Statistical arbitrage employs quantitative models to exploit pricing inefficiencies across correlated assets, aiming for market-neutral returns by dynamically adjusting positions based on historical price relationships. Risk parity allocates portfolio weights according to risk contribution, balancing volatility across asset classes to achieve diversified and stable performance. Discover how these distinct trading strategies can optimize investment outcomes and manage risk effectively.

Why it is important

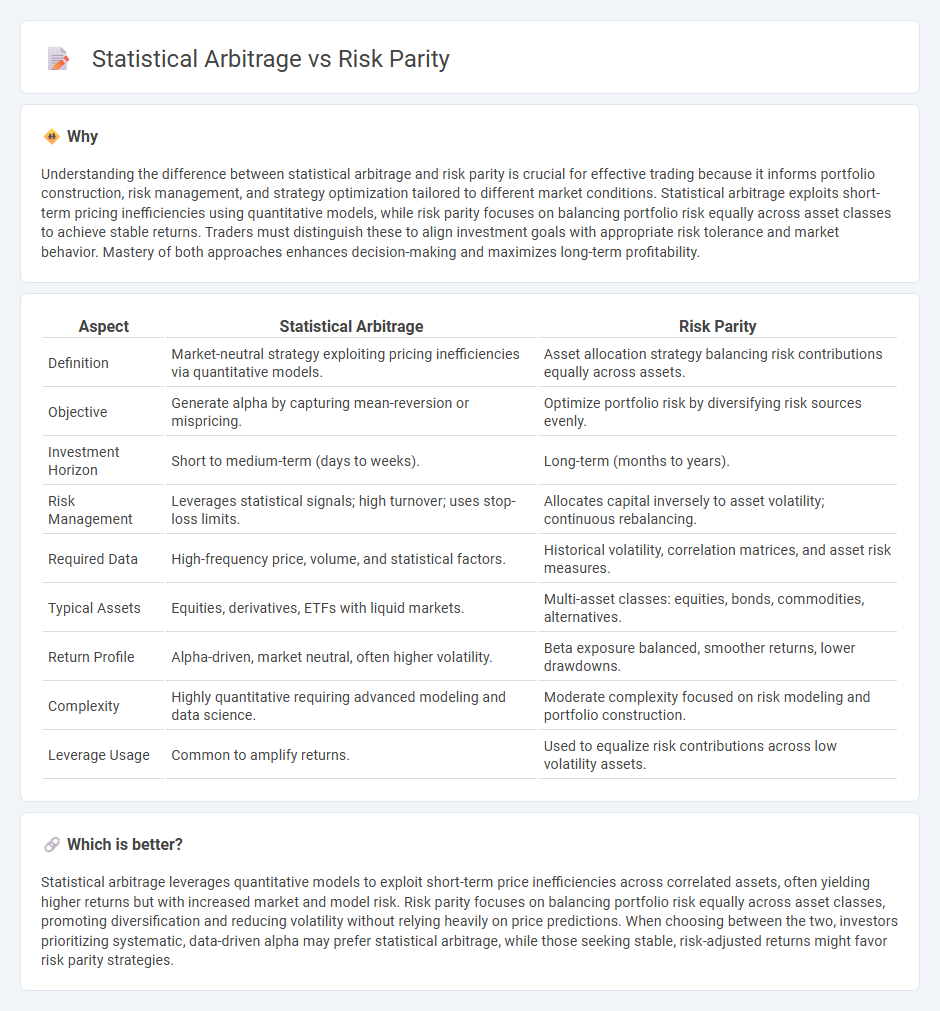

Understanding the difference between statistical arbitrage and risk parity is crucial for effective trading because it informs portfolio construction, risk management, and strategy optimization tailored to different market conditions. Statistical arbitrage exploits short-term pricing inefficiencies using quantitative models, while risk parity focuses on balancing portfolio risk equally across asset classes to achieve stable returns. Traders must distinguish these to align investment goals with appropriate risk tolerance and market behavior. Mastery of both approaches enhances decision-making and maximizes long-term profitability.

