Quantitative momentum trading capitalizes on statistical trends and price momentum to identify profitable investment opportunities, utilizing complex algorithms and historical data patterns. Sentiment analysis assesses market emotions and investor behavior through social media, news, and other textual data to predict market movements. Explore the differences between these powerful strategies to enhance your trading decisions.

Why it is important

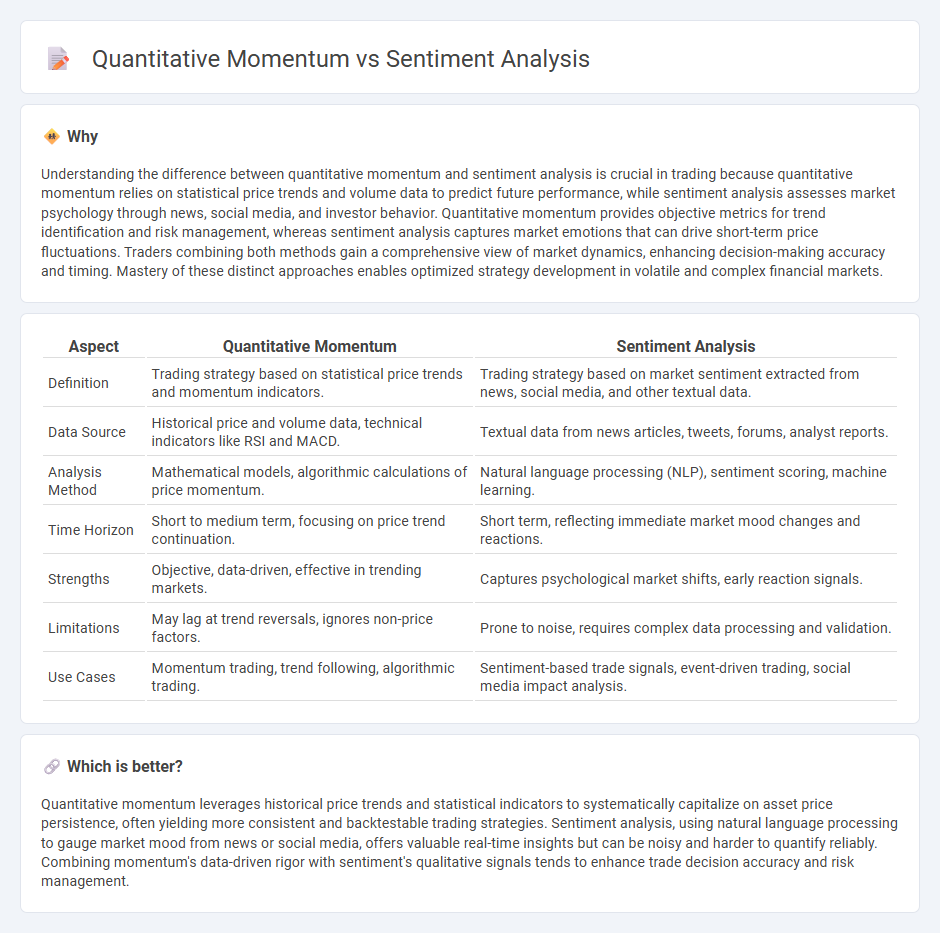

Understanding the difference between quantitative momentum and sentiment analysis is crucial in trading because quantitative momentum relies on statistical price trends and volume data to predict future performance, while sentiment analysis assesses market psychology through news, social media, and investor behavior. Quantitative momentum provides objective metrics for trend identification and risk management, whereas sentiment analysis captures market emotions that can drive short-term price fluctuations. Traders combining both methods gain a comprehensive view of market dynamics, enhancing decision-making accuracy and timing. Mastery of these distinct approaches enables optimized strategy development in volatile and complex financial markets.

Comparison Table

| Aspect | Quantitative Momentum | Sentiment Analysis |

|---|---|---|

| Definition | Trading strategy based on statistical price trends and momentum indicators. | Trading strategy based on market sentiment extracted from news, social media, and other textual data. |

| Data Source | Historical price and volume data, technical indicators like RSI and MACD. | Textual data from news articles, tweets, forums, analyst reports. |

| Analysis Method | Mathematical models, algorithmic calculations of price momentum. | Natural language processing (NLP), sentiment scoring, machine learning. |

| Time Horizon | Short to medium term, focusing on price trend continuation. | Short term, reflecting immediate market mood changes and reactions. |

| Strengths | Objective, data-driven, effective in trending markets. | Captures psychological market shifts, early reaction signals. |

| Limitations | May lag at trend reversals, ignores non-price factors. | Prone to noise, requires complex data processing and validation. |

| Use Cases | Momentum trading, trend following, algorithmic trading. | Sentiment-based trade signals, event-driven trading, social media impact analysis. |

Which is better?

Quantitative momentum leverages historical price trends and statistical indicators to systematically capitalize on asset price persistence, often yielding more consistent and backtestable trading strategies. Sentiment analysis, using natural language processing to gauge market mood from news or social media, offers valuable real-time insights but can be noisy and harder to quantify reliably. Combining momentum's data-driven rigor with sentiment's qualitative signals tends to enhance trade decision accuracy and risk management.

Connection

Quantitative momentum captures price trends through statistical models, while sentiment analysis quantifies market psychology via data from news, social media, and investor behavior. Integrating these methods enhances trading strategies by identifying momentum signals supported by positive or negative sentiment shifts. This combination improves predictive accuracy in anticipating asset price movements and market reversals.

Key Terms

**Sentiment Analysis:**

Sentiment analysis leverages natural language processing and machine learning to evaluate public opinion by analyzing text data from social media, news, and reviews, providing real-time insights into market sentiment. It captures emotional tone and investor attitudes, which can forecast stock price movements and market trends more dynamically than traditional financial metrics. Discover how sentiment analysis transforms data into actionable investment strategies.

News Sentiment

News sentiment analysis evaluates public opinion and emotions expressed in textual news data to predict market trends and investor behavior. Quantitative momentum strategies rely on numerical price and volume data to identify assets with trending upward or downward price movements. Explore the intersection of news sentiment and quantitative momentum to gain deeper insights into market dynamics.

Social Media Signals

Sentiment analysis leverages natural language processing to gauge public opinion from social media signals, providing real-time insights into market sentiment. Quantitative momentum, on the other hand, uses statistical models to identify price trends and momentum by analyzing historical price and volume data, often complemented by sentiment indicators for enhanced accuracy. Explore how integrating social media-driven sentiment analysis with quantitative momentum strategies can optimize trading performance and market prediction.

Source and External Links

Sentiment Analysis and How to Leverage It - Qualtrics - Sentiment analysis interprets how people feel about a topic by analyzing qualitative data, with approaches like fine-grained, aspect-based, and intent-based sentiment analysis to measure intensity, specific features, or underlying reasons for expressions.

What Is Sentiment Analysis? - IBM - Sentiment analysis, or opinion mining, evaluates large volumes of text to classify sentiment as positive, negative, or neutral, enabling companies to better understand customer feelings and improve experiences using AI tools.

What is Sentiment Analysis? - AWS - Sentiment analysis determines emotional tone in digital text, with types including fine-grained scoring, aspect-based, intent-based, and emotional detection to analyze customer feedback and psychological states.

dowidth.com

dowidth.com