Tape reading involves analyzing real-time order flow and price movements to anticipate short-term market trends, relying heavily on market psychology and volume patterns. Statistical arbitrage employs quantitative models and historical price data correlations to identify and exploit pricing inefficiencies across securities, often leveraging high-frequency trading algorithms. Explore these contrasting trading strategies to understand their unique benefits and applications.

Why it is important

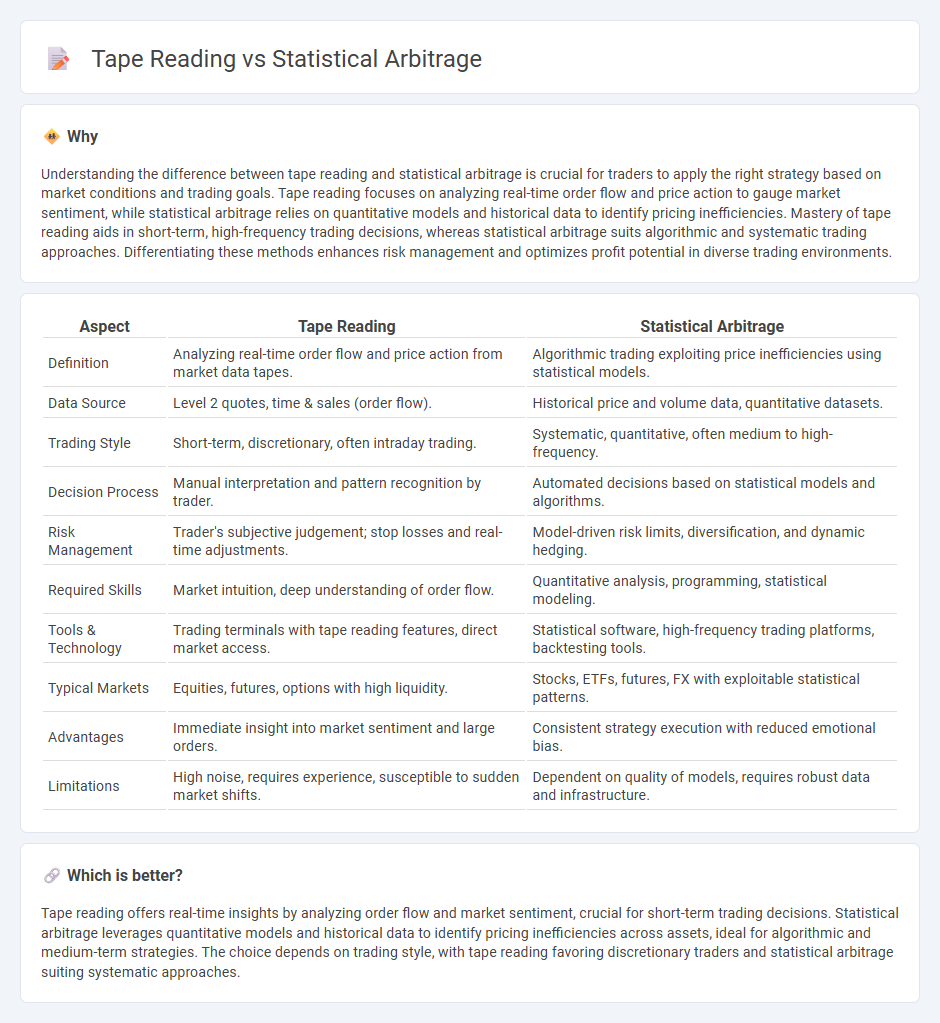

Understanding the difference between tape reading and statistical arbitrage is crucial for traders to apply the right strategy based on market conditions and trading goals. Tape reading focuses on analyzing real-time order flow and price action to gauge market sentiment, while statistical arbitrage relies on quantitative models and historical data to identify pricing inefficiencies. Mastery of tape reading aids in short-term, high-frequency trading decisions, whereas statistical arbitrage suits algorithmic and systematic trading approaches. Differentiating these methods enhances risk management and optimizes profit potential in diverse trading environments.