Comparison Table

| Aspect | Statistical Arbitrage | Risk Parity |

|---|---|---|

| Definition | Market-neutral strategy exploiting pricing inefficiencies via quantitative models. | Asset allocation strategy balancing risk contributions equally across assets. |

| Objective | Generate alpha by capturing mean-reversion or mispricing. | Optimize portfolio risk by diversifying risk sources evenly. |

| Investment Horizon | Short to medium-term (days to weeks). | Long-term (months to years). |

| Risk Management | Leverages statistical signals; high turnover; uses stop-loss limits. | Allocates capital inversely to asset volatility; continuous rebalancing. |

| Required Data | High-frequency price, volume, and statistical factors. | Historical volatility, correlation matrices, and asset risk measures. |

| Typical Assets | Equities, derivatives, ETFs with liquid markets. | Multi-asset classes: equities, bonds, commodities, alternatives. |

| Return Profile | Alpha-driven, market neutral, often higher volatility. | Beta exposure balanced, smoother returns, lower drawdowns. |

| Complexity | Highly quantitative requiring advanced modeling and data science. | Moderate complexity focused on risk modeling and portfolio construction. |

| Leverage Usage | Common to amplify returns. | Used to equalize risk contributions across low volatility assets. |

Which is better?

Statistical arbitrage leverages quantitative models to exploit short-term price inefficiencies across correlated assets, often yielding higher returns but with increased market and model risk. Risk parity focuses on balancing portfolio risk equally across asset classes, promoting diversification and reducing volatility without relying heavily on price predictions. When choosing between the two, investors prioritizing systematic, data-driven alpha may prefer statistical arbitrage, while those seeking stable, risk-adjusted returns might favor risk parity strategies.

Connection

Statistical arbitrage and risk parity both aim to optimize portfolio returns by leveraging quantitative methods to balance risk exposure. Statistical arbitrage uses statistical models to identify pricing inefficiencies and capitalize on mean-reverting behaviors across correlated assets. Risk parity allocates capital across assets based on their risk contributions, complementing statistical arbitrage by ensuring diversified risk distribution and enhancing portfolio stability.

Key Terms

Portfolio Allocation (Risk Parity)

Risk parity is a portfolio allocation strategy designed to balance risk contributions from different asset classes, aiming for a more diversified risk exposure rather than equal capital allocation. It uses volatility and correlation metrics to assign weights, reducing concentration in high-risk assets and enhancing risk-adjusted returns. Explore the nuances of risk parity versus statistical arbitrage to optimize your investment strategy.

Mean Reversion (Statistical Arbitrage)

Risk parity allocates assets based on equalizing risk contributions across portfolio components, emphasizing diversification and volatility balancing. Statistical arbitrage, centered on mean reversion, exploits short-term price deviations by identifying and trading mispriced securities to capture expected corrections. Explore more to understand how these strategies leverage risk and return dynamics in quantitative investing.

Leverage (Both)

Risk parity strategies use leverage to equalize risk contributions across asset classes, often targeting consistent volatility levels by adjusting positions according to asset risk profiles. Statistical arbitrage employs leverage to exploit short-term mispricings between correlated securities, dynamically adjusting exposure based on predictive models and market inefficiencies. Explore the nuances of leverage application in both approaches to optimize portfolio performance.

Source and External Links

An Introduction to Risk Parity - Risk parity is an investment strategy that builds a diversified portfolio where all asset classes contribute equally to the portfolio's total risk, focusing on balancing risk rather than capital allocation and does not require forecasting returns, only risk measures like volatility.

Understanding Risk Parity | CME Group - Risk parity aims to balance total portfolio risk contribution from each asset class, avoiding risk concentration like in traditional 60/40 equity-bond splits, potentially achieving superior risk-adjusted returns by equalizing risk rather than dollars.

Risk parity - Meketa Investment Group - Risk parity allocates risk equally among portfolio assets, often using leverage to match traditional portfolio risk levels; it typically results in higher bond and lower equity allocations, performing well in equity downturns but possibly underperforming during rising interest rates.

dowidth.com

dowidth.com