Trading with proprietary firms demands real capital and emotional resilience, exposing traders to true market risks absent in demo trading environments. Demo accounts use simulated funds and conditions, which can mask psychological pressures such as risk management and decision-making under stress. Explore how understanding these challenges can enhance your transition to live trading with prop firms.

Why it is important

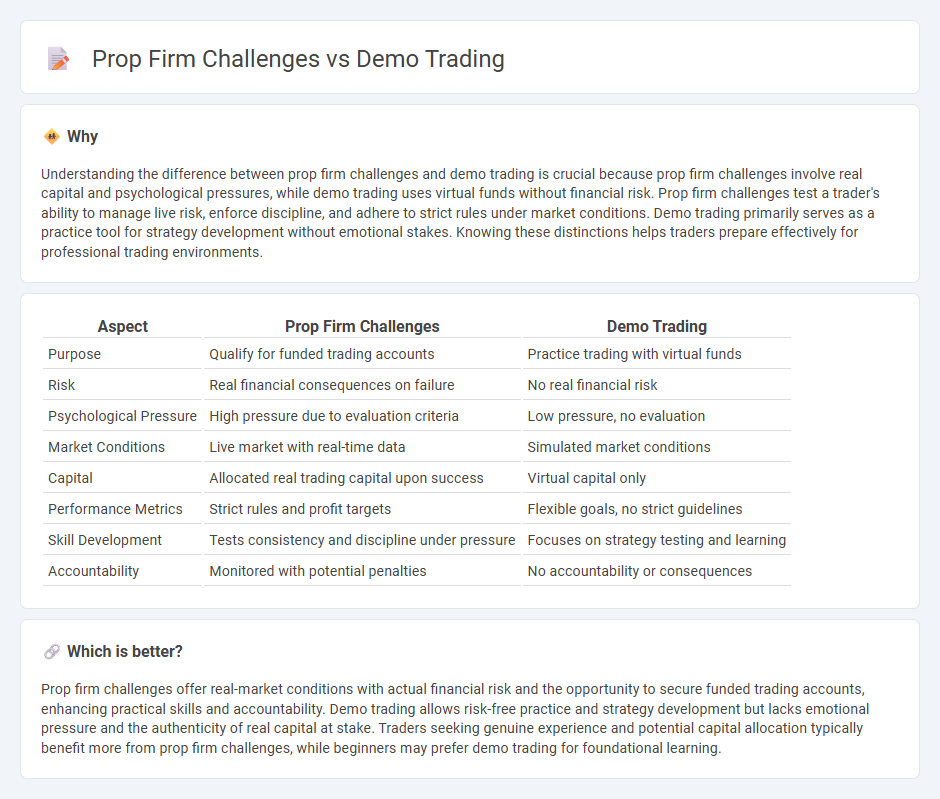

Understanding the difference between prop firm challenges and demo trading is crucial because prop firm challenges involve real capital and psychological pressures, while demo trading uses virtual funds without financial risk. Prop firm challenges test a trader's ability to manage live risk, enforce discipline, and adhere to strict rules under market conditions. Demo trading primarily serves as a practice tool for strategy development without emotional stakes. Knowing these distinctions helps traders prepare effectively for professional trading environments.

Comparison Table

| Aspect | Prop Firm Challenges | Demo Trading |

|---|---|---|

| Purpose | Qualify for funded trading accounts | Practice trading with virtual funds |

| Risk | Real financial consequences on failure | No real financial risk |

| Psychological Pressure | High pressure due to evaluation criteria | Low pressure, no evaluation |

| Market Conditions | Live market with real-time data | Simulated market conditions |

| Capital | Allocated real trading capital upon success | Virtual capital only |

| Performance Metrics | Strict rules and profit targets | Flexible goals, no strict guidelines |

| Skill Development | Tests consistency and discipline under pressure | Focuses on strategy testing and learning |

| Accountability | Monitored with potential penalties | No accountability or consequences |

Which is better?

Prop firm challenges offer real-market conditions with actual financial risk and the opportunity to secure funded trading accounts, enhancing practical skills and accountability. Demo trading allows risk-free practice and strategy development but lacks emotional pressure and the authenticity of real capital at stake. Traders seeking genuine experience and potential capital allocation typically benefit more from prop firm challenges, while beginners may prefer demo trading for foundational learning.

Connection

Prop firm challenges simulate real market conditions to assess a trader's skills under pressure, providing an essential bridge between demo trading and live trading. Demo trading allows traders to practice strategies and understand platform mechanics without financial risk, but it often lacks the psychological intensity present in prop firm challenges. Success in prop firm challenges indicates a trader's readiness to manage real capital, bridging the gap between risk-free demo accounts and live account trading with genuine market stakes.

Key Terms

Virtual Funds

Demo trading platforms utilize virtual funds to simulate real-market conditions, allowing traders to practice without financial risk but often lack the emotional pressure experienced in live trading. Prop firms allocate virtual funds during evaluation phases to assess trader performance, yet challenges include discrepancies between demo results and actual trading due to slippage and order execution variances. Explore deeper insights into how virtual funds impact the transition from demo trading to prop firm success.

Drawdown Limits

Drawdown limits in demo trading often lack the real financial pressure seen in proprietary firm accounts, which enforce strict risk management to protect capital. Prop firms typically impose tight drawdown caps, requiring traders to maintain discipline under actual monetary constraints, unlike demo environments where losses do not impact real funds. Explore how navigating these drawdown boundaries shapes trading strategies and risk management techniques in professional trading settings.

Evaluation Phase

The Evaluation Phase in prop firm trading requires traders to demonstrate consistent profitability and risk management skills under strict guidelines, contrasting with demo trading's risk-free environment and less stringent rules. Many traders face significant challenges during this phase, including maintaining steady drawdowns and meeting profit targets within specified timeframes to qualify for funded accounts. Explore effective strategies and insights to successfully navigate the Evaluation Phase and advance your prop trading career.

Source and External Links

Demo Trading Account | Binary Options Demo - Practice trading binary options, knock-outs, and call spreads with $10,000 in virtual funds on a regulated platform, including mobile access and risk management tools.

Practice on a Demo Trading Account - Sharpen your trading skills and test strategies risk-free with Exness by exploring global financial markets using multiple platforms like MetaTrader 4/5 and mobile apps.

Demo Trading Account: Try IG's Paper Trading Simulator - Use IG's demo account to trade stocks, forex, CFDs, and over 17,000 markets with real-time prices and advanced tools like MetaTrader 4 for free practice.

dowidth.com

dowidth.com