Liquidity sweeps involve large market orders that quickly consume available liquidity at multiple price levels, often signaling aggressive trading strategies. Flash crashes occur when rapid, deep price declines are triggered by sudden liquidity withdrawals or algorithmic trading errors, causing extreme market volatility. Explore the intricacies of liquidity sweeps versus flash crashes to better navigate volatile trading environments.

Why it is important

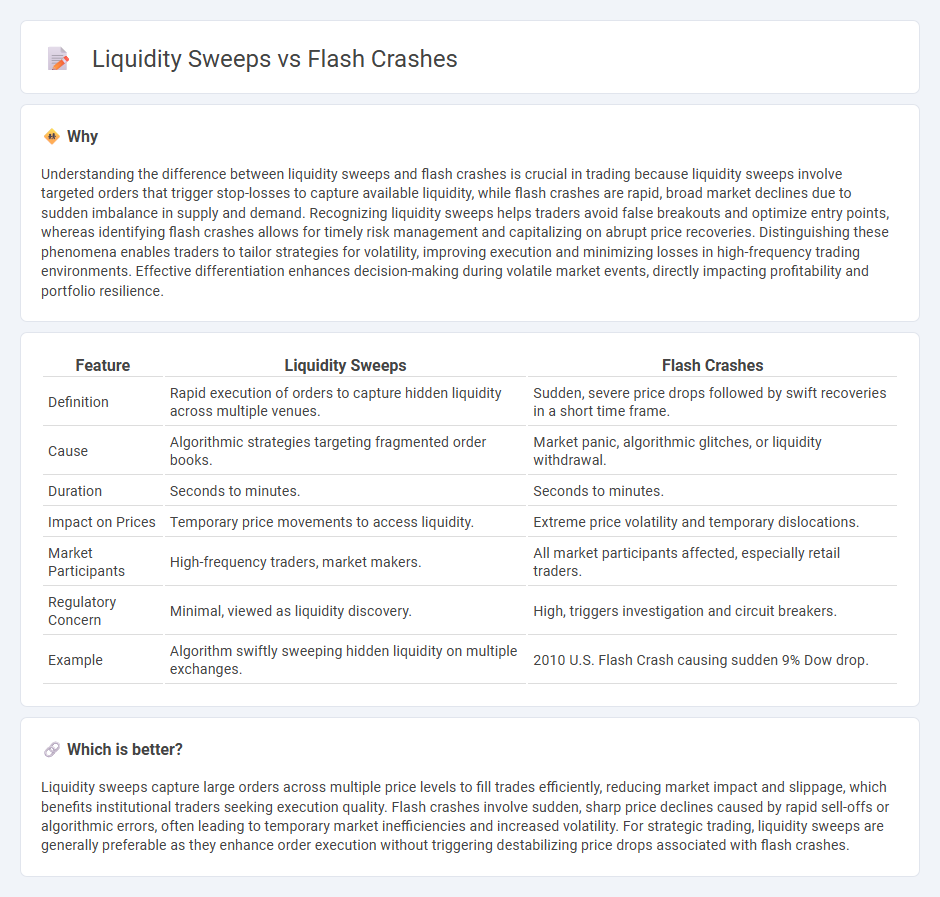

Understanding the difference between liquidity sweeps and flash crashes is crucial in trading because liquidity sweeps involve targeted orders that trigger stop-losses to capture available liquidity, while flash crashes are rapid, broad market declines due to sudden imbalance in supply and demand. Recognizing liquidity sweeps helps traders avoid false breakouts and optimize entry points, whereas identifying flash crashes allows for timely risk management and capitalizing on abrupt price recoveries. Distinguishing these phenomena enables traders to tailor strategies for volatility, improving execution and minimizing losses in high-frequency trading environments. Effective differentiation enhances decision-making during volatile market events, directly impacting profitability and portfolio resilience.

Comparison Table

| Feature | Liquidity Sweeps | Flash Crashes |

|---|---|---|

| Definition | Rapid execution of orders to capture hidden liquidity across multiple venues. | Sudden, severe price drops followed by swift recoveries in a short time frame. |

| Cause | Algorithmic strategies targeting fragmented order books. | Market panic, algorithmic glitches, or liquidity withdrawal. |

| Duration | Seconds to minutes. | Seconds to minutes. |

| Impact on Prices | Temporary price movements to access liquidity. | Extreme price volatility and temporary dislocations. |

| Market Participants | High-frequency traders, market makers. | All market participants affected, especially retail traders. |

| Regulatory Concern | Minimal, viewed as liquidity discovery. | High, triggers investigation and circuit breakers. |

| Example | Algorithm swiftly sweeping hidden liquidity on multiple exchanges. | 2010 U.S. Flash Crash causing sudden 9% Dow drop. |

Which is better?

Liquidity sweeps capture large orders across multiple price levels to fill trades efficiently, reducing market impact and slippage, which benefits institutional traders seeking execution quality. Flash crashes involve sudden, sharp price declines caused by rapid sell-offs or algorithmic errors, often leading to temporary market inefficiencies and increased volatility. For strategic trading, liquidity sweeps are generally preferable as they enhance order execution without triggering destabilizing price drops associated with flash crashes.

Connection

Liquidity sweeps occur when large market orders rapidly consume available liquidity across multiple price levels, often triggering significant price movements. Flash crashes happen when these swift depletions of liquidity cause extreme, short-lived price declines followed by quick recoveries. The interaction between liquidity sweeps and flash crashes highlights vulnerabilities in market structure, where sudden liquidity vacuums lead to instability in asset prices.

Key Terms

Liquidity

Flash crashes are abrupt, severe price drops caused by rapid order imbalances in low-liquidity markets, often triggering stop-losses and algorithmic trading responses that exacerbate volatility. Liquidity sweeps involve the rapid consumption of available buy or sell orders across multiple price levels, draining market depth and leading to swift price movements without sufficient counter orders to stabilize the market. Explore detailed market dynamics and risk management strategies by diving deeper into liquidity events and their impact on trading.

Order Book

Flash crashes occur when sudden, severe price drops disrupt the order book, causing a rapid depletion of liquidity and triggering automated sell-offs. Liquidity sweeps involve aggressive order placements that consume available liquidity across multiple price levels, effectively resetting the order book depth and influencing short-term price dynamics. Explore the mechanisms behind order book imbalances and their impact on market stability to understand these phenomena in greater detail.

Market Impact

Flash crashes cause sudden, sharp price declines triggered by rapid sell orders and automated trading systems, leading to severe but typically brief market disruptions. Liquidity sweeps involve large orders aggressively hitting various price levels, depleting available liquidity and causing gradual price erosion with sustained market impact. Explore further to understand how these events shape market dynamics and trading strategies.

Source and External Links

Flash Crashes Explained - IG - A flash crash is a rapid, deep decline in a security's price caused largely by algorithmic and high-frequency trading triggering automated sell orders, often in low liquidity situations, followed by an equally rapid recovery due to buying algorithms balancing the market.

Flash Crashes - Overview, Causes, and Past examples - Flash crashes are sudden, brief plunges in asset prices caused by computer algorithms that react to selling pressure by rapidly increasing sell orders, creating a snowball effect followed by quick price rebounds without any fundamental news driving the moves.

Flash crash - Wikipedia - Defined as a very rapid and volatile fall in security prices followed by a quick recovery, flash crashes are often linked to high-frequency and black-box trading, where liquidity withdrawal and market participant pause can cause and then reverse large market swings within minutes.

dowidth.com

dowidth.com