Gamma squeeze occurs when options market makers hedge their positions by buying the underlying asset in response to rising gamma, causing rapid price increases. Delta squeeze involves traders buying the underlying asset as its delta--sensitivity to price changes--rises, amplifying price movement. Explore the key differences and strategies behind gamma and delta squeezes to enhance your trading knowledge.

Why it is important

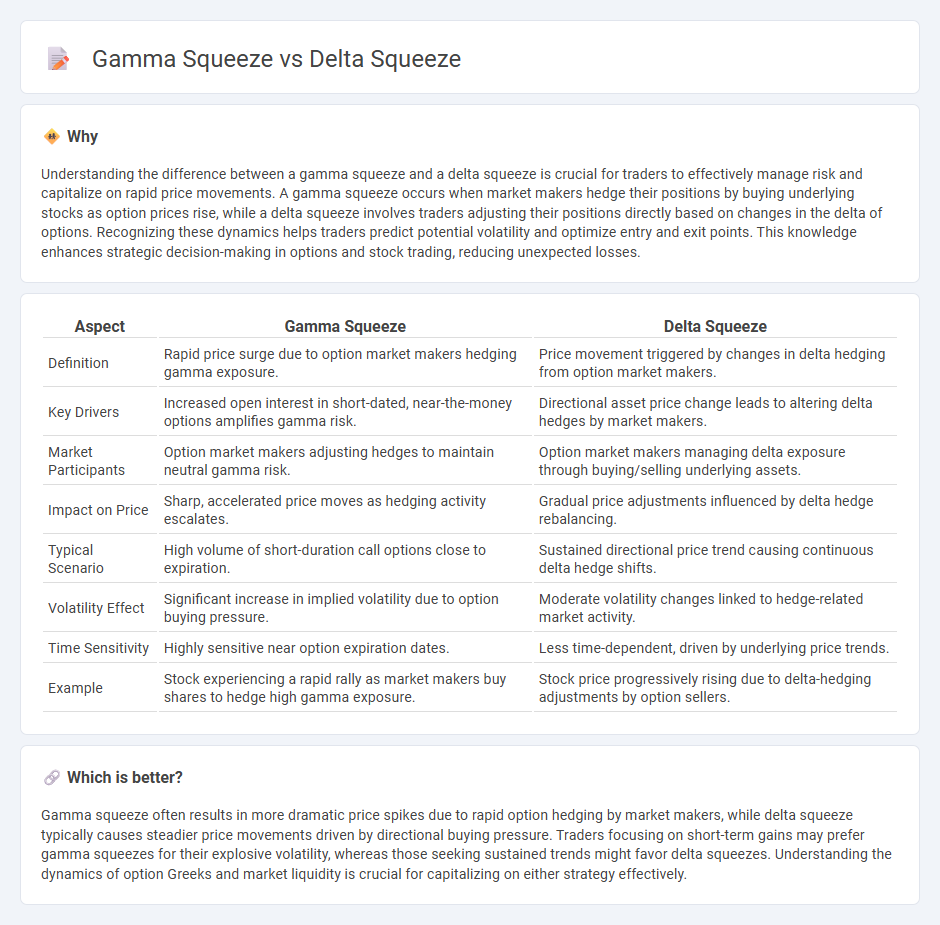

Understanding the difference between a gamma squeeze and a delta squeeze is crucial for traders to effectively manage risk and capitalize on rapid price movements. A gamma squeeze occurs when market makers hedge their positions by buying underlying stocks as option prices rise, while a delta squeeze involves traders adjusting their positions directly based on changes in the delta of options. Recognizing these dynamics helps traders predict potential volatility and optimize entry and exit points. This knowledge enhances strategic decision-making in options and stock trading, reducing unexpected losses.

