Dark pool aggregation consolidates multiple private trading venues to improve liquidity and reduce market impact for institutional investors. Systematic internalizers execute client orders directly within a firm's own books, offering price transparency and immediate execution outside public exchanges. Explore the unique mechanisms and advantages of these trading alternatives to optimize your market strategy.

Why it is important

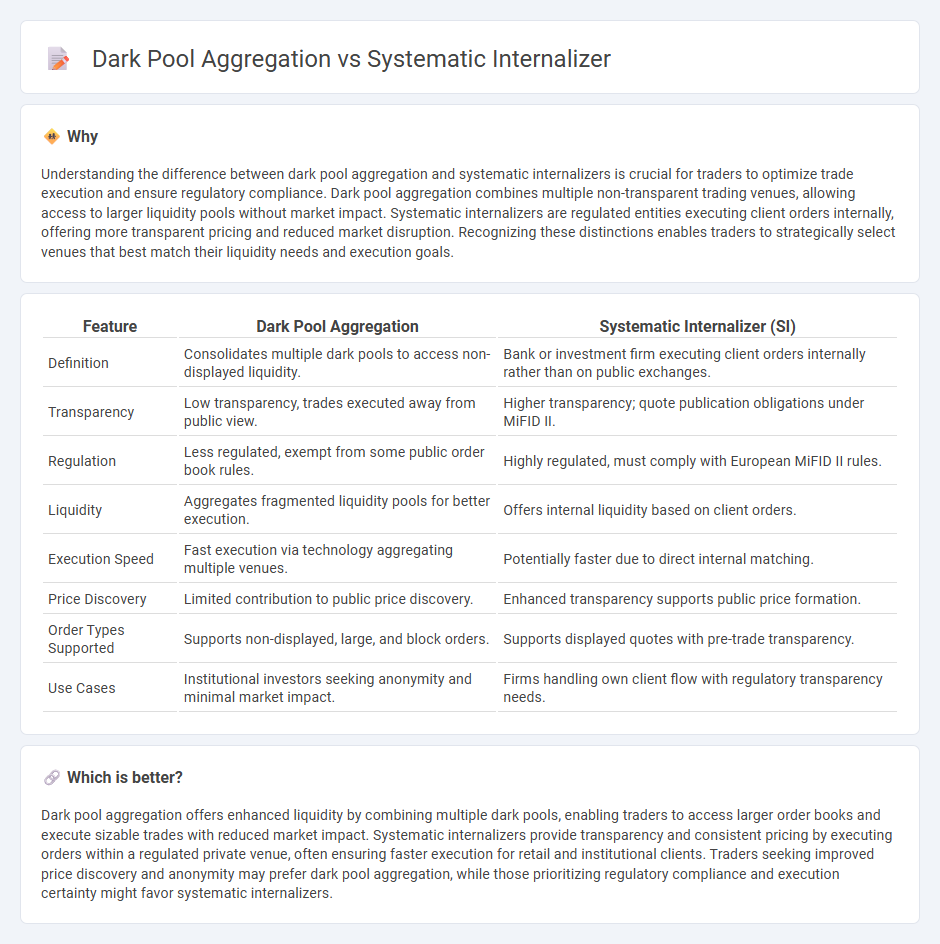

Understanding the difference between dark pool aggregation and systematic internalizers is crucial for traders to optimize trade execution and ensure regulatory compliance. Dark pool aggregation combines multiple non-transparent trading venues, allowing access to larger liquidity pools without market impact. Systematic internalizers are regulated entities executing client orders internally, offering more transparent pricing and reduced market disruption. Recognizing these distinctions enables traders to strategically select venues that best match their liquidity needs and execution goals.

Comparison Table

| Feature | Dark Pool Aggregation | Systematic Internalizer (SI) |

|---|---|---|

| Definition | Consolidates multiple dark pools to access non-displayed liquidity. | Bank or investment firm executing client orders internally rather than on public exchanges. |

| Transparency | Low transparency, trades executed away from public view. | Higher transparency; quote publication obligations under MiFID II. |

| Regulation | Less regulated, exempt from some public order book rules. | Highly regulated, must comply with European MiFID II rules. |

| Liquidity | Aggregates fragmented liquidity pools for better execution. | Offers internal liquidity based on client orders. |

| Execution Speed | Fast execution via technology aggregating multiple venues. | Potentially faster due to direct internal matching. |

| Price Discovery | Limited contribution to public price discovery. | Enhanced transparency supports public price formation. |

| Order Types Supported | Supports non-displayed, large, and block orders. | Supports displayed quotes with pre-trade transparency. |

| Use Cases | Institutional investors seeking anonymity and minimal market impact. | Firms handling own client flow with regulatory transparency needs. |

Which is better?

Dark pool aggregation offers enhanced liquidity by combining multiple dark pools, enabling traders to access larger order books and execute sizable trades with reduced market impact. Systematic internalizers provide transparency and consistent pricing by executing orders within a regulated private venue, often ensuring faster execution for retail and institutional clients. Traders seeking improved price discovery and anonymity may prefer dark pool aggregation, while those prioritizing regulatory compliance and execution certainty might favor systematic internalizers.

Connection

Dark pool aggregation and systematic internalizers are connected through their shared role in enhancing liquidity and minimizing market impact for large institutional trades. Dark pool aggregation consolidates orders from multiple private venues, allowing systematic internalizers--regulated firms executing proprietary trades--to internalize client orders efficiently outside public exchanges. This relationship supports improved price discovery and reduced transaction costs in fragmented markets.

Key Terms

Transparency

Systematic internalizers (SIs) operate as regulated entities executing client orders against their own inventory, enhancing market transparency by providing pre-trade price quotes under MiFID II regulations. Dark pool aggregators consolidate liquidity from multiple non-displayed venues, offering improved execution but often at the expense of transparency due to minimal pre-trade information disclosure. Explore the dynamics of market transparency in relation to SIs and dark pool aggregators to optimize trading strategies.

Order Execution

Systematic internalizers execute client orders within their own liquidity pool, often resulting in faster trade settlements and price improvements compared to public exchanges. Dark pool aggregation combines multiple private trading venues to increase liquidity and minimize market impact, offering anonymity and enhanced order execution strategies. Explore the differences and benefits of these approaches to optimize your trading outcomes.

Counterparty Identification

Systematic internalizers execute client orders against their own inventory, providing transparent counterparty identification by directly matching buy and sell interests within regulated frameworks. Dark pool aggregations consolidate orders from various venues, often masking counterparty identities to preserve anonymity and minimize market impact. Explore deeper insights into how each trading mechanism affects counterparty transparency and market dynamics.

Source and External Links

MiFID II: Are you a systematic internaliser? - A systematic internaliser (SI) is an investment firm that deals on its own account on an organised, frequent, systematic, and substantial basis when executing client orders outside regulated markets, obligated to assess SI status quarterly and comply with transparency rules.

What's a Systematic Internaliser? - Defined in MiFID II, a SI executes client orders over-the-counter (OTC) on its own account frequently and systematically; firms must re-assess quarterly based on six-month trading data with specific volume-based criteria for frequency, systematicity, and substantiality.

Systematic Internalisers - SIs are investment firms trading on own account frequently and systematically outside trading venues like regulated markets or MTFs; MiFID II expanded their scope to include various instruments with quantitative thresholds for substantial trading volumes to determine SI status.

dowidth.com

dowidth.com