Liquidity mining involves providing assets to decentralized finance (DeFi) protocols to earn rewards, enhancing market depth and token utility. Flash loans allow users to borrow large amounts of capital instantly without collateral, enabling arbitrage, refinancing, or complex trading strategies within a single transaction. Explore the intricacies of liquidity mining and flash loans to optimize your DeFi trading tactics.

Why it is important

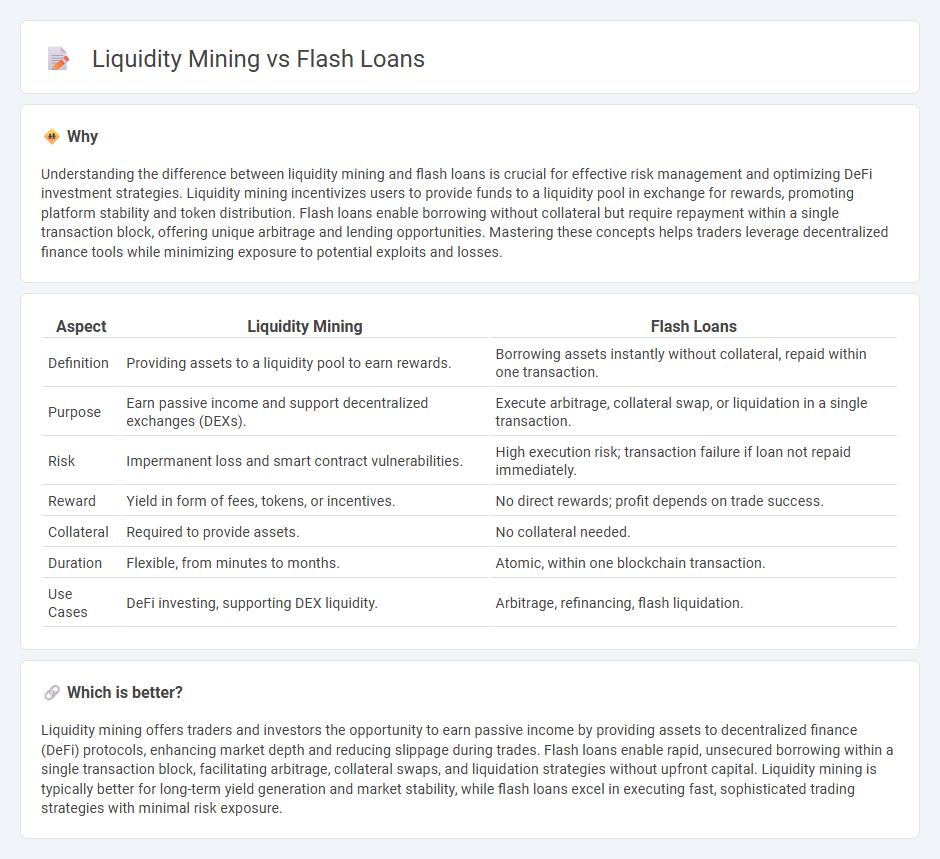

Understanding the difference between liquidity mining and flash loans is crucial for effective risk management and optimizing DeFi investment strategies. Liquidity mining incentivizes users to provide funds to a liquidity pool in exchange for rewards, promoting platform stability and token distribution. Flash loans enable borrowing without collateral but require repayment within a single transaction block, offering unique arbitrage and lending opportunities. Mastering these concepts helps traders leverage decentralized finance tools while minimizing exposure to potential exploits and losses.

Comparison Table

| Aspect | Liquidity Mining | Flash Loans |

|---|---|---|

| Definition | Providing assets to a liquidity pool to earn rewards. | Borrowing assets instantly without collateral, repaid within one transaction. |

| Purpose | Earn passive income and support decentralized exchanges (DEXs). | Execute arbitrage, collateral swap, or liquidation in a single transaction. |

| Risk | Impermanent loss and smart contract vulnerabilities. | High execution risk; transaction failure if loan not repaid immediately. |

| Reward | Yield in form of fees, tokens, or incentives. | No direct rewards; profit depends on trade success. |

| Collateral | Required to provide assets. | No collateral needed. |

| Duration | Flexible, from minutes to months. | Atomic, within one blockchain transaction. |

| Use Cases | DeFi investing, supporting DEX liquidity. | Arbitrage, refinancing, flash liquidation. |

Which is better?

Liquidity mining offers traders and investors the opportunity to earn passive income by providing assets to decentralized finance (DeFi) protocols, enhancing market depth and reducing slippage during trades. Flash loans enable rapid, unsecured borrowing within a single transaction block, facilitating arbitrage, collateral swaps, and liquidation strategies without upfront capital. Liquidity mining is typically better for long-term yield generation and market stability, while flash loans excel in executing fast, sophisticated trading strategies with minimal risk exposure.

Connection

Liquidity mining incentivizes users to provide capital to decentralized finance (DeFi) protocols by offering rewards, enhancing the pool of assets available for transactions. Flash loans leverage these liquidity pools by allowing users to borrow substantial amounts instantly without collateral, as long as the loan is repaid within one transaction block. The interplay between liquidity mining and flash loans fuels DeFi growth by improving capital efficiency and enabling sophisticated trading strategies such as arbitrage and refinancing.

Key Terms

**Flash Loans:**

Flash loans offer uncollateralized borrowing within a single transaction, enabling rapid arbitrage, refinancing, or collateral swapping in DeFi ecosystems. They exploit atomicity of blockchain transactions to ensure loan repayment before transaction completion, minimizing lender risk. Discover more about the mechanics and applications of flash loans in decentralized finance.

Collateral-free borrowing

Flash loans enable users to borrow uncollateralized funds instantly within a single transaction, leveraging blockchain protocols like Aave and dYdX to execute arbitrage or refinance opportunities without upfront capital. Liquidity mining incentivizes users to provide collateralized assets to decentralized pools, earning rewards but requiring locked funds and exposure to impermanent loss. Explore comprehensive analyses on how collateral-free borrowing with flash loans revolutionizes decentralized finance strategies and risk management.

Arbitrage

Flash loans enable instant, uncollateralized borrowing, allowing arbitrageurs to exploit price differences across multiple decentralized exchanges within a single transaction. Liquidity mining incentivizes users to provide capital to DeFi protocols, earning rewards while supporting market depth but requires capital risk and longer commitment. Explore how integrating flash loans with liquidity mining strategies can optimize arbitrage opportunities and maximize returns.

Source and External Links

What is a flash loan? - Coinbase - Flash loans are uncollateralized loans in DeFi where users borrow and repay assets within the same blockchain transaction, enabling arbitrage, liquidations, and other advanced financial operations without upfront collateral.

What Are Flash Loans? >> Meaning and Definition | Chainlink - Flash loans provide instant capital with no collateral by requiring repayment within the same transaction, commonly used for arbitrage, liquidations, and collateral swaps in DeFi.

What are Flash Loans? - Winston & Strawn - Flash loans are smart contract-enabled uncollateralized loans repaid within one transaction, offering risk-free arbitrage opportunities by exploiting price differences between exchanges.

dowidth.com

dowidth.com