Options flow provides real-time insights into market sentiment by tracking large trades and unusual activity, revealing where institutional investors are positioning themselves. Quantitative analysis uses mathematical models and historical data to identify trading patterns and optimize strategies based on statistical probabilities. Explore deeper into how combining options flow with quantitative analysis can enhance your trading decisions.

Why it is important

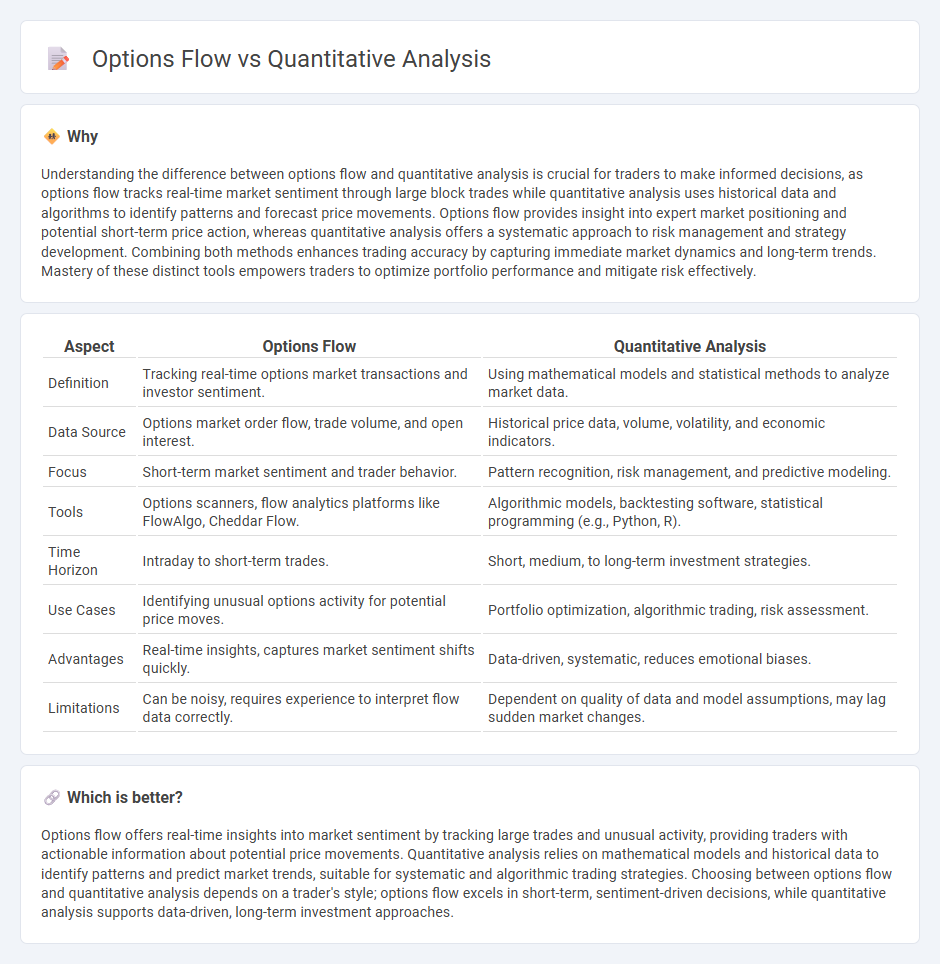

Understanding the difference between options flow and quantitative analysis is crucial for traders to make informed decisions, as options flow tracks real-time market sentiment through large block trades while quantitative analysis uses historical data and algorithms to identify patterns and forecast price movements. Options flow provides insight into expert market positioning and potential short-term price action, whereas quantitative analysis offers a systematic approach to risk management and strategy development. Combining both methods enhances trading accuracy by capturing immediate market dynamics and long-term trends. Mastery of these distinct tools empowers traders to optimize portfolio performance and mitigate risk effectively.

Comparison Table

| Aspect | Options Flow | Quantitative Analysis |

|---|---|---|

| Definition | Tracking real-time options market transactions and investor sentiment. | Using mathematical models and statistical methods to analyze market data. |

| Data Source | Options market order flow, trade volume, and open interest. | Historical price data, volume, volatility, and economic indicators. |

| Focus | Short-term market sentiment and trader behavior. | Pattern recognition, risk management, and predictive modeling. |

| Tools | Options scanners, flow analytics platforms like FlowAlgo, Cheddar Flow. | Algorithmic models, backtesting software, statistical programming (e.g., Python, R). |

| Time Horizon | Intraday to short-term trades. | Short, medium, to long-term investment strategies. |

| Use Cases | Identifying unusual options activity for potential price moves. | Portfolio optimization, algorithmic trading, risk assessment. |

| Advantages | Real-time insights, captures market sentiment shifts quickly. | Data-driven, systematic, reduces emotional biases. |

| Limitations | Can be noisy, requires experience to interpret flow data correctly. | Dependent on quality of data and model assumptions, may lag sudden market changes. |

Which is better?

Options flow offers real-time insights into market sentiment by tracking large trades and unusual activity, providing traders with actionable information about potential price movements. Quantitative analysis relies on mathematical models and historical data to identify patterns and predict market trends, suitable for systematic and algorithmic trading strategies. Choosing between options flow and quantitative analysis depends on a trader's style; options flow excels in short-term, sentiment-driven decisions, while quantitative analysis supports data-driven, long-term investment approaches.

Connection

Options flow provides real-time data on large trades and market sentiment, which quantitative analysis uses to develop predictive models and trading algorithms. By integrating options flow information, quantitative strategies can identify unusual trading activity and enhance risk management. This connection improves decision-making accuracy in options trading and market forecasting.

Key Terms

Quantitative Analysis:

Quantitative analysis leverages statistical models and mathematical computations to evaluate financial data, identify trends, and forecast market behavior with precision. It relies on algorithmic trading strategies and large datasets to optimize portfolio management and risk assessment. Explore deeper insights into quantitative analysis for enhanced investment decision-making.

Algorithmic Trading

Quantitative analysis leverages mathematical models and statistical techniques to identify trading patterns and predict market movements, forming the backbone of algorithmic trading strategies. Options flow analysis examines real-time options market activity, offering insights into market sentiment and potential price shifts, which can be integrated into algorithms for enhanced decision-making. Explore how combining these approaches can optimize algorithmic trading performance and risk management.

Statistical Arbitrage

Quantitative analysis in Statistical Arbitrage leverages mathematical models and historical data to identify price inefficiencies across securities, optimizing buy and sell signals within algorithmic trading frameworks. Options flow analysis provides real-time insights into market sentiment by examining options order activities, reflecting institutional players' expectations that can validate or challenge quantitative signals. Explore in-depth methodologies combining statistical models with options flow to enhance arbitrage strategies and improve predictive accuracy.

Source and External Links

What Is Quantitative Analysis? Definition and Methods | Indeed.com - Quantitative analysis is the collection and evaluation of numerical data to identify trends, predict outcomes, and support decision-making across fields such as finance, business, and research.

Quantitative Analysis - Definition, Techniques and Applications - It involves techniques like regression analysis, linear programming, and data mining to measure and model business performance and economic relationships through statistical methods.

Quantitative Data Analysis. A Complete Guide [2025] - SixSigma.us - Quantitative data analysis uses statistical and computational tools such as descriptive statistics, predictive modeling, and machine learning to extract insights, forecast trends, and enable data-driven decisions.

dowidth.com

dowidth.com