Quantitative momentum trading relies on algorithmic analysis of price trends and volume data to identify securities with strong upward or downward momentum. Macro trading focuses on broad economic indicators and geopolitical events to predict market movements across asset classes. Explore deeper insights into these strategies to enhance your trading performance.

Why it is important

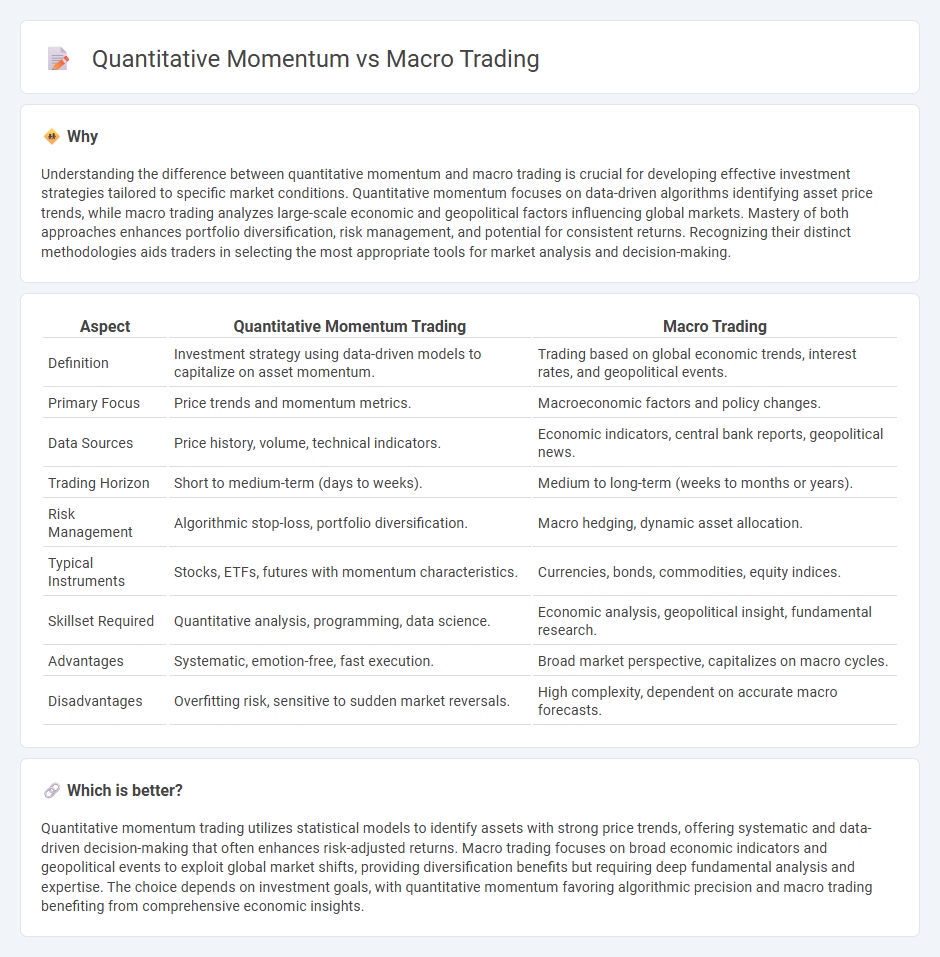

Understanding the difference between quantitative momentum and macro trading is crucial for developing effective investment strategies tailored to specific market conditions. Quantitative momentum focuses on data-driven algorithms identifying asset price trends, while macro trading analyzes large-scale economic and geopolitical factors influencing global markets. Mastery of both approaches enhances portfolio diversification, risk management, and potential for consistent returns. Recognizing their distinct methodologies aids traders in selecting the most appropriate tools for market analysis and decision-making.

Comparison Table

| Aspect | Quantitative Momentum Trading | Macro Trading |

|---|---|---|

| Definition | Investment strategy using data-driven models to capitalize on asset momentum. | Trading based on global economic trends, interest rates, and geopolitical events. |

| Primary Focus | Price trends and momentum metrics. | Macroeconomic factors and policy changes. |

| Data Sources | Price history, volume, technical indicators. | Economic indicators, central bank reports, geopolitical news. |

| Trading Horizon | Short to medium-term (days to weeks). | Medium to long-term (weeks to months or years). |

| Risk Management | Algorithmic stop-loss, portfolio diversification. | Macro hedging, dynamic asset allocation. |

| Typical Instruments | Stocks, ETFs, futures with momentum characteristics. | Currencies, bonds, commodities, equity indices. |

| Skillset Required | Quantitative analysis, programming, data science. | Economic analysis, geopolitical insight, fundamental research. |

| Advantages | Systematic, emotion-free, fast execution. | Broad market perspective, capitalizes on macro cycles. |

| Disadvantages | Overfitting risk, sensitive to sudden market reversals. | High complexity, dependent on accurate macro forecasts. |

Which is better?

Quantitative momentum trading utilizes statistical models to identify assets with strong price trends, offering systematic and data-driven decision-making that often enhances risk-adjusted returns. Macro trading focuses on broad economic indicators and geopolitical events to exploit global market shifts, providing diversification benefits but requiring deep fundamental analysis and expertise. The choice depends on investment goals, with quantitative momentum favoring algorithmic precision and macro trading benefiting from comprehensive economic insights.

Connection

Quantitative momentum leverages statistical models to identify securities with strong price trends, providing systematic signals for trading decisions. Macro trading analyzes large-scale economic indicators and geopolitical trends to forecast market movements across asset classes. Integrating quantitative momentum with macro trading enhances strategy robustness by combining precise trend identification with broad economic context, improving risk-adjusted returns.

Key Terms

**Macro Trading:**

Macro trading involves analyzing global economic indicators, geopolitical events, and interest rate movements to capitalize on broad market shifts. This strategy relies heavily on fundamental data such as GDP growth rates, inflation trends, and central bank policies to make informed investment decisions. Discover how macro trading strategies can enhance portfolio diversification and risk management.

Interest Rates

Macro trading strategies analyze broad economic indicators such as interest rate trends set by central banks to predict market movements and adjust portfolios accordingly. Quantitative momentum focuses on systematically identifying securities with strong price trends influenced by interest rate changes, using mathematical models to capture momentum effects. Explore the nuanced impacts of interest rates on these trading methods to optimize your investment approach.

Geopolitical Events

Macro trading strategies analyze global economic trends and geopolitical events to capitalize on shifts in currency, commodity, and bond markets. Quantitative momentum leverages statistical models and historical price data to identify assets with strong recent performance, often less influenced by sudden geopolitical disruptions. Explore how integrating geopolitical analysis can enhance momentum-based trading for more resilient investment strategies.

Source and External Links

Macro trading: How to trade macroeconomic events - Equiti - Macro trading is a strategy that uses economic and political events, such as economic indicators, central bank policies, and inflation data, to predict price movements in shares, bonds, currencies, and commodities, requiring disciplined risk management and deep analysis of global trends.

Examples of Macro Trading Factors | Macrosynergy - Pure macro trading strategies rely solely on macroeconomic indicators and apply principles like risk parity and diversification to trade assets such as FX forwards, producing alpha independent of equity and bond benchmarks.

Global Macro Strategy - Corporate Finance Institute - Global macro trading involves interpreting large-scale macroeconomic and geopolitical events worldwide to make investment decisions across diverse asset classes, commonly used by hedge funds with flexible investing mandates.

dowidth.com

dowidth.com