Paper trading platforms simulate real market conditions, enabling users to practice live trading strategies without risking actual capital, offering immediate feedback and hands-on experience. Backtesting tools analyze historical market data to evaluate the performance of trading strategies over time, helping traders identify profitable patterns and optimize approaches before live deployment. Explore the distinct advantages of paper trading and backtesting to enhance your trading strategy development.

Why it is important

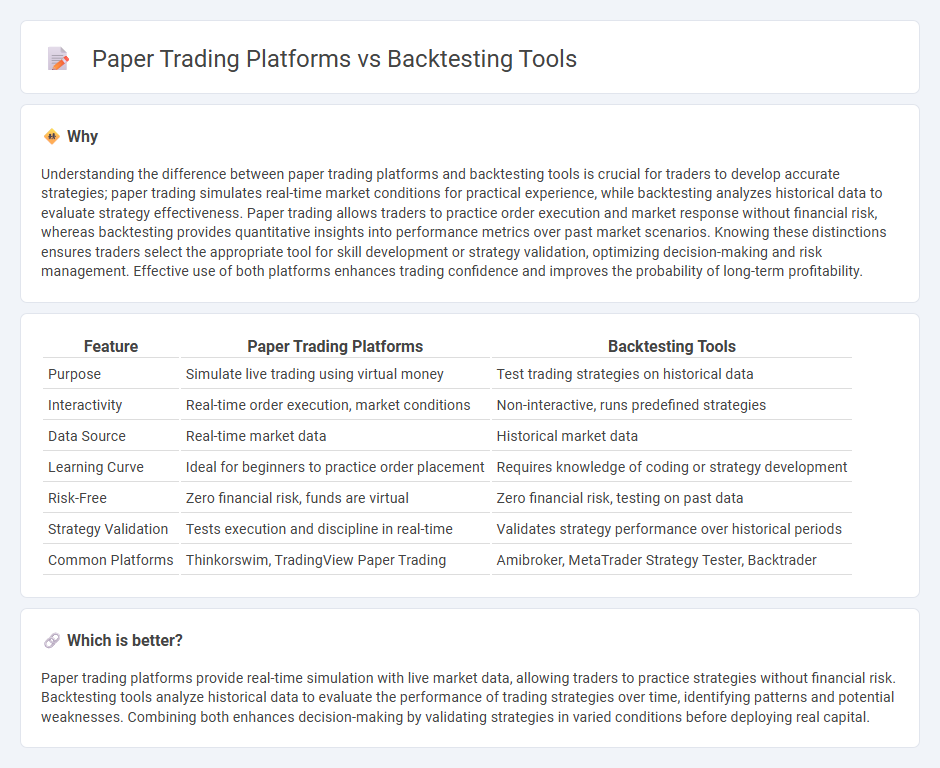

Understanding the difference between paper trading platforms and backtesting tools is crucial for traders to develop accurate strategies; paper trading simulates real-time market conditions for practical experience, while backtesting analyzes historical data to evaluate strategy effectiveness. Paper trading allows traders to practice order execution and market response without financial risk, whereas backtesting provides quantitative insights into performance metrics over past market scenarios. Knowing these distinctions ensures traders select the appropriate tool for skill development or strategy validation, optimizing decision-making and risk management. Effective use of both platforms enhances trading confidence and improves the probability of long-term profitability.

Comparison Table

| Feature | Paper Trading Platforms | Backtesting Tools |

|---|---|---|

| Purpose | Simulate live trading using virtual money | Test trading strategies on historical data |

| Interactivity | Real-time order execution, market conditions | Non-interactive, runs predefined strategies |

| Data Source | Real-time market data | Historical market data |

| Learning Curve | Ideal for beginners to practice order placement | Requires knowledge of coding or strategy development |

| Risk-Free | Zero financial risk, funds are virtual | Zero financial risk, testing on past data |

| Strategy Validation | Tests execution and discipline in real-time | Validates strategy performance over historical periods |

| Common Platforms | Thinkorswim, TradingView Paper Trading | Amibroker, MetaTrader Strategy Tester, Backtrader |

Which is better?

Paper trading platforms provide real-time simulation with live market data, allowing traders to practice strategies without financial risk. Backtesting tools analyze historical data to evaluate the performance of trading strategies over time, identifying patterns and potential weaknesses. Combining both enhances decision-making by validating strategies in varied conditions before deploying real capital.

Connection

Paper trading platforms simulate real-market trading environments, allowing users to practice strategies without financial risk, while backtesting tools analyze historical market data to evaluate the effectiveness of these strategies. Both tools complement each other by providing traders with empirical insights and practical experience, enhancing decision-making accuracy and risk management. Integrating paper trading with backtesting enables iterative strategy refinement, increasing the likelihood of consistent profitability in live trading.

Key Terms

**Backtesting Tools:**

Backtesting tools enable traders to evaluate trading strategies using historical market data, providing insights into performance metrics such as profit margins, drawdowns, and win rates. These tools support algorithmic strategy refinement and risk management by simulating trades across various market conditions without real-time execution risks. Explore our comprehensive guide to backtesting tools to enhance your trading strategy effectiveness.

Historical Data Analysis

Backtesting tools leverage extensive historical data sets to simulate trading strategies, enabling traders to evaluate performance under past market conditions with precise metrics like drawdown and Sharpe ratio. Paper trading platforms provide real-time or delayed market environments for practice but lack in-depth historical data analysis critical for refining strategy robustness over various market cycles. Explore comprehensive backtesting solutions to enhance your historical data analysis and strategy development.

Strategy Simulation

Backtesting tools provide historical data analysis to evaluate trading strategies' performance under past market conditions, ensuring accurate simulation of market dynamics and risk factors. Paper trading platforms offer real-time practice environments to test strategies without financial risk, allowing traders to experience live order execution and market fluctuations. Explore more to understand how combining both enhances trading strategy development effectively.

Source and External Links

7 Best Stock Backtesting Platforms of 2025 - A detailed list of top stock backtesting tools including TrendSpider, TradingView, Trade Ideas, FinViz, Backtest Zone, Backtrader, and QuantConnect, outlining their pricing, coding requirements, and ideal user profiles for testing trading strategies without risk.

The Best Backtesting Software For Traders In 2025 - In-depth review of backtesting software options, emphasizing TrendSpider's AI-powered, no-code approach for complex backtesting and strategy development with up to 50 years of historical data, alongside subscription details.

Options Backtesting Tool: Test Your Options Strategies - Free backtesting tool from tastytrade that lets users test options strategies over historical data spanning 10+ years, including multi-leg trades, with customizable exit conditions and detailed performance metrics.

dowidth.com

dowidth.com