Dark pool prints represent large, anonymous trades executed off public exchanges, offering traders insight into institutional activity without market impact. Tape reading involves analyzing real-time time and sales data to gauge market sentiment and anticipate price movements based on trade volume and size. Discover how mastering these techniques can enhance your trading strategy and decision-making.

Why it is important

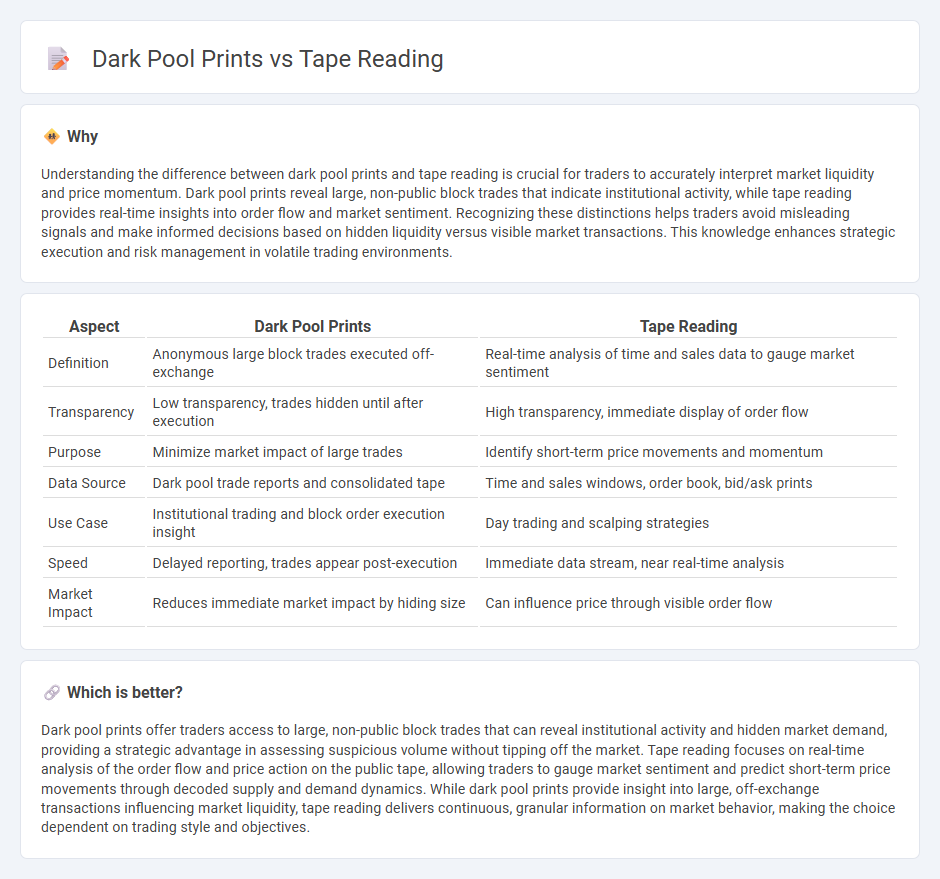

Understanding the difference between dark pool prints and tape reading is crucial for traders to accurately interpret market liquidity and price momentum. Dark pool prints reveal large, non-public block trades that indicate institutional activity, while tape reading provides real-time insights into order flow and market sentiment. Recognizing these distinctions helps traders avoid misleading signals and make informed decisions based on hidden liquidity versus visible market transactions. This knowledge enhances strategic execution and risk management in volatile trading environments.

Comparison Table

| Aspect | Dark Pool Prints | Tape Reading |

|---|---|---|

| Definition | Anonymous large block trades executed off-exchange | Real-time analysis of time and sales data to gauge market sentiment |

| Transparency | Low transparency, trades hidden until after execution | High transparency, immediate display of order flow |

| Purpose | Minimize market impact of large trades | Identify short-term price movements and momentum |

| Data Source | Dark pool trade reports and consolidated tape | Time and sales windows, order book, bid/ask prints |

| Use Case | Institutional trading and block order execution insight | Day trading and scalping strategies |

| Speed | Delayed reporting, trades appear post-execution | Immediate data stream, near real-time analysis |

| Market Impact | Reduces immediate market impact by hiding size | Can influence price through visible order flow |

Which is better?

Dark pool prints offer traders access to large, non-public block trades that can reveal institutional activity and hidden market demand, providing a strategic advantage in assessing suspicious volume without tipping off the market. Tape reading focuses on real-time analysis of the order flow and price action on the public tape, allowing traders to gauge market sentiment and predict short-term price movements through decoded supply and demand dynamics. While dark pool prints provide insight into large, off-exchange transactions influencing market liquidity, tape reading delivers continuous, granular information on market behavior, making the choice dependent on trading style and objectives.

Connection

Dark pool prints provide insight into large, non-public trades often executed by institutional investors, while tape reading involves analyzing the time, price, and volume of these prints to gauge market sentiment. Traders use tape reading to interpret dark pool activity, identifying potential price movements based on the hidden liquidity and volume patterns. This connection enhances decision-making by revealing supply and demand dynamics not visible on conventional exchanges.

Key Terms

**Tape Reading:**

Tape reading involves analyzing real-time order flow and price movements to gauge market sentiment and anticipate short-term price action in stocks. This technique relies on interpreting the Time and Sales data, Level 2 quotes, and volume patterns to identify aggressive buying or selling pressure. Explore how mastering tape reading can enhance your trading precision and market timing.

Time and Sales

Tape reading analyzes real-time Time and Sales data to pinpoint market momentum by observing individual trade prints, sizes, and speed, helping traders anticipate price movements. Dark pool prints reveal off-exchange large block trades not visible on public order books, providing insights into institutional activity and potential market impact. Explore the nuances between these methods to enhance trading strategies and market comprehension.

Order Flow

Tape reading involves analyzing real-time trade data to gauge market sentiment by observing the size, speed, and price of transactions on a public exchange. Dark pool prints reveal hidden large institutional orders executed off-exchange, providing insights into significant market moves without public transparency. Explore our detailed guide to master both techniques and enhance your order flow trading strategy.

Source and External Links

What Is Tape Reading and How Does It Work - Earn2Trade Blog - Tape reading is an old technique used to analyze price and volume data by observing the number and type of trades, allowing traders to identify support and resistance levels, but it requires complementing with other market analysis tools for a complete picture.

What is Tape Reading Today? - Bookmap - Tape reading originated from reading stock quotes on ticker tape machines and today refers to reading Time & Sales data to interpret order flow, though it only shows transactions and lacks the full market structure and liquidity context.

Top 4 Tape Reading Mistakes (& How Scalping Can Save You!) - YouTube - Tape reading evolved from old ticker tape analysis to modern tools such as level 2 quotes and time & sales, helping traders visualize bid, offer, and transactions interplay that informs their market decisions.

dowidth.com

dowidth.com