Paper trading platforms offer simulated environments for beginners and traders testing strategies without real financial risk, featuring virtual capital and real-market data. Institutional trading platforms provide advanced tools, high-speed execution, and access to deep liquidity pools tailored for professional traders and large-volume transactions. Explore the key differences to determine which platform best suits your trading goals and experience level.

Why it is important

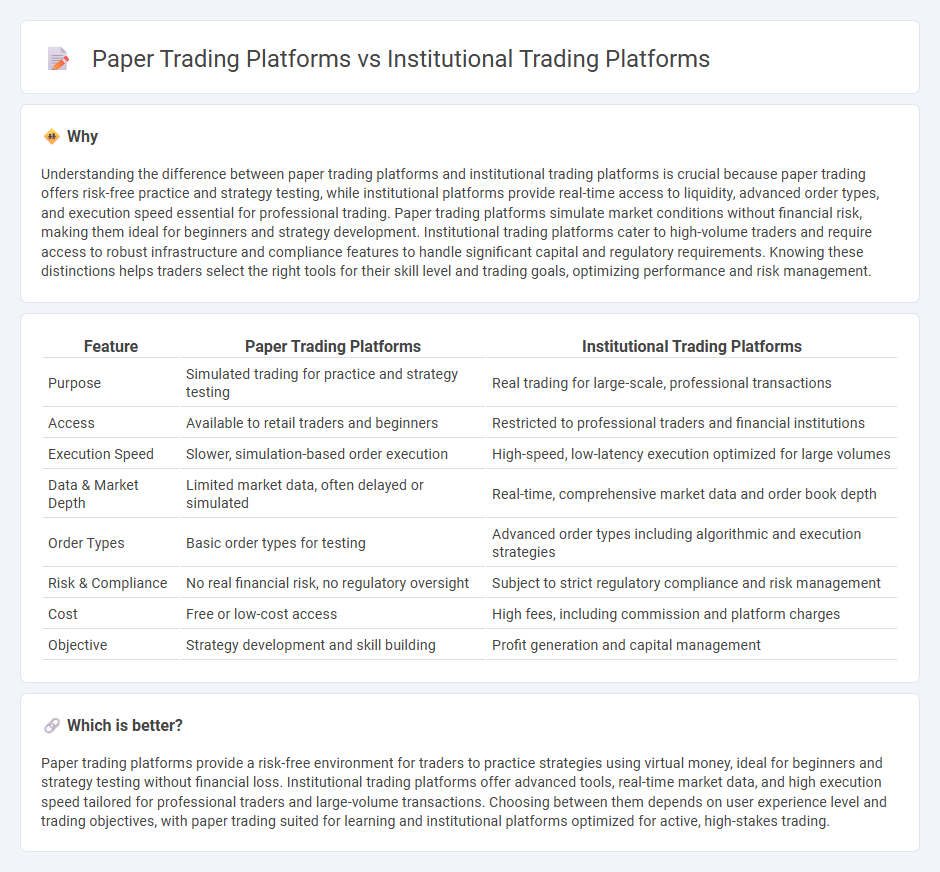

Understanding the difference between paper trading platforms and institutional trading platforms is crucial because paper trading offers risk-free practice and strategy testing, while institutional platforms provide real-time access to liquidity, advanced order types, and execution speed essential for professional trading. Paper trading platforms simulate market conditions without financial risk, making them ideal for beginners and strategy development. Institutional trading platforms cater to high-volume traders and require access to robust infrastructure and compliance features to handle significant capital and regulatory requirements. Knowing these distinctions helps traders select the right tools for their skill level and trading goals, optimizing performance and risk management.

Comparison Table

| Feature | Paper Trading Platforms | Institutional Trading Platforms |

|---|---|---|

| Purpose | Simulated trading for practice and strategy testing | Real trading for large-scale, professional transactions |

| Access | Available to retail traders and beginners | Restricted to professional traders and financial institutions |

| Execution Speed | Slower, simulation-based order execution | High-speed, low-latency execution optimized for large volumes |

| Data & Market Depth | Limited market data, often delayed or simulated | Real-time, comprehensive market data and order book depth |

| Order Types | Basic order types for testing | Advanced order types including algorithmic and execution strategies |

| Risk & Compliance | No real financial risk, no regulatory oversight | Subject to strict regulatory compliance and risk management |

| Cost | Free or low-cost access | High fees, including commission and platform charges |

| Objective | Strategy development and skill building | Profit generation and capital management |

Which is better?

Paper trading platforms provide a risk-free environment for traders to practice strategies using virtual money, ideal for beginners and strategy testing without financial loss. Institutional trading platforms offer advanced tools, real-time market data, and high execution speed tailored for professional traders and large-volume transactions. Choosing between them depends on user experience level and trading objectives, with paper trading suited for learning and institutional platforms optimized for active, high-stakes trading.

Connection

Paper trading platforms simulate real market conditions using historical and live data, enabling traders to practice without financial risk. Institutional trading platforms integrate advanced algorithms and real-time analytics, often incorporating insights gained from extensive paper trading to refine strategies. Both platforms connect through data interoperability and technology, allowing a seamless transition from simulated environments to live institutional trading.

Key Terms

Liquidity

Institutional trading platforms offer deep liquidity pools derived from aggregating orders across multiple financial institutions, enabling large-volume executions with minimal market impact. Paper trading platforms simulate this liquidity but lack real-time order flow, resulting in less accurate representations of bid-ask spreads and slippage. Explore the differences further to understand how liquidity influences trading performance on these platforms.

Order Execution

Institutional trading platforms prioritize advanced order execution features such as algorithmic trading, direct market access, and real-time liquidity aggregation to optimize trade speed and minimize slippage. Paper trading platforms primarily simulate order execution without real-time market impact, focusing on educational and strategy-testing purposes rather than actual trade execution efficiency. Explore deeper insights into how order execution technologies differ between these trading environments.

Market Simulation

Institutional trading platforms offer advanced market simulation tools that replicate real-time trading environments with high precision, incorporating complex order types and market depth data essential for professional traders. Paper trading platforms provide simplified simulations designed for educational purposes, often lacking the nuanced market dynamics present in institutional systems. Explore the differences in market simulation capabilities to choose the platform that best suits your trading goals.

Source and External Links

TradeStation Institutional | Customizable Solutions - TradeStation Institutional offers advanced, customizable trading software, reliable brokerage, and API solutions designed specifically for institutional investors, with over 40 years of expertise in executing complex trading strategies across multiple asset classes including equities, options, futures, commodities, and ETFs.

Tradeweb: Institutional Market - Tradeweb provides institutional investors with transparent, efficient trading platforms offering deep liquidity, pre-trade price intelligence, flexible trading protocols, and post-trade analysis across multiple asset classes globally, integrating with major order management systems for streamlined execution.

Top Trading Platforms - Sterling Trader(r) Elite - Sterling Trader Elite is a widely-used professional trading platform with customizable controls, advanced algorithmic order entry, real-time market data, and multi-asset trading capabilities, suitable for institutional traders, hedge funds, and proprietary trading firms worldwide.

dowidth.com

dowidth.com