High-frequency scalp bots execute rapid trades using algorithmic strategies to capitalize on small price movements within milliseconds. Sentiment analysis trading bots analyze social media, news, and market sentiment data to predict market trends and make informed decisions over longer intervals. Explore the advantages and limitations of both trading bots to enhance your trading strategy.

Why it is important

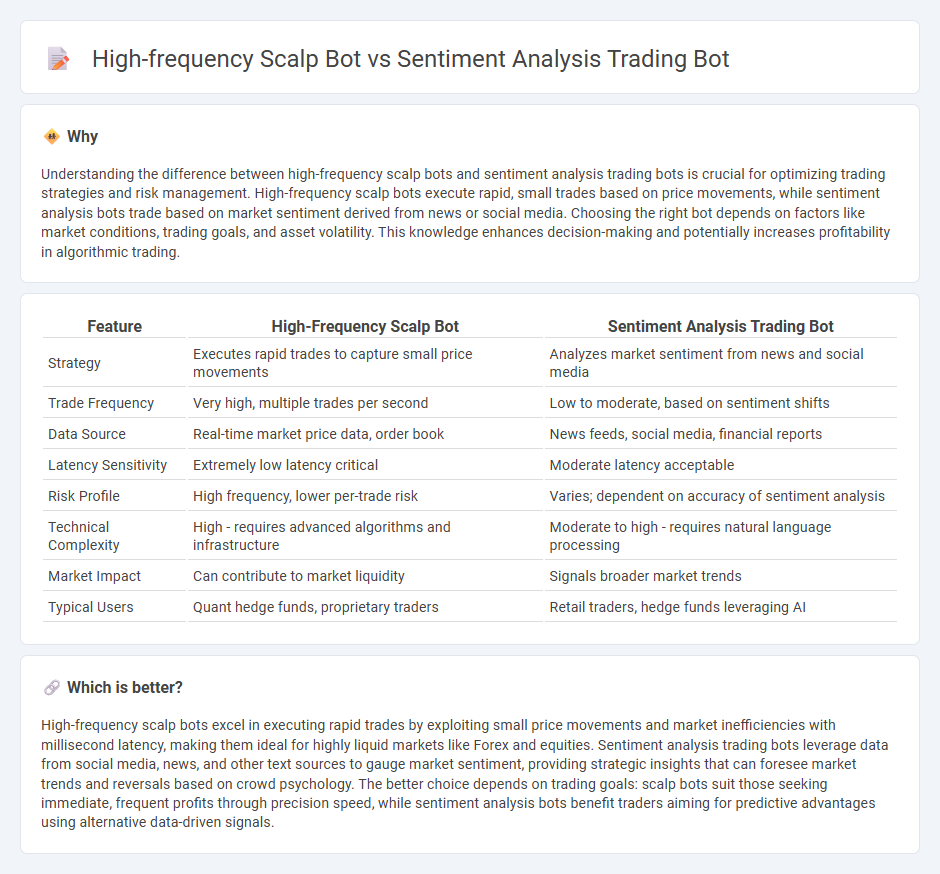

Understanding the difference between high-frequency scalp bots and sentiment analysis trading bots is crucial for optimizing trading strategies and risk management. High-frequency scalp bots execute rapid, small trades based on price movements, while sentiment analysis bots trade based on market sentiment derived from news or social media. Choosing the right bot depends on factors like market conditions, trading goals, and asset volatility. This knowledge enhances decision-making and potentially increases profitability in algorithmic trading.

Comparison Table

| Feature | High-Frequency Scalp Bot | Sentiment Analysis Trading Bot |

|---|---|---|

| Strategy | Executes rapid trades to capture small price movements | Analyzes market sentiment from news and social media |

| Trade Frequency | Very high, multiple trades per second | Low to moderate, based on sentiment shifts |

| Data Source | Real-time market price data, order book | News feeds, social media, financial reports |

| Latency Sensitivity | Extremely low latency critical | Moderate latency acceptable |

| Risk Profile | High frequency, lower per-trade risk | Varies; dependent on accuracy of sentiment analysis |

| Technical Complexity | High - requires advanced algorithms and infrastructure | Moderate to high - requires natural language processing |

| Market Impact | Can contribute to market liquidity | Signals broader market trends |

| Typical Users | Quant hedge funds, proprietary traders | Retail traders, hedge funds leveraging AI |

Which is better?

High-frequency scalp bots excel in executing rapid trades by exploiting small price movements and market inefficiencies with millisecond latency, making them ideal for highly liquid markets like Forex and equities. Sentiment analysis trading bots leverage data from social media, news, and other text sources to gauge market sentiment, providing strategic insights that can foresee market trends and reversals based on crowd psychology. The better choice depends on trading goals: scalp bots suit those seeking immediate, frequent profits through precision speed, while sentiment analysis bots benefit traders aiming for predictive advantages using alternative data-driven signals.

Connection

High-frequency scalp bots execute rapid trades capitalizing on small price fluctuations, while sentiment analysis trading bots interpret market emotions from news and social media to predict price trends. Integrating sentiment analysis enhances scalp bots by providing real-time emotional context, enabling more informed and precise entry and exit points. This synergy improves algorithmic trading performance by combining quantitative speed with qualitative market insights.

Key Terms

Natural Language Processing (NLP)

Sentiment analysis trading bots leverage Natural Language Processing (NLP) to interpret market sentiment from news, social media, and financial reports, enabling informed trading decisions based on public opinion trends. High-frequency scalp bots execute rapid trades using algorithms focused on price movements and order book dynamics, prioritizing speed and execution over sentiment data. Discover how integrating advanced NLP techniques can transform trading strategies by exploring the balance between sentiment analysis and high-frequency scalping.

Order Execution Speed

Sentiment analysis trading bots leverage real-time social media and news sentiment data to inform trade decisions, prioritizing accuracy in interpreting market mood rather than raw execution speed. High-frequency scalp bots excel in order execution speed, handling thousands of trades per second by exploiting minor price discrepancies, essential for scalping strategies. Explore the trade-offs between precision and speed to optimize your trading bot strategy.

Market Microstructure

Sentiment analysis trading bots leverage natural language processing to gauge market mood from news and social media, informing strategic trades based on collective investor sentiment. High-frequency scalp bots capitalize on market microstructure by executing rapid, small-profit trades exploiting bid-ask spreads and order book dynamics, often within milliseconds. Explore further to understand how these distinct approaches influence trading performance in ultra-fast market environments.

Source and External Links

Trading 101: Sentiment Analysis Explained - Explains how sentiment analysis is used in trading via copy bots, sentiment indicators, or building your own bot using Python to analyze social media data for generating trade signals.

How AI Bots Combine Fundamental and Sentiment Analysis for Trading - Describes how AI-powered trading bots integrate fundamental and sentiment analysis by examining financial data and market sentiment from social media and news to make trading decisions.

cryptocontrol/sentiment-trading-bot: A bot that trades crypto based on public sentiment - A Java-based crypto trading bot called Whitebird that uses sentiment data from sources like Twitter and Reddit via the CryptoControl Sentiment API to take long or short positions depending on positive or negative sentiment.

dowidth.com

dowidth.com