Delta neutral strategy aims to minimize directional risk by balancing positive and negative delta positions, often using options and underlying assets to maintain a portfolio with near-zero delta exposure. Covered call involves holding a long position in an asset while selling call options on the same asset, generating income through premiums but capping upside potential. Explore these strategies further to understand their distinct risk-reward profiles and ideal market conditions.

Why it is important

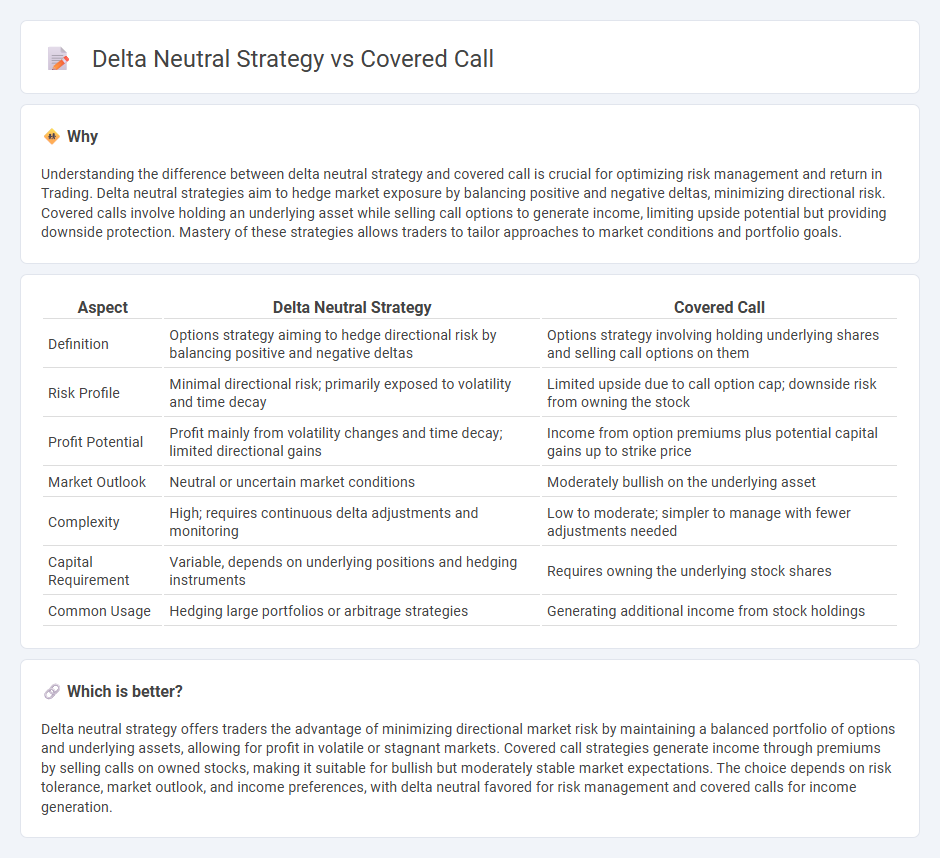

Understanding the difference between delta neutral strategy and covered call is crucial for optimizing risk management and return in Trading. Delta neutral strategies aim to hedge market exposure by balancing positive and negative deltas, minimizing directional risk. Covered calls involve holding an underlying asset while selling call options to generate income, limiting upside potential but providing downside protection. Mastery of these strategies allows traders to tailor approaches to market conditions and portfolio goals.

Comparison Table

| Aspect | Delta Neutral Strategy | Covered Call |

|---|---|---|

| Definition | Options strategy aiming to hedge directional risk by balancing positive and negative deltas | Options strategy involving holding underlying shares and selling call options on them |

| Risk Profile | Minimal directional risk; primarily exposed to volatility and time decay | Limited upside due to call option cap; downside risk from owning the stock |

| Profit Potential | Profit mainly from volatility changes and time decay; limited directional gains | Income from option premiums plus potential capital gains up to strike price |

| Market Outlook | Neutral or uncertain market conditions | Moderately bullish on the underlying asset |

| Complexity | High; requires continuous delta adjustments and monitoring | Low to moderate; simpler to manage with fewer adjustments needed |

| Capital Requirement | Variable, depends on underlying positions and hedging instruments | Requires owning the underlying stock shares |

| Common Usage | Hedging large portfolios or arbitrage strategies | Generating additional income from stock holdings |

Which is better?

Delta neutral strategy offers traders the advantage of minimizing directional market risk by maintaining a balanced portfolio of options and underlying assets, allowing for profit in volatile or stagnant markets. Covered call strategies generate income through premiums by selling calls on owned stocks, making it suitable for bullish but moderately stable market expectations. The choice depends on risk tolerance, market outlook, and income preferences, with delta neutral favored for risk management and covered calls for income generation.

Connection

The delta neutral strategy minimizes portfolio risk by balancing positive and negative delta positions, effectively stabilizing price movements. A covered call involves holding an underlying asset while selling call options, generating income but introducing a slight negative delta. Combining these approaches enables traders to hedge against downside risk while earning premium income, achieving a more balanced and strategically neutral market exposure.

Key Terms

Option Premium

Covered call strategies generate income by selling call options on stocks already owned, capturing option premiums as immediate profit while limiting upside potential. Delta neutral strategies aim to maintain a balanced portfolio delta close to zero, using options and underlying assets to hedge directional risk and capitalize on option premiums from volatility rather than directional moves. Explore detailed comparisons to understand which option premium approach aligns best with your risk tolerance and market outlook.

Hedging

Covered call involves holding a long position in an underlying asset while simultaneously selling call options to generate income and provide partial downside protection. Delta neutral strategy focuses on balancing the delta of an options portfolio to maintain a hedged position, minimizing directional risk and continuously adjusting to market movements. Explore detailed comparisons to understand which hedging approach aligns best with your investment goals.

Position Delta

Covered call strategy involves holding a long position in an underlying asset while simultaneously selling call options, resulting in a net positive delta that benefits from moderate upward price movement. Delta neutral strategy aims to maintain an overall delta of zero by balancing long and short positions or options, minimizing directional risk and stabilizing portfolio value against price fluctuations. Explore further to understand how position delta influences risk management and profit potential in both strategies.

Source and External Links

Covered option - Wikipedia - A covered call is a financial strategy where the investor sells a call option while owning the underlying stock, receiving a premium that limits loss but also caps the upside profit potential, and is considered a relatively conservative approach.

What Is A Covered Call Options Strategy? | Bankrate - A covered call involves owning 100 shares of stock and selling one call option on that stock to earn premium income, with breakeven calculated as stock price minus premium received, benefiting if the stock remains stable or rises moderately by expiration.

What is a covered call? - Fidelity Investments - This income-generating strategy combines owning stock and selling a call option on that stock, allowing the investor to collect premiums but risking having to sell the shares at the strike price if exercised.

dowidth.com

dowidth.com