Comparison Table

| Aspect | Gamma Squeeze | Delta Squeeze |

|---|---|---|

| Definition | Rapid price surge due to option market makers hedging gamma exposure. | Price movement triggered by changes in delta hedging from option market makers. |

| Key Drivers | Increased open interest in short-dated, near-the-money options amplifies gamma risk. | Directional asset price change leads to altering delta hedges by market makers. |

| Market Participants | Option market makers adjusting hedges to maintain neutral gamma risk. | Option market makers managing delta exposure through buying/selling underlying assets. |

| Impact on Price | Sharp, accelerated price moves as hedging activity escalates. | Gradual price adjustments influenced by delta hedge rebalancing. |

| Typical Scenario | High volume of short-duration call options close to expiration. | Sustained directional price trend causing continuous delta hedge shifts. |

| Volatility Effect | Significant increase in implied volatility due to option buying pressure. | Moderate volatility changes linked to hedge-related market activity. |

| Time Sensitivity | Highly sensitive near option expiration dates. | Less time-dependent, driven by underlying price trends. |

| Example | Stock experiencing a rapid rally as market makers buy shares to hedge high gamma exposure. | Stock price progressively rising due to delta-hedging adjustments by option sellers. |

Which is better?

Gamma squeeze often results in more dramatic price spikes due to rapid option hedging by market makers, while delta squeeze typically causes steadier price movements driven by directional buying pressure. Traders focusing on short-term gains may prefer gamma squeezes for their explosive volatility, whereas those seeking sustained trends might favor delta squeezes. Understanding the dynamics of option Greeks and market liquidity is crucial for capitalizing on either strategy effectively.

Connection

Gamma squeeze and delta squeeze are interconnected through options trading dynamics, where delta represents the rate of change of an option's price relative to the underlying asset, and gamma measures the rate of change of delta itself. When significant options activity pushes market makers to hedge their delta exposure, accelerated buying or selling can trigger a gamma squeeze, causing rapid price movements in the underlying stock. This feedback loop between delta hedging and gamma adjustments amplifies volatility and can lead to sharp asset price surges during periods of intense market interest.

Key Terms

**Delta (Δ)**

Delta (D) measures an option's sensitivity to changes in the underlying asset's price, crucial in understanding both delta squeezes and gamma squeezes. A delta squeeze occurs when sudden buying pressure rapidly shifts the delta of options, forcing market makers to adjust their hedges aggressively, impacting the stock price. Explore further to grasp how delta dynamics drive these market phenomena.

**Gamma (Γ)**

Gamma (G) measures the rate of change of an option's delta relative to the underlying asset's price, playing a critical role in gamma squeeze scenarios by accelerating price movements as traders adjust hedges. In a gamma squeeze, rising option buying forces market makers to buy underlying shares aggressively, amplifying price spikes due to gamma's convexity effect. Discover how gamma dynamics differentiate gamma squeezes from delta squeezes and impact trading strategies.

**Hedging**

Delta squeeze occurs when market makers hedge their delta exposure by buying or selling the underlying asset as option prices move, causing increased volatility. Gamma squeeze intensifies this effect as market makers rapidly adjust their hedges due to the gamma rate, accelerating buying or selling pressure in response to sharp price changes. Explore how dynamic hedging strategies amplify market movements in these phenomena.

Source and External Links

What is a Gamma Squeeze And How Does It Work? - A delta squeeze involves the delta of options, which measures how much the option price changes with the underlying stock price, and forces market makers to buy shares to hedge as delta rises, often leading to rapid stock price increases known as gamma squeezes.

Gamma Squeeze Explained | The Role of Delta & Market ... - A delta squeeze occurs when rising stock prices increase the option delta, forcing market makers to buy more shares to maintain their hedge, creating a feedback loop pushing the stock higher, which is a key driver of a gamma squeeze.

How Options Delta & Gamma Squeeze - Delta represents the sensitivity of option price to the underlying stock price, and when market makers hedge delta risk by buying more shares as delta rises, it can trigger a gamma squeeze that drives the stock price upward rapidly.

dowidth.com

dowidth.com