Dark pool aggregation consolidates private trading venues to provide institutional investors with improved liquidity and reduced market impact, enhancing large order execution. High-Frequency Trading (HFT) leverages advanced algorithms and ultra-low latency to capitalize on minute price fluctuations across markets within milliseconds. Explore how these trading strategies influence market dynamics and investment outcomes.

Why it is important

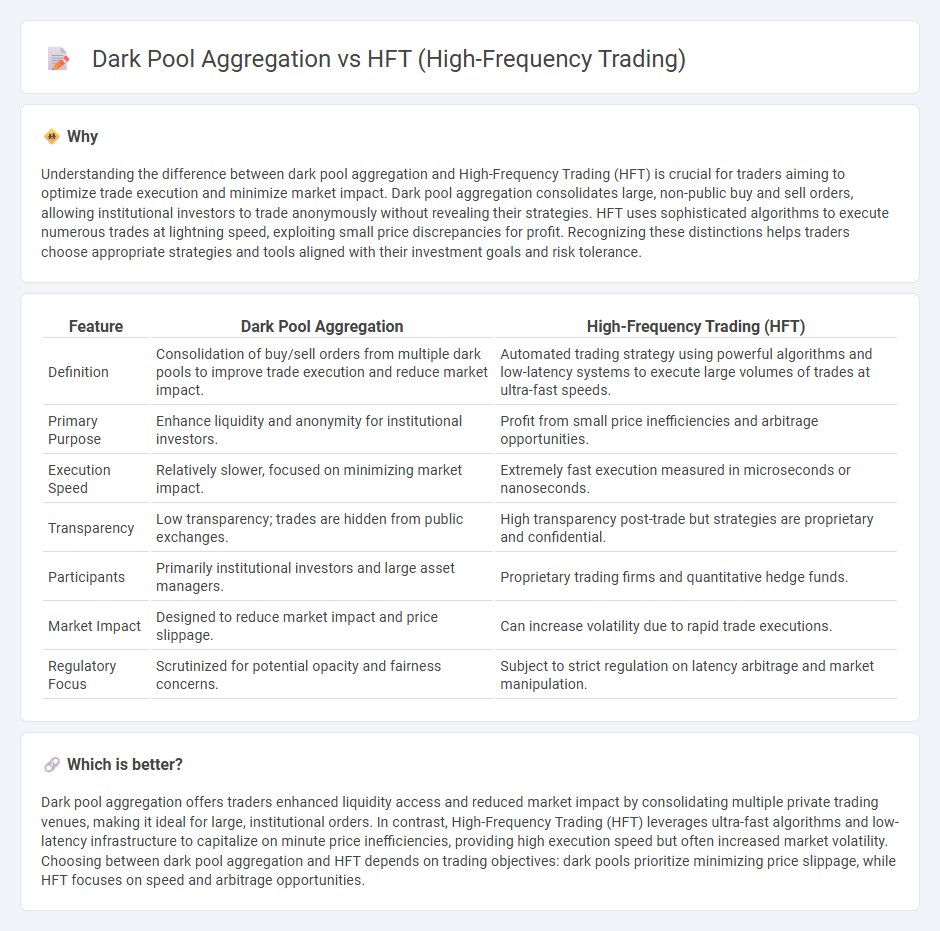

Understanding the difference between dark pool aggregation and High-Frequency Trading (HFT) is crucial for traders aiming to optimize trade execution and minimize market impact. Dark pool aggregation consolidates large, non-public buy and sell orders, allowing institutional investors to trade anonymously without revealing their strategies. HFT uses sophisticated algorithms to execute numerous trades at lightning speed, exploiting small price discrepancies for profit. Recognizing these distinctions helps traders choose appropriate strategies and tools aligned with their investment goals and risk tolerance.

Comparison Table

| Feature | Dark Pool Aggregation | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Consolidation of buy/sell orders from multiple dark pools to improve trade execution and reduce market impact. | Automated trading strategy using powerful algorithms and low-latency systems to execute large volumes of trades at ultra-fast speeds. |

| Primary Purpose | Enhance liquidity and anonymity for institutional investors. | Profit from small price inefficiencies and arbitrage opportunities. |

| Execution Speed | Relatively slower, focused on minimizing market impact. | Extremely fast execution measured in microseconds or nanoseconds. |

| Transparency | Low transparency; trades are hidden from public exchanges. | High transparency post-trade but strategies are proprietary and confidential. |

| Participants | Primarily institutional investors and large asset managers. | Proprietary trading firms and quantitative hedge funds. |

| Market Impact | Designed to reduce market impact and price slippage. | Can increase volatility due to rapid trade executions. |

| Regulatory Focus | Scrutinized for potential opacity and fairness concerns. | Subject to strict regulation on latency arbitrage and market manipulation. |

Which is better?

Dark pool aggregation offers traders enhanced liquidity access and reduced market impact by consolidating multiple private trading venues, making it ideal for large, institutional orders. In contrast, High-Frequency Trading (HFT) leverages ultra-fast algorithms and low-latency infrastructure to capitalize on minute price inefficiencies, providing high execution speed but often increased market volatility. Choosing between dark pool aggregation and HFT depends on trading objectives: dark pools prioritize minimizing price slippage, while HFT focuses on speed and arbitrage opportunities.

Connection

Dark pool aggregation consolidates liquidity from multiple private trading venues, enabling high-frequency trading (HFT) algorithms to access fragmented markets more efficiently. HFT leverages the aggregated dark pool data to execute rapid trades with minimal market impact, exploiting price discrepancies across venues. This symbiotic relationship enhances market liquidity and price discovery while maintaining trade anonymity.

Key Terms

Latency

High-frequency trading (HFT) relies on ultra-low latency to execute large volumes of trades within microseconds, leveraging speed advantages to capitalize on market inefficiencies. Dark pool aggregation consolidates liquidity from multiple private exchanges, with latency playing a critical role in ensuring timely access to hidden orders and price discovery. Explore the technical strategies behind latency optimization in HFT and dark pool systems to gain deeper insights.

Order Matching

High-frequency trading (HFT) leverages ultra-low latency algorithms to execute large volumes of orders at lightning speed, optimizing order matching through rapid market data analysis. Dark pool aggregation consolidates liquidity from multiple non-transparent venues, enhancing order matching by minimizing market impact and reducing information leakage. Explore how combining HFT and dark pool strategies can optimize order matching efficiency for institutional traders.

Market Transparency

High-frequency trading (HFT) leverages advanced algorithms and ultra-low latency systems to execute thousands of trades per second, contributing to increased market liquidity but sometimes raising concerns about market fairness. Dark pool aggregation consolidates trading volumes from multiple private exchanges, enabling large orders to be executed discreetly and reducing market impact but potentially decreasing overall market transparency. Explore how these trading mechanisms affect market efficiency and investor protection for deeper insights.

Source and External Links

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT is algorithmic trading characterized by extremely high-speed trade execution, a very large number of transactions, and very short-term investment horizons, allowing institutions to profit from tiny price fluctuations and increasing market liquidity by narrowing bid-ask spreads.

What is high-frequency trading (HFT)? - HFT uses sophisticated algorithms to rapidly buy and sell securities in milliseconds, aiming to profit from small market changes using strategies like statistical arbitrage, and typically accounts for over half of US stock trades, benefiting both institutions and retail investors.

High-Frequency Trading Explained: What Is It and How Do ... - HFT employs powerful computers and ultra-low-latency systems to monitor multiple markets and execute vast numbers of trades at microsecond speeds, capturing tiny price differences across exchanges for substantial aggregated profits.

dowidth.com

dowidth.com