Retail flow chasing involves traders reacting to market movements driven by retail investor behavior, often resulting in higher volatility and unpredictable price swings. Algorithmic trading uses sophisticated computer programs to execute trades at high speed based on predefined criteria, providing increased efficiency and reduced emotional bias. Explore the differences between these strategies to understand how each impacts market dynamics and trading performance.

Why it is important

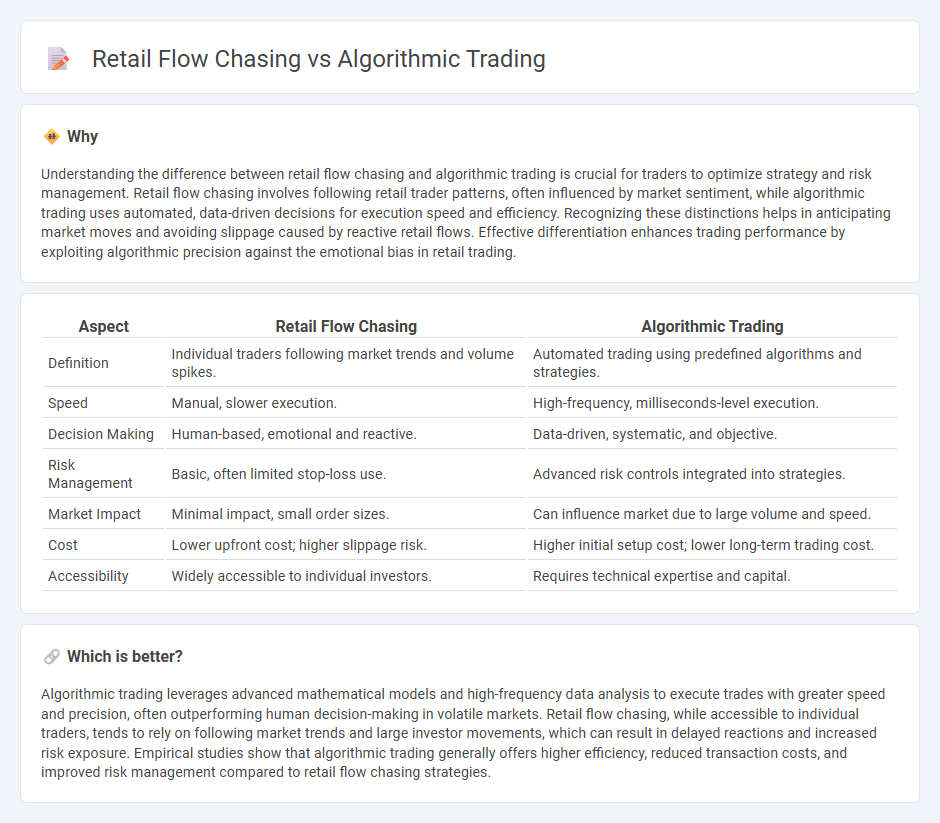

Understanding the difference between retail flow chasing and algorithmic trading is crucial for traders to optimize strategy and risk management. Retail flow chasing involves following retail trader patterns, often influenced by market sentiment, while algorithmic trading uses automated, data-driven decisions for execution speed and efficiency. Recognizing these distinctions helps in anticipating market moves and avoiding slippage caused by reactive retail flows. Effective differentiation enhances trading performance by exploiting algorithmic precision against the emotional bias in retail trading.

Comparison Table

| Aspect | Retail Flow Chasing | Algorithmic Trading |

|---|---|---|

| Definition | Individual traders following market trends and volume spikes. | Automated trading using predefined algorithms and strategies. |

| Speed | Manual, slower execution. | High-frequency, milliseconds-level execution. |

| Decision Making | Human-based, emotional and reactive. | Data-driven, systematic, and objective. |

| Risk Management | Basic, often limited stop-loss use. | Advanced risk controls integrated into strategies. |

| Market Impact | Minimal impact, small order sizes. | Can influence market due to large volume and speed. |

| Cost | Lower upfront cost; higher slippage risk. | Higher initial setup cost; lower long-term trading cost. |

| Accessibility | Widely accessible to individual investors. | Requires technical expertise and capital. |

Which is better?

Algorithmic trading leverages advanced mathematical models and high-frequency data analysis to execute trades with greater speed and precision, often outperforming human decision-making in volatile markets. Retail flow chasing, while accessible to individual traders, tends to rely on following market trends and large investor movements, which can result in delayed reactions and increased risk exposure. Empirical studies show that algorithmic trading generally offers higher efficiency, reduced transaction costs, and improved risk management compared to retail flow chasing strategies.

Connection

Retail flow chasing relies heavily on real-time data analytics and market sentiment indicators, which algorithmic trading systems use to execute high-frequency trades based on patterns in retail investor behavior. Algorithmic trading algorithms adapt to the influx of retail trades by identifying trends and exploiting short-term price inefficiencies created by retail flow surges. This interplay drives increased market volatility and liquidity, influencing price discovery processes and trading strategies across asset classes.

Key Terms

Execution Speed

Algorithmic trading leverages high-frequency data processing and advanced algorithms to execute orders within microseconds, drastically minimizing latency and market impact. Retail flow chasing relies more on human reaction and slower order routing, often resulting in increased slippage and delayed trade execution. Explore the technical nuances influencing execution speed differences and their impact on trading strategies.

Order Types

Algorithmic trading utilizes advanced order types such as iceberg, TWAP, and VWAP to execute large trades with minimal market impact, optimizing execution speed and price. Retail flow chasing primarily relies on market and limit orders to follow retail investor sentiment and momentum, often resulting in higher slippage and reduced efficiency. Explore more to understand how different order types influence execution strategies in these trading approaches.

Market Impact

Algorithmic trading leverages complex mathematical models and high-frequency data to minimize market impact by executing large orders through numerous small trades, thereby preserving price stability. Retail flow chasing involves reacting to imbalances caused by retail investor orders, which can amplify volatility and create larger price swings as market participants attempt to capitalize on short-term imbalances. Explore detailed strategies and data analysis to understand how these approaches influence market dynamics and impact trading performance.

Source and External Links

Understanding the Basics of Algorithmic Trading | Market ... - Algorithmic trading uses computer programs with defined instructions (algorithms) to place trades automatically based on factors like timing, price, and quantity, allowing trades at speeds and frequencies beyond human capabilities, with origins in the 1970s and widespread use today through APIs facilitating fast execution and strategy development.

What is Algorithmic Trading and How Do You Get Started? - IG - Algorithmic trading strategies involve pre-set rules such as price action or technical analysis indicators triggering buy or sell orders, often used in high-frequency trading for quick profits, and can be customized based on market conditions, time frames, and risk management parameters.

Algorithmic trading - Algorithmic trading has evolved from fixed pre-programmed rules using technical indicators to incorporating machine learning approaches like deep reinforcement learning (DRL), enabling algorithms to self-adapt dynamically to market conditions, improving performance in volatile markets beyond traditional static models.

dowidth.com

dowidth.com