Trade journaling software provides detailed records of transactions, helping traders analyze performance patterns and improve strategies through historical data insights. Alert systems focus on real-time notifications about market movements, enabling traders to act quickly on price changes and trading signals. Discover how combining trade journaling software with alert systems can enhance your trading efficiency and decision-making.

Why it is important

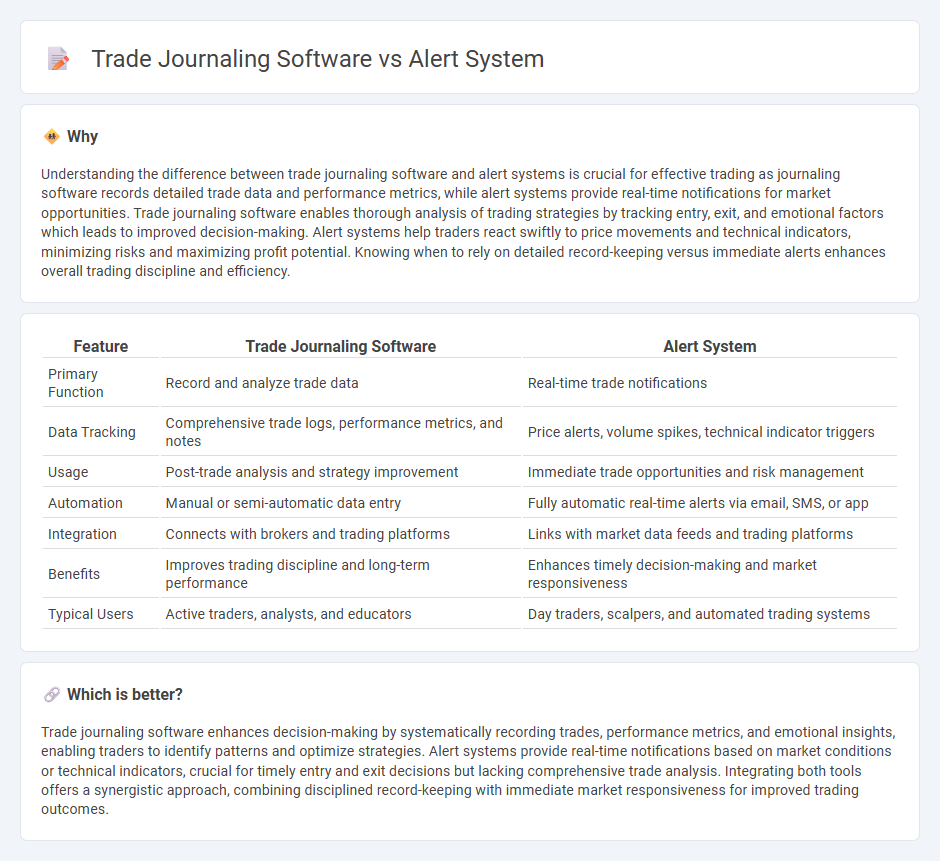

Understanding the difference between trade journaling software and alert systems is crucial for effective trading as journaling software records detailed trade data and performance metrics, while alert systems provide real-time notifications for market opportunities. Trade journaling software enables thorough analysis of trading strategies by tracking entry, exit, and emotional factors which leads to improved decision-making. Alert systems help traders react swiftly to price movements and technical indicators, minimizing risks and maximizing profit potential. Knowing when to rely on detailed record-keeping versus immediate alerts enhances overall trading discipline and efficiency.

Comparison Table

| Feature | Trade Journaling Software | Alert System |

|---|---|---|

| Primary Function | Record and analyze trade data | Real-time trade notifications |

| Data Tracking | Comprehensive trade logs, performance metrics, and notes | Price alerts, volume spikes, technical indicator triggers |

| Usage | Post-trade analysis and strategy improvement | Immediate trade opportunities and risk management |

| Automation | Manual or semi-automatic data entry | Fully automatic real-time alerts via email, SMS, or app |

| Integration | Connects with brokers and trading platforms | Links with market data feeds and trading platforms |

| Benefits | Improves trading discipline and long-term performance | Enhances timely decision-making and market responsiveness |

| Typical Users | Active traders, analysts, and educators | Day traders, scalpers, and automated trading systems |

Which is better?

Trade journaling software enhances decision-making by systematically recording trades, performance metrics, and emotional insights, enabling traders to identify patterns and optimize strategies. Alert systems provide real-time notifications based on market conditions or technical indicators, crucial for timely entry and exit decisions but lacking comprehensive trade analysis. Integrating both tools offers a synergistic approach, combining disciplined record-keeping with immediate market responsiveness for improved trading outcomes.

Connection

Trade journaling software integrates seamlessly with alert systems to enhance trading performance by automatically logging trade entries, exits, and market conditions alongside real-time notifications. This connection helps traders identify patterns, optimize strategies, and respond promptly to market changes using data-driven insights. Utilizing combined trade journaling and alert systems increases decision-making accuracy and supports risk management through timely alerts linked to historical trading data.

Key Terms

**Alert System:**

Alert systems provide real-time notifications on market movements, enabling traders to react swiftly to price changes, volume spikes, or technical indicator thresholds. These systems enhance decision-making by delivering customizable alerts via email, SMS, or app notifications, ensuring traders stay informed without constant monitoring. Explore more about how alert systems can transform your trading strategy and improve responsiveness.

Real-time Notifications

Real-time notifications in alert systems provide instant updates on market movements, enabling traders to react swiftly to price changes, volume spikes, and breaking news. Trade journaling software typically lacks immediate alert capabilities, focusing instead on recording and analyzing past trades for performance improvement. Discover how integrating real-time alert systems with journaling software can enhance trading decisions and risk management.

Price Triggers

Price triggers in alert systems enable traders to receive instant notifications when asset prices reach predefined levels, facilitating timely decision-making. Trade journaling software, while primarily focused on recording trade details, often incorporates price trigger features to analyze entry and exit points for strategy refinement. Discover how integrating price triggers with trade journaling can enhance trading performance and risk management.

Source and External Links

Emergency Alert System - Wikipedia - The Emergency Alert System (EAS) is a US national warning system allowing authorities to broadcast emergency alerts through various media including TV, radio, cable, and satellite using Specific Area Message Encoding for targeted alerts.

Integrated Public Alert & Warning System | FEMA.gov - FEMA's IPAWS integrates alert delivery through EAS, Wireless Emergency Alerts, and NOAA Weather Radio, enabling emergency messages to be sent via multiple communication pathways to reach the public effectively.

The Emergency Alert System (EAS) | Federal Communications Commission - EAS is a national public warning system used by state and local authorities to deliver urgent emergency information such as weather and AMBER alerts, involving broadcasters and requiring capability for presidential national emergency addresses.

dowidth.com

dowidth.com