Comparison Table

| Aspect | Tape Reading | Statistical Arbitrage |

|---|---|---|

| Definition | Analyzing real-time order flow and price action from market data tapes. | Algorithmic trading exploiting price inefficiencies using statistical models. |

| Data Source | Level 2 quotes, time & sales (order flow). | Historical price and volume data, quantitative datasets. |

| Trading Style | Short-term, discretionary, often intraday trading. | Systematic, quantitative, often medium to high-frequency. |

| Decision Process | Manual interpretation and pattern recognition by trader. | Automated decisions based on statistical models and algorithms. |

| Risk Management | Trader's subjective judgement; stop losses and real-time adjustments. | Model-driven risk limits, diversification, and dynamic hedging. |

| Required Skills | Market intuition, deep understanding of order flow. | Quantitative analysis, programming, statistical modeling. |

| Tools & Technology | Trading terminals with tape reading features, direct market access. | Statistical software, high-frequency trading platforms, backtesting tools. |

| Typical Markets | Equities, futures, options with high liquidity. | Stocks, ETFs, futures, FX with exploitable statistical patterns. |

| Advantages | Immediate insight into market sentiment and large orders. | Consistent strategy execution with reduced emotional bias. |

| Limitations | High noise, requires experience, susceptible to sudden market shifts. | Dependent on quality of models, requires robust data and infrastructure. |

Which is better?

Tape reading offers real-time insights by analyzing order flow and market sentiment, crucial for short-term trading decisions. Statistical arbitrage leverages quantitative models and historical data to identify pricing inefficiencies across assets, ideal for algorithmic and medium-term strategies. The choice depends on trading style, with tape reading favoring discretionary traders and statistical arbitrage suiting systematic approaches.

Connection

Tape reading provides real-time market data crucial for identifying price patterns and order flow dynamics, which enhances the effectiveness of statistical arbitrage strategies. Statistical arbitrage relies on quantitative models analyzing historical price relationships and anomalies that tape reading can verify through live trade and volume insights. This synergy improves the precision of trade execution and risk management in high-frequency and algorithmic trading environments.

Key Terms

**Statistical Arbitrage:**

Statistical arbitrage leverages quantitative models and historical data to identify and exploit price inefficiencies across multiple securities, using algorithms and large datasets for systematic trading strategies. This approach contrasts with tape reading, which relies on real-time interpretation of trade prints and order flow for short-term market predictions. Explore more to understand how statistical arbitrage applies advanced analytics to maximize trading performance.

Mean Reversion

Statistical arbitrage exploits historical price patterns and mean reversion principles by identifying price discrepancies across correlated assets, using quantitative models for automated trades. Tape reading, by contrast, relies on real-time analysis of order flow and market momentum to anticipate short-term price reversals based on immediate supply and demand signals. Explore deeper insights into mean reversion strategies by comparing data-driven algorithms with behavioral tape reading techniques.

Pairs Trading

Statistical arbitrage leverages quantitative models and historical price data to identify mean-reverting pairs in stocks, enabling traders to capitalize on price discrepancies with reduced market risk. Tape reading, by contrast, relies on real-time analysis of order flow and trade volume to anticipate short-term price movements but lacks the systematic approach found in pairs trading strategies. Explore the nuances of pairs trading to understand how blending statistical insights with market microstructure can enhance trading performance.

Source and External Links

Top Statistical Arbitrage Strategies and Their Risks - WunderTrading - Statistical arbitrage is a market-neutral quantitative trading strategy that exploits price discrepancies between correlated securities using algorithms and mean reversion, involving simultaneously long and short positions to hedge market risks and aim for consistent returns.

Statistical arbitrage - Wikipedia - Statistical arbitrage (StatArb) refers to short-term, heavily quantitative trading strategies that use mean reversion models and multi-factor statistical signals to manage broadly diversified portfolios, often implemented automatically with a focus on trading cost efficiency and market-neutral exposure.

Quantitative Methods of Statistical Arbitrage - Statistical arbitrage exploits mean reversion in spreads constructed from pairs or portfolios of assets, using quantitative methods to identify and trade on pricing inefficiencies in financial markets.

dowidth.com

dowidth.com