Penny jump refers to the minimum price increment of $0.01 used to price securities, often impacting the bid-ask spreads and market liquidity. Tick size is the smallest allowable price movement set by exchanges, varying by market and asset class, which influences order execution and trading strategies. Discover more about how penny jumps and tick sizes shape trading dynamics and market efficiency.

Why it is important

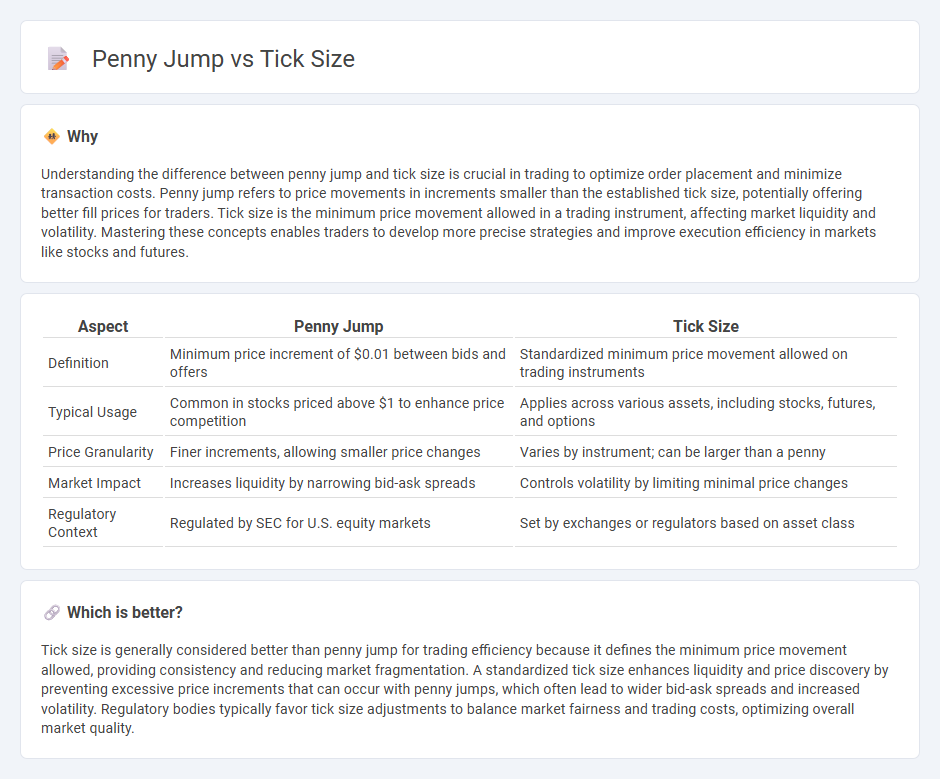

Understanding the difference between penny jump and tick size is crucial in trading to optimize order placement and minimize transaction costs. Penny jump refers to price movements in increments smaller than the established tick size, potentially offering better fill prices for traders. Tick size is the minimum price movement allowed in a trading instrument, affecting market liquidity and volatility. Mastering these concepts enables traders to develop more precise strategies and improve execution efficiency in markets like stocks and futures.

Comparison Table

| Aspect | Penny Jump | Tick Size |

|---|---|---|

| Definition | Minimum price increment of $0.01 between bids and offers | Standardized minimum price movement allowed on trading instruments |

| Typical Usage | Common in stocks priced above $1 to enhance price competition | Applies across various assets, including stocks, futures, and options |

| Price Granularity | Finer increments, allowing smaller price changes | Varies by instrument; can be larger than a penny |

| Market Impact | Increases liquidity by narrowing bid-ask spreads | Controls volatility by limiting minimal price changes |

| Regulatory Context | Regulated by SEC for U.S. equity markets | Set by exchanges or regulators based on asset class |

Which is better?

Tick size is generally considered better than penny jump for trading efficiency because it defines the minimum price movement allowed, providing consistency and reducing market fragmentation. A standardized tick size enhances liquidity and price discovery by preventing excessive price increments that can occur with penny jumps, which often lead to wider bid-ask spreads and increased volatility. Regulatory bodies typically favor tick size adjustments to balance market fairness and trading costs, optimizing overall market quality.

Connection

Penny jump refers to the minimum increment by which a stock's price can move, directly influenced by the tick size set by the exchange. Tick size, often one cent for most stocks, determines the smallest price change allowable, affecting liquidity and trading strategies. Smaller tick sizes enable finer price movements, impacting bid-ask spreads and order book dynamics in trading.

Key Terms

Minimum Price Movement

The tick size represents the minimum price movement allowed for a trading instrument on an exchange, often set by regulatory bodies to standardize price increments. Penny jump, commonly referring to a $0.01 price increment, is a specific form of tick size used in markets where price movements can occur in one-cent intervals. Understanding the differences between tick size and penny jump can enhance trading strategies and accuracy; explore further to grasp their detailed impact on market dynamics.

Liquidity

Tick size and penny jump directly impact market liquidity by defining the minimum price increments at which stocks can trade, influencing bid-ask spreads and order book depth. Larger tick sizes often lead to wider spreads but can enhance liquidity for less active stocks by encouraging market maker participation, while penny jumps offer tighter spreads but may reduce quoting incentives. Explore further to understand how these mechanisms shape trading strategies and market efficiency.

Order Book

Tick size defines the minimum price increment at which securities can be traded, impacting the granularity of price changes in the order book. Penny jumps refer to price improvements by one cent, enabling finer adjustments and potentially tighter bid-ask spreads. Explore how tick size and penny jumps influence liquidity, price discovery, and order book dynamics in modern markets.

Source and External Links

Tick Size in Trading: Definition, How it Works & Why it Matters - Tick size is the smallest price increment a security's price can move, affecting market liquidity, trading costs, and traders' psychology by influencing decision-making, risk perception, and market stability.

Tick size - In financial markets, tick size is the minimum price increment for quoting securities, varying by asset type and affecting how prices such as bonds and futures are quoted, e.g., U.S. bonds use one thirty-second increments.

Tick Size - Tick size represents the smallest price fluctuation of an asset, important for placing consistent bids and offers in trading, demonstrated by an example where a stock with Rs. 0.10 tick size trades in increments of Rs. 0.10 only.

dowidth.com

dowidth.com