Execution algorithms leverage advanced quantitative models and real-time market data to optimize trade timing and minimize market impact, outperforming traditional manual trading methods reliant on human judgment. These algorithms execute large orders by breaking them into smaller, strategically timed trades, enhancing efficiency and reducing transaction costs. Explore the benefits and applications of execution algorithms to revolutionize your trading strategy.

Why it is important

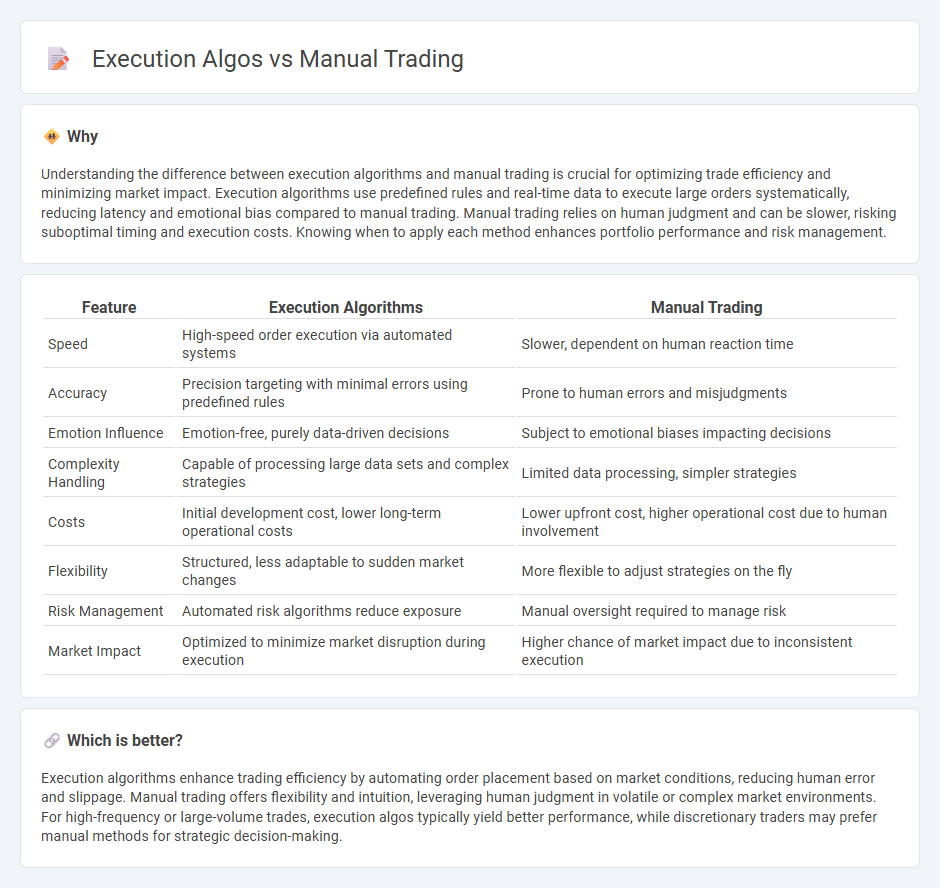

Understanding the difference between execution algorithms and manual trading is crucial for optimizing trade efficiency and minimizing market impact. Execution algorithms use predefined rules and real-time data to execute large orders systematically, reducing latency and emotional bias compared to manual trading. Manual trading relies on human judgment and can be slower, risking suboptimal timing and execution costs. Knowing when to apply each method enhances portfolio performance and risk management.

Comparison Table

| Feature | Execution Algorithms | Manual Trading |

|---|---|---|

| Speed | High-speed order execution via automated systems | Slower, dependent on human reaction time |

| Accuracy | Precision targeting with minimal errors using predefined rules | Prone to human errors and misjudgments |

| Emotion Influence | Emotion-free, purely data-driven decisions | Subject to emotional biases impacting decisions |

| Complexity Handling | Capable of processing large data sets and complex strategies | Limited data processing, simpler strategies |

| Costs | Initial development cost, lower long-term operational costs | Lower upfront cost, higher operational cost due to human involvement |

| Flexibility | Structured, less adaptable to sudden market changes | More flexible to adjust strategies on the fly |

| Risk Management | Automated risk algorithms reduce exposure | Manual oversight required to manage risk |

| Market Impact | Optimized to minimize market disruption during execution | Higher chance of market impact due to inconsistent execution |

Which is better?

Execution algorithms enhance trading efficiency by automating order placement based on market conditions, reducing human error and slippage. Manual trading offers flexibility and intuition, leveraging human judgment in volatile or complex market environments. For high-frequency or large-volume trades, execution algos typically yield better performance, while discretionary traders may prefer manual methods for strategic decision-making.

Connection

Execution algorithms enhance manual trading by automating the order placement process, reducing latency and minimizing market impact. Traders use these algorithms to execute large orders efficiently while maintaining control over strategy and timing. This synergy allows for optimized trade execution, blending human judgment with algorithmic precision.

Key Terms

Discretion

Manual trading relies heavily on trader discretion, allowing for flexible decision-making based on real-time market conditions and nuanced judgment. Execution algorithms minimize human bias by automating order placement, utilizing pre-set parameters to optimize trade efficiency and reduce market impact. Explore the strengths and limitations of discretionary trading versus execution algorithms to enhance your trading strategy.

Automation

Execution algorithms enhance trade efficiency through automation, reducing human error and latency inherent in manual trading processes. These algorithms leverage real-time data and preset parameters to execute orders at optimal prices, optimizing market impact and minimizing slippage. Explore advanced automation strategies to elevate trading precision and outcomes.

Latency

Manual trading often experiences higher latency due to human decision-making and input delays, resulting in slower order execution times. Execution algorithms leverage advanced technology and low-latency networks to optimize order routing and execution speed, significantly reducing market impact and slippage. Discover how latency differences impact trading performance and inform strategy choices in our detailed analysis.

Source and External Links

What is Manual Trading? Characteristics of Manual Traders - Manual trading is the process of buying and selling financial assets based on a trader's own analysis and judgment, requiring emotional control, market experience, and real-time decision-making using strategies like day trading and swing trading.

Auto-Trading vs. Manual Trading: Which Is Best? - AvaTrade - Manual trading involves active, real-time involvement by the trader who makes every buy, adjust, and exit decision themselves, offering greater control but demanding more time and emotional resilience compared to automated trading.

Manual vs. Automated Trading in Forex: Which Strategy Suits You Best? - Manual trading is a hands-on approach allowing for flexibility, adaptability to market news, and deeper learning but is time-intensive, vulnerable to emotional bias, and inconsistent compared to automated systems.

dowidth.com

dowidth.com