from price movements of underlying assets (such as shares or indices) by exchanging the difference in value at contract closure, without ever owning the asset.

Contracts-for-Difference (CfDs) - Florence School of Regulation - In energy, Contracts-for-Difference (CfDs) are used to provide price stability for renewable energy producers by fixing electricity prices over time, reducing exposure to market volatility.

dowidth.com

dowidth